The finance industry is undergoing a major transformation thanks to the rapid adoption of AI technology. Much of this trend has been driven by increased demand for efficiency, accuracy, and security in an industry that deals with vast amounts of data and capital daily.

The appeal of AI to the finance industry is hard to refute, with the IMF predicting that financial sector spending on artificial intelligence will more than double to USD 97 billion by 2027.

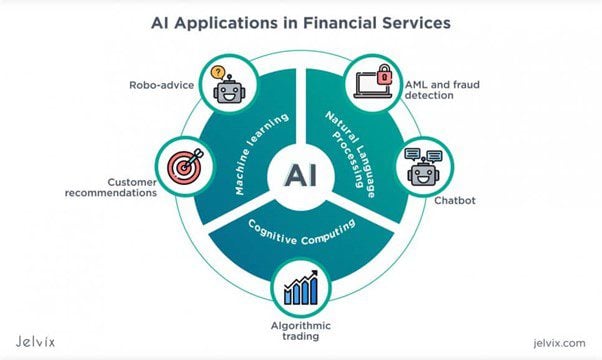

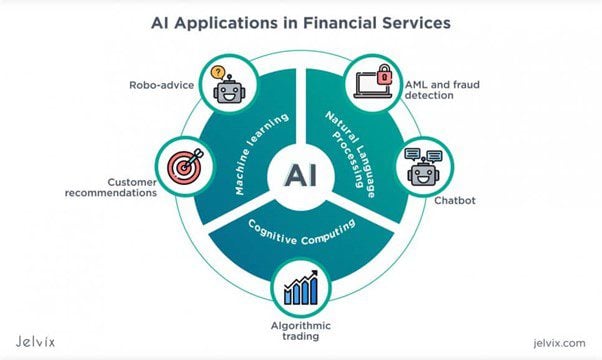

With the above in mind, let’s take a look at the diverse applications of AI in finance and how it is revolutionizing traditional practices, streamlining operations, and facilitating innovation.

Risk Management

With the ability to process and analyze vast amounts of data, AI tools are now on the frontline of risk management in the financial sector. While traditional risk management processes are effective, they simply cannot keep pace with the complexity and volume of modern financial data.

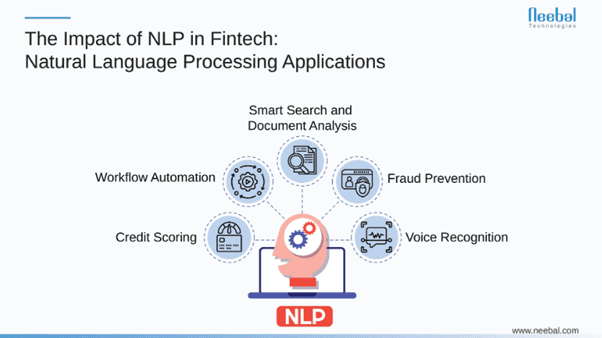

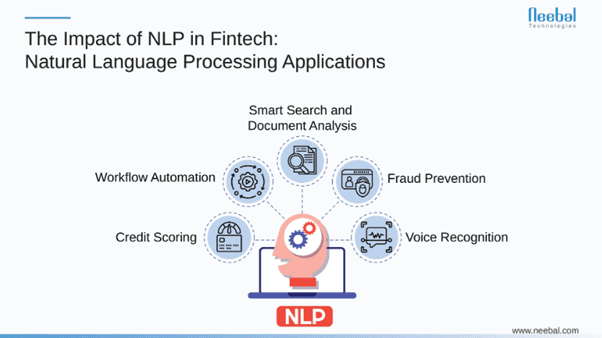

When used in conjunction with machine learning (ML), AI can identify patterns in the data to better assess creditworthiness, which results in fewer loan defaults and more attractive profit margins for the lender.

More specifically, generative AI is being deployed to create financial time series that estimate important metrics such as value at risk (VaR) and expected shortfall (ES). Unlike traditional models that only consider simplified assumptions, AI enables finance companies to simulate hypothetical (but plausible) scenarios based on complex interdependencies.

Supplementing both VaR and ES is stress testing, with generative AI used by banks to predict how adverse events would impact their balance sheet and liquidity, among other factors.

Fraud Detection

As fraud becomes more sophisticated, traditional rule-based systems have been exposed as inadequate. AI has emerged as a powerful tool in the battle against financial fraud because it offers a more proactive and adaptive approach to detection and prevention.

Again, the ability of AI and ML to recognize patterns and anomalies in vast datasets is key. Machine learning algorithms are now trained on historical transaction data to first identify normal consumer behavior and then look for deviations from that behavior.

Atypical behavior in a consumer finance context takes many forms. It may involve unusually large purchases in a foreign country or multiple transactions in rapid succession.

Irrespective of the context, however, AI systems:

Flag potentially fraudulent transactions in real-time

Automate incident response

Learn from whatever information they collect to better prepare for the next incidence of fraud

In Australia, many of these mechanisms are now combined with Confirm of Payee (CoP). It's worth noting that these mechanisms cannot prevent or flag all types of scam tactics, so think of them as layers that each help reduce your fraud risks.

How ANZ Uses AI to Detect Fraud

ANZ has invested heavily in AI to boost its security measures, with its AI-driven approach able to prevent over $106 million in losses to cybercriminals in 2023.

The bank introduced new algorithms aimed at identifying suspicious activity in 2024, with a particular focus on peer-to-peer and other emerging payment channels.

One notable implementation is their Scam Scoring model, which uses AI to detect and prevent scams more effectively. New algorithms were also added to the bank’s Mule Detection capability to reduce the movement of illicit funds to organized crime.

Trading and Investment Management

Trading and investment management is another context in finance where AI has made substantial inroads. Some of the key applications are listed below.

Robo-Advisors

Robo-advisors are automated platforms that provide financial planning and investment management services using AI and ML. Since there is typically little human intervention, they are an affordable option for clients who want a portfolio tailored to their needs, objectives, and risk profile.

Algorithmic Trading

In algorithmic trading, AI-powered algorithms automatically execute trade orders based on predefined criteria. They also analyze data from market prices, news articles, and even social media sentiment to enhance their predictive capabilities and make more informed trading decisions.

High-Frequency Trading (HFT)

Companies like Goldman Sachs use AI in HFT systems to outperform human traders and portfolio managers. Here, AI is combined with ML-based neural networks to analyze enormous volumes of data in real time, identify the patterns, and execute trades at unprecedented speed.

AI-driven HFT systems are a natural fit in an industry where agility, accuracy, and efficiency are prized. Such systems are also more profitable because they capitalize on extremely short-term market fluctuations.

Compliance and Regulatory Reporting

The financial industry is highly regulated, and while compliance and proper reporting are critical, the processes that underpin these pillars are often complex and resource-intensive.

Artificial intelligence is now at the forefront of compliance and regulatory reporting. Some AI models monitor transaction data and market activity to detect insider trading or market manipulation. Others analyze regulatory changes to predict the compliance requirements of tomorrow.

How AI Streamlines KYC and AML Processes

AI also streamlines know-your-customer (KYC) and anti-money laundering (AML) – two key areas of compliance that reduce instances of fraud and other cybercrimes.

HSBC has had difficulty with AML compliance because of its vast and complex operations across multiple jurisdictions. Like other large financial institutions, it could no longer rely on traditional rule-based systems that were hard to scale, did not adapt to evolving threats, and generated a high number of false positives.

The limitations of this system were exposed in 2017 when it was discovered that the bank had moved over $545 million in laundered funds for an operation out of Russia.

While not complicit in the scam, HSBC resolved to incorporate AI into its AML practices. Today, the company’s AI technology identifies patterns and inconsistencies that manual checks could never detect.

Enhanced Customer Service

Like any industry, exceptional customer service is crucial to attracting customers and reducing churn. Modern customers are more discerning, less loyal, and happy to shop around. In addition to traditional financial services, these customers also expect banks and fintech companies to care about their financial well-being.

The solution is AI-driven chatbots and interactive voice response (IVR) systems, which are more sophisticated, intelligent, and useful than their predecessors.

Most chatbots incorporate natural language processing (NLP) – a sub-field of AI that enables them to comprehend context, identify customer intent, and provide relevant answers or solutions.

Chatbots can also integrate across multiple communication channels and since they are available 24/7, reduce wait times and improve customer satisfaction.

Chatbot Examples

Ceba, the Commonwealth Bank chatbot, can help customers with more than 200 common banking tasks. It can also recognize the approximately 60,000 ways customers enquire about these tasks and seamlessly transfer customers to human support staff if required.

UBank also offers a chatbot that former CEO Lee Hatton described as "smart, approachable and a little bit cheeky.”

Mia (My Interactive Agent) is a chatbot with a human-like avatar that can answer 300 questions about the home loan application process and make it less painful for customers.

Personalized Product Recommendations

Personalization of financial products and services involves the use of big data, artificial intelligence, and advanced analytics to deliver highly tailored products and advice. This is an emerging and potentially lucrative area of AI in finance. A report by Accenture found that 73% of consumers would share personal information with their bank in exchange for personalized products.

Financial institutions offer these products based on a customer’s specific financial situation, objectives, and preferences. If an individual is saving for a home deposit, for example, the bank may offer them a high-interest savings account or mortgage tailored to their circumstances.

There are also AI systems that analyze a customer’s credit score, transaction history, and online behavior to recommend suitable credit cards. If it was observed that the customer often traveled overseas, the bank could recommend an appropriate, low-fee credit card that also rewarded them with frequent flyer points.

Summary:

AI is reshaping the finance industry in profound ways with smarter, more adaptive systems that respond to complex financial problems. The technology also enables companies to make sense of vast amounts of consumer and financial data.

In risk management, banks use AI to analyze vast datasets and identify potential risks before they materialize. AI can be used to analyze, prepare, and mitigate risks on both the micro level (consumer credit risk) and the macro level (geopolitical risk).

Artificial intelligence is also a key defense against online fraud. Algorithms analyze user behavior and establish a baseline of normalcy to identify anomalies that may represent fraud. Unlike traditional rule-based detection systems, AI models learn by incorporating new data and adapting to threats as they evolve.

Customer service and product personalization are other aspects of finance that have benefited from AI. Chatbots reduce costs for the business and offer customers tailored support 24/7. Banks also use AI to analyze customer data and offer them tailored products and services.