You might've heard about social engineering, a common cybercrime tactic. As the gatekeepers of an organization’s finances, AP teams are often the targets of socially engineered attacks.

So how do they work, how common are they, and what can you do about them?

The meaning of "social engineering"

“Social engineering” describes a range of tactics for getting people to take actions they wouldn’t normally take or revealing sensitive information they wouldn’t normally reveal. While some cybercrime depends on sophisticated hacking and system infiltration, social engineering typically looks a lot more like old-fashioned deception and manipulation – but, of course, cybercriminals are liable to pair those tactics with hacked information or infiltration whenever possible.

Basically, social engineering attacks rely on people’s instinct and desire to be helpful to others. It’s a form of psychological manipulation that can happen digitally or in person, but hybrid workplaces and the proliferation of cybercrime have heightened the risk of digital variants of socially engineered attacks.

For example, a cybercriminal might impersonate a member of an organization’s IT team and persuade an AP officer to reveal sensitive payment information. Or they may infiltrate a senior executive’s email and use it to instruct an employee to make a fraudulent payment, often relying on additional tactics like urgency or catching the employee during especially hectic periods.

Types of socially engineered attacks

Baiting

This type of social engineering tactic uses a false promise – or ‘bait’ – to lure a victim into doing something that reveals information or helps the scammer infect a system with malicious software (“malware”). For instance, the fraudster might trick an employee into downloading malware by including an email attachment with a title like “Changes to our annual bonus policy.” Who wouldn’t want to know about policy changes that might affect their bank account?

Physical baiting is less common but still exists. This involves leaving equally enticing-sounding flash drives or hard drives in conspicuous places, with the aim of getting employees to connect their devices to them.

Scareware

Instead of baiting victims with something enticing, scareware relies on motivating them with something, well, scary. This can include false warnings that the target’s device has already been infected or compromised in some way. The goal is to persuade users into downloading a ‘solution’ that actually exposes them to malware or data theft.

Pretexting

Pretexting uses stories or impersonation to gradually get targets to reveal useful information – including highly sensitive information like banking details or personally identifiable information about themselves or others.

The scammer might establish trust by impersonating a known connection or someone with authority, such as an IT professional or bank official. Under the guise of verifying the victim’s identity, they can then start to persuade them into sharing information that helps the fraudster carry out the attempted cybercrime.

Phishing and BECs

Phishing sometimes involves a blanket message sent to many users, while spear-fishing and whaling are highly targeted approaches aimed at a lower volume of recipients. Business email compromise (BEC) scams are a type of spear-fishing attack that uses email to deceive employees into facilitating a cybercrime.

Other variations are phishing done by SMS (“smishing”) or voice phishing (“vishing”), which uses phone calls or deep fake technology to carry out pretexting.

Learn more about phishing in all its forms.

How common is social engineering in Australia?

The short answer? Common enough to be concerning.

We know this from the Notifiable Data Breaches (NDB) Report, which the Office of the Australian Information Commissioner (OAIC) releases twice a year. The report delves into the volume and causes of data breaches that were reported to the Commission over the previous six-month period.

Under Australia’s NDB Scheme, any entity that’s covered by the Privacy Act has to notify the OAIC if it experiences a data breach in which:

personal information was compromised, and

affected individuals are likely to suffer serious harm as a result of the data breach.

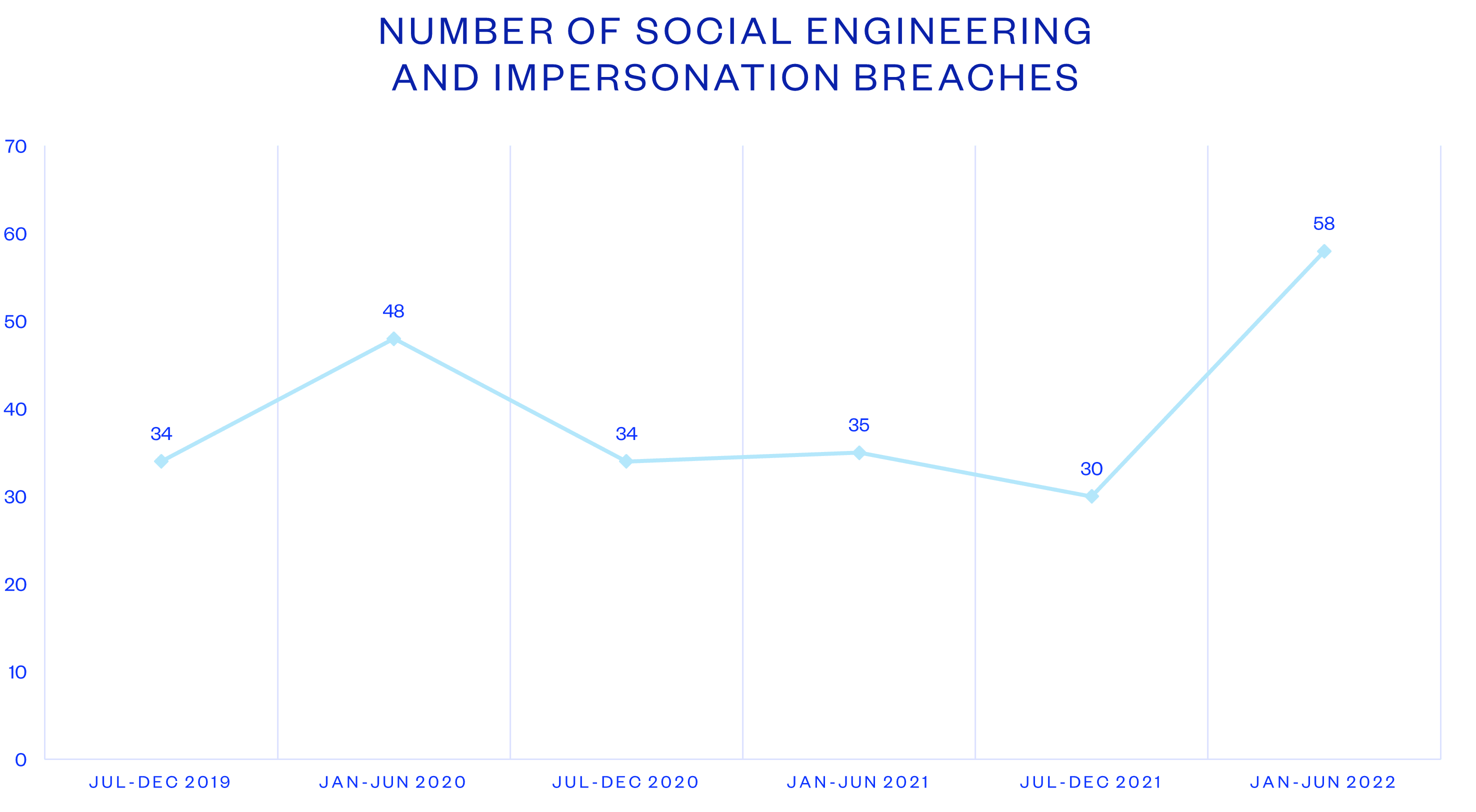

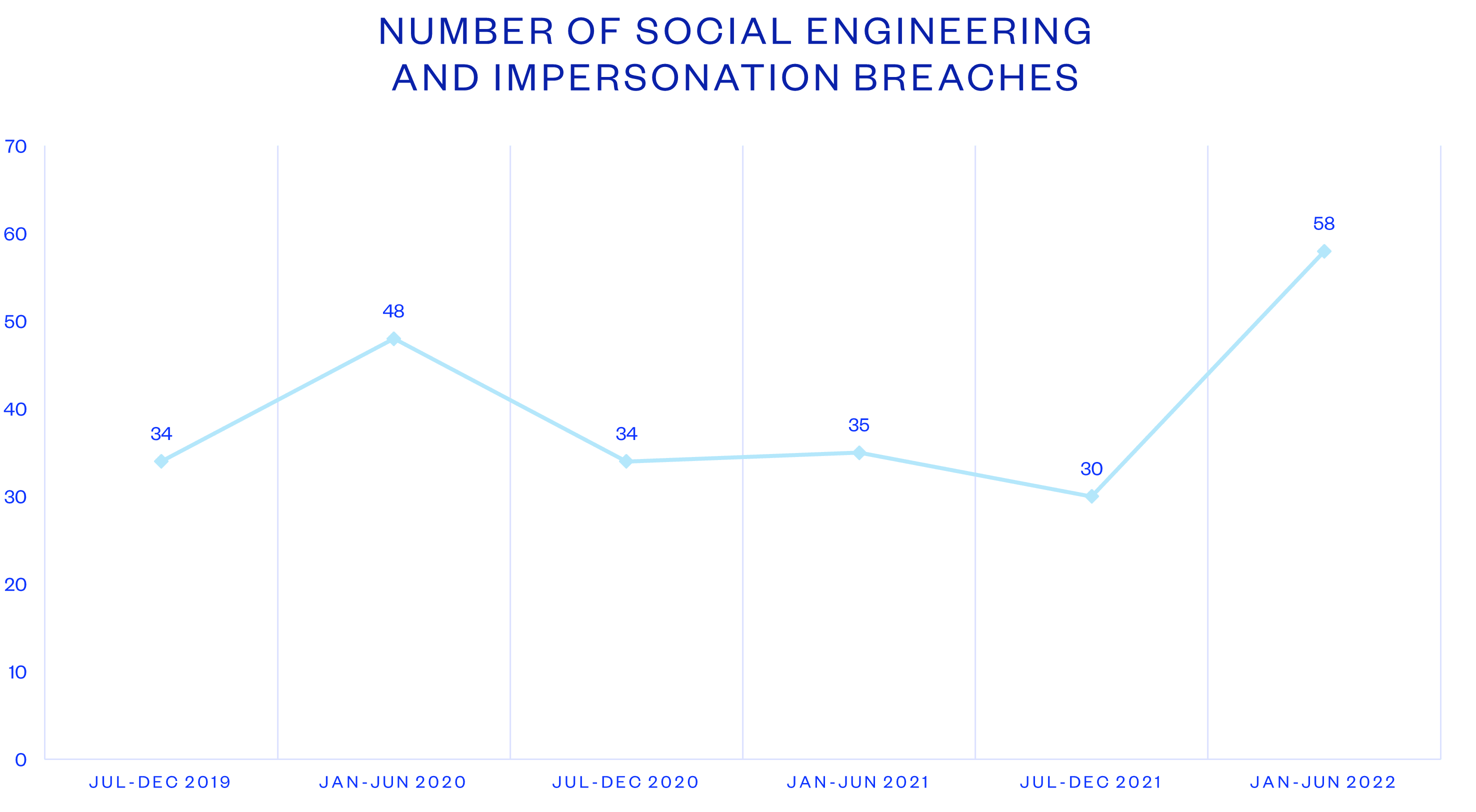

These reports are a useful barometer for identifying trends in data breaches. And, when looking at reports from recent years, it’s clear that social engineering is steadily increasing as a cause of data breaches.

Source: OAIC

The latest NDB Report, covering January to June 2022, saw 58 reports of social engineering causing a data breach. That’s nearly double the 30 cases reported in the previous six-month period.

How can you protect your organization from social engineering attacks?

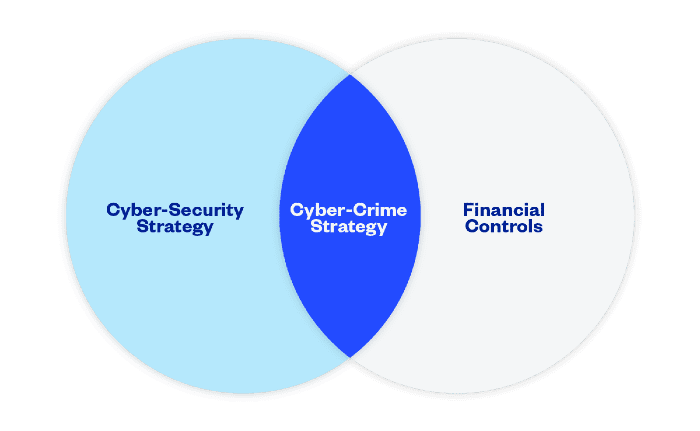

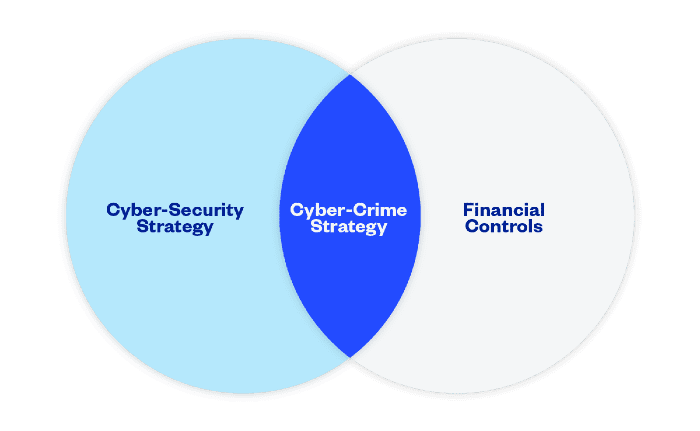

There’s no single solution that can protect against all forms of social engineering attacks, which is why finance leaders need to own their organization’s cybercrime strategy. This is the intersection between your financial controls and your cybersecurity strategy – without one, organizations tend to have gaps that cybercriminals are learning to exploit with greater and greater frequency.

A cybercrime strategy unites your cyberstrategy with your financial controls, pre-empting even some of the most cutting-edge cybercrime tactics. But it includes a few different elements – some of those include better training and technology to arm your AP team against a fast-evolving generation of scammers and cybercriminals.

Training

Generally, AP staff aren’t trained to identify social engineering techniques. And, as we can see from our social engineering example, these deceptions are often very sophisticated and hard to identify. Despite this lack of training, AP staff tend to be primary targets of financially motivated cybercriminals.

AP and finance professionals need dedicated cybercrime training – beyond standard cybersecurity training, which usually only touches on basics and isn’t tailored to any particular organizational function. To effectively combat the growing diversity of cybercrime tactics, leaders should consider finance-specific training, such as:

Warning signs of manipulated invoices or ABA files

How scammers have hoodwinked other AP professionals into sending funds to unauthorized bank accounts

The risks your organization could face if and when scammers breach your suppliers’ systems

New advancements in technology that can help fraudsters imitate or commandeer the identities of trusted contacts

Of course, training is just one element of a healthy cybercrime strategy. Others include fostering an anti-cybercrime culture, ensuring you have the right tech stack and implementing the right processes and procedures.

Ready to thwart social engineering attempts?

Find out how to kickstart your cybercrime strategy in our 2023 Cybersecurity Guide for CFOs.