Are you in charge of vendor payments, payment compliance, or treasury? If so, you’ve probably heard talks about NACHA compliance changes going into effect in 2026. These changes are coming quickly, making it important to get your finance team on track for compliance.

In this article, we’ll cover the NACHA rule changes in 2025, including the timeline for compliance changes and what you can do to position your payment team for success.

What are NACHA Rule Changes 2025?

The National Automated Clearing House Association, known as NACHA, is the governing body that manages the Automated Clearing House (ACH) network. The rise of ACH fraud, including vendor impersonation and Business Email Compromise, has generated significant financial losses. As a result, NACHA is updating its rules, requiring businesses to engage in ACH fraud monitoring and other proactive practices. Starting in 2026, businesses are required to implement risk-based processes, which include two main components:

- Complete a risk analysis – Businesses will need to segment outbound payment transactions into risk categories, such as high and low. This will help identify shortcomings in processes and controls.

- Implement formal processes – Businesses will also be required to ensure information related to high-risk transactions is verified through a validated source. These controls must be consistently applied.

The fundamentals of these rule changes rely on implementing stronger controls and proactive monitoring to eliminate fraud at the source. Companies can no longer verify bank information through email. There needs to be defined policies and procedures in place to verify information to lower fraud.

NACHA compliance examples

Risk-based processes is a vague term that can mean different things to each organization. However, NACHA has given a few compliance examples that demonstrate what they are looking for, including:

Multi-layered identity verification

Information provided should be verified with outside sources, such as a Tax Identifying Number (TIN) and Employer Identification Number (EIN) being verified through a government database or tracking the source of a device to ensure it’s in the correct location.

How Eftsure helps: Eftsure confirms TINs and EINs against authoritative government sources and monitors device-level data to verify geographic consistency, helping organisations establish robust identity controls.

Account ownership and information matching

Bank accounts should be verified against the entity’s legal registration. For example, verifying the legal name in the state in which the company was formed.

How Eftsure helps: Eftsure verifies that bank account details align with official company registrations, ensuring that the account is legitimately associated with the named entity.

Behavioral and predictive analysis

Using machine learning to uncover unusual and suspicious activity patterns.

How Eftsure helps: Eftsure uses real-time fraud signal detection and vendor behaviour analytics to flag anomalies and emerging threats, enhancing visibility into potentially suspicious activity.

Ongoing payment monitoring

Paying close attention to high-value transactions to verify that the proper controls and safeguards are in place.

How Eftsure helps: Eftsure continuously monitors outgoing payments, especially high-value transactions, alerting finance teams to irregularities and helping enforce payment controls.

While some businesses may already have basic ACH fraud monitoring policies, NACHA rule changes in 2025 will require the expansion of these safeguards.

See how Eftsure can help your finance team stay compliant and secure — book a demo today.

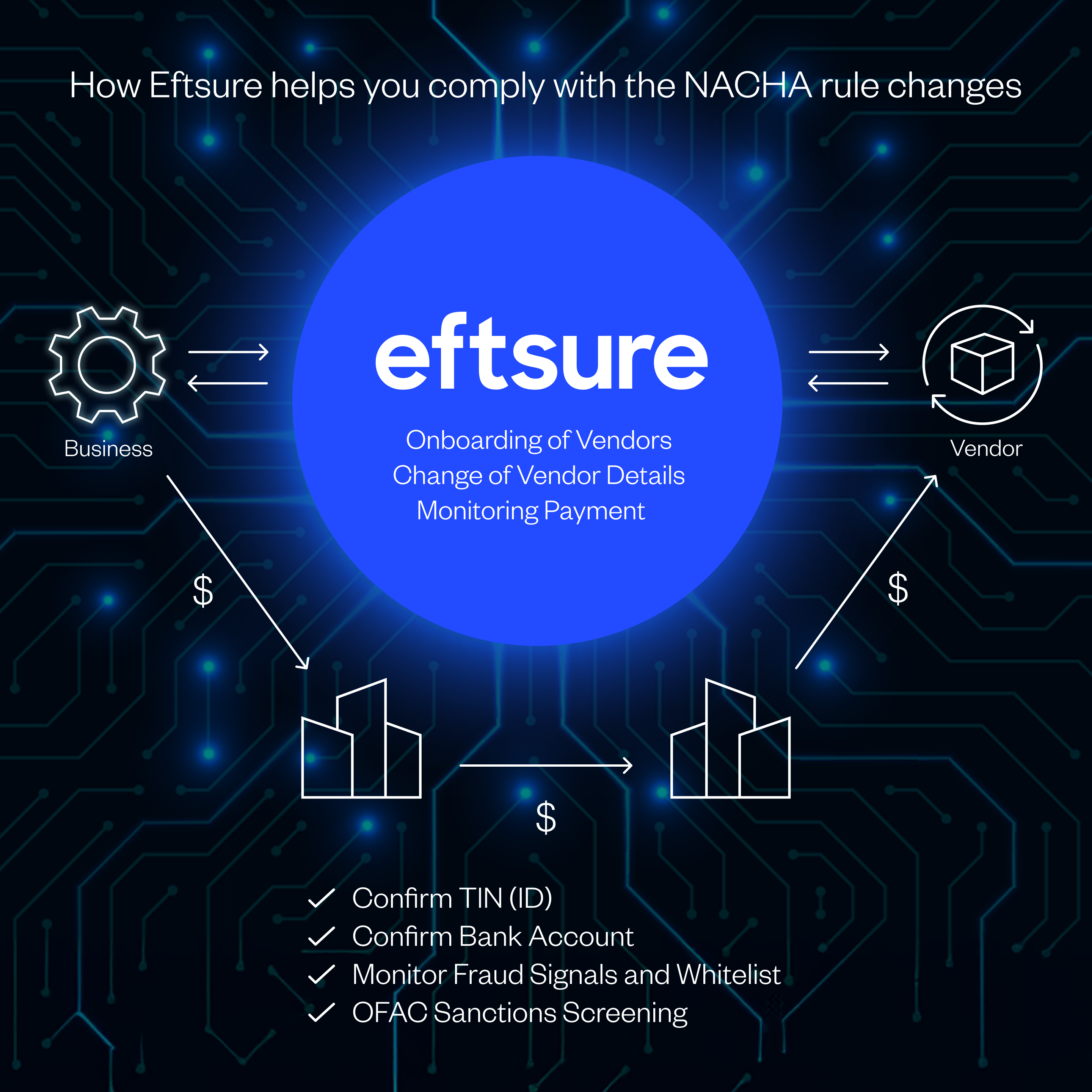

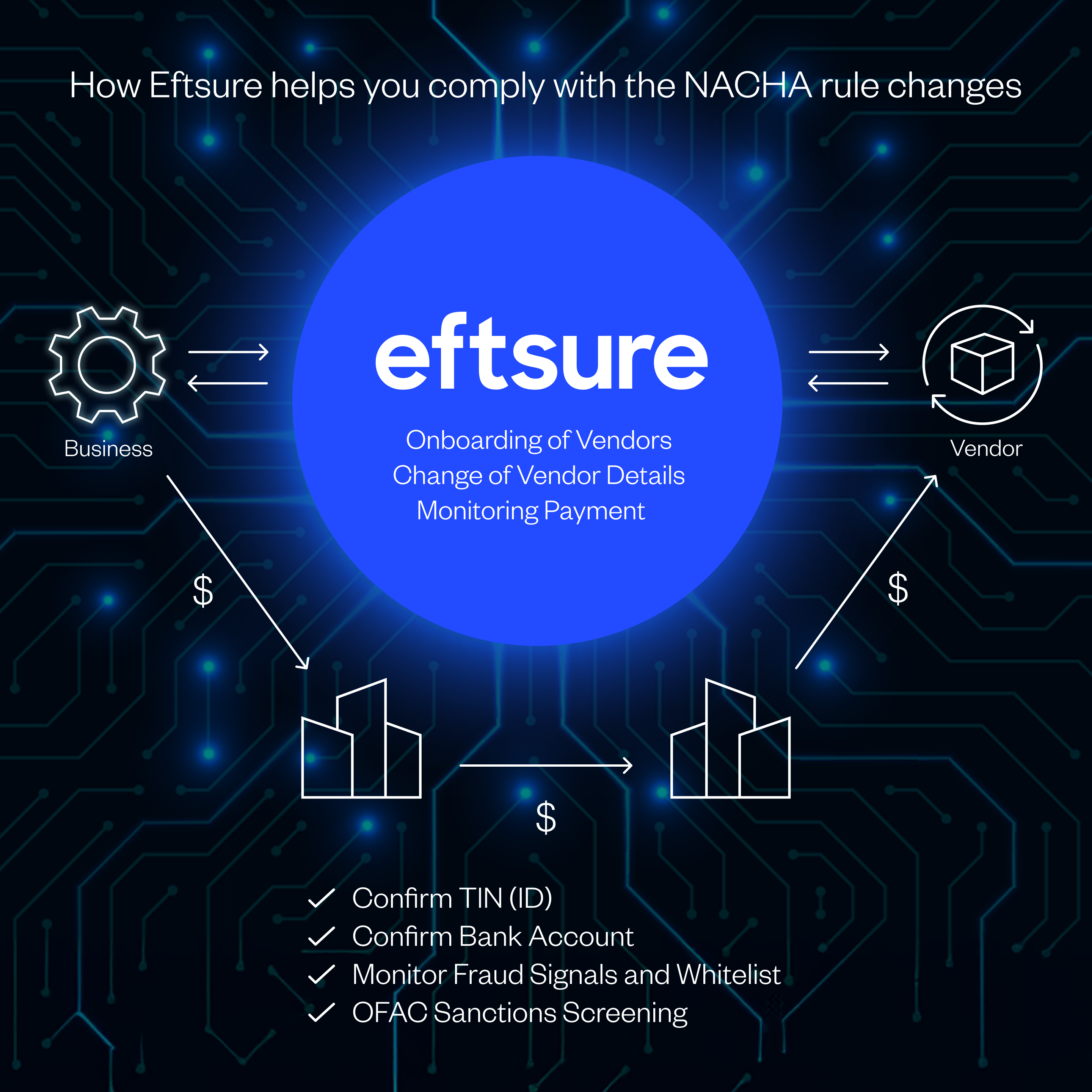

How Eftsure helps you comply with NACHA rule changes

What does Eftsure do?

Confirm TIN (ID) – Supports multi-layered identity verification by confirming Tax Identification Numbers (TINs) and Employer Identification Numbers (EINs) against trusted external sources, such as government databases.

Confirm Bank Account – Enables account ownership and information matching by verifying bank account details against the entity’s legal registration, including cross-checking legal names and formation jurisdictions.

How Eftsure helps you comply with the NACHA rule changes

Monitor Fraud Signals and Whitelist – Enhances ongoing payment monitoring through continuous analysis of payment behaviour, fraud signals, and deviations from approved payment patterns.

OFAC Sanctions Screening – Automates sanctions screening to prevent payments to restricted entities, reinforcing your compliance posture.

Want to see it in action? Request a demo to learn how Eftsure simplifies NACHA compliance for finance teams.

What is the timeline for NACHA compliance changes?

NACHA understands that these compliance changes can present challenges for organizations, which is why they have a phased-in approach depending on your ACH transaction volume. If your company originates more than 6 million ACH transactions or receives more than 10 million in 2023, you will need to comply by March 20, 2026. All other businesses will have until June 22, 2026.

Avoiding 2026 disruptions: 3 strategies

NACHA noncompliance can come with serious implications, including being denied access to the ACH network, and fines and penalties. Here are three strategies to avoid business disruptions going into 2026.

- Use ACH compliance checklists

An ACH compliance checklist is a quick guide that companies can use to ensure NACHA rules are being followed. This checklist typically includes basic information, verifications, internal control checks, approvals, and other authentication policies that align with NACHA’s new risk-based requirements. Not only can ACH compliance checklists streamline your ACH processes, but you can also ensure full compliance with NACHA rule changes.

- Revamp ACH fraud monitoring policies

One of the main goals of NACHA rule changes is to reduce ACH fraud. Revamping your existing fraud monitoring policies to account for changes in today’s payment landscape will be crucial. For example, maybe your ACH fraud monitoring policies flag all transactions over $10,000 for a supervisor review or implement two-step verification. Having defined policies and procedures keeps everyone on your team on the same page with NACHA compliance.

- Leverage payment protection software

Taking on NACHA rule changes internally can be difficult, which is why businesses are shifting toward payment protection software. Programs like Eftsure have built-in fraud checks and automated controls that manage your payments. Eftsure verifies bank account information and Tax Identifying Numbers (TINs) during onboarding and throughout the payment lifecycle. Leveraging payment protection software can also help your team transition to NACHA compliance with the new regulation changes.

Summary

NACHA compliance changes are non-negotiable for all businesses by the end of June 22, 2026. Taking a proactive approach to implementing the necessary changes in your risk management will be important going into the next few months.

Navigating regulatory change requires the right tools. Book a demo to see how Eftsure can help your organisation stay compliant, reduce risk, and safeguard every payment.