What is MFA?

Multi-factor authentication (MFA) is a security method that requires users to prove their identity using two or more distinct factors before accessing …

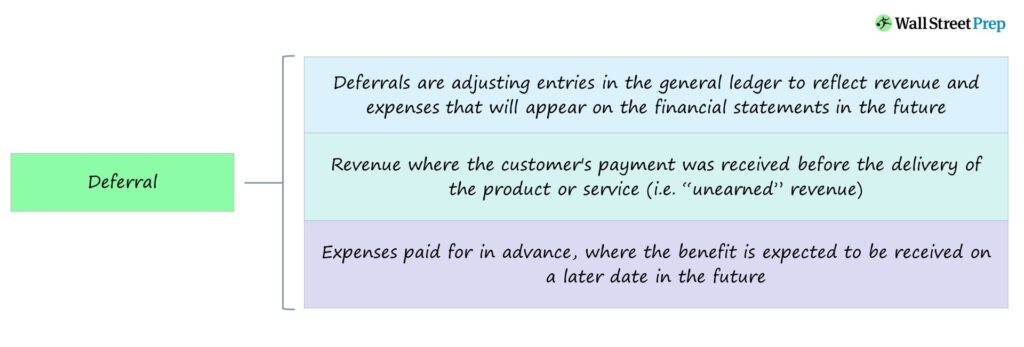

A deferral is an entry made on a company’s books to delay the recognition of a transaction until a future accounting period. Deferrals are made for two classes of transactions: revenue and expenses. Deferred revenue occurs when performance obligations have not been satisfied, meaning the company cannot report the revenue on the income statement.

Deferred expenses are known as prepaid expenses and occur when you prepay for an item. For example, paying for a two-year subscription upfront or the next month’s health insurance premium ahead of time are examples of prepaid expenses. Companies can only report expenses on the income statement that relate to the period.

It’s important to note that deferrals in accounting are mainly used with the accrual method of accounting. Cash basis accounting recognizes revenue and expenses when transactions hit the checking account, eliminating the need for adjusting entries.

Deferrals look to adjust your financial statements for accuracy. Without deferral regulations in place, companies could recognize revenue to make their financial position look more attractive to lenders, investors, and other external parties.

Deferrals are important for two main reasons: the matching principle and compliance with ASC 606. Let’s explore these two factors in more detail.

Deferrals adjust a company’s books to comply with the matching principle. The matching principle requires that revenue and expenses must be reported in the accounting period they are related to. This results in the need for deferral entries to maintain compliance with GAAP.

For example, let’s say you have a multi-year contract with a customer. The customer makes quarterly payments. One of your suppliers was offering a discount at year-end, so you decided to order supplies for the next two quarters.

The matching principle requires you to record the supplies as a prepaid expense. This is because the revenue associated with those expenses has not been incurred or recognized. The company will begin recognizing the expenses in the following quarters when payment has been received.

ASC 606 outlines the steps a company must follow before it can recognize revenue. These standards are required by Generally Accepted Accounting Principles (GAAP). Here are the five steps to recognize revenue:

Let’s say that you have a $10,000 contract with a customer. The performance obligations are broken down into $1,000 for the preliminary plan, $6,000 upon delivery of the machine, and $3,000 for a 12-month maintenance contract. The customer pays for the entire contract upfront.

At the end of the year, you’ve completed the preliminary plan, the delivery of the machine, and two months of the maintenance contract. Your business will need to create a $2,500 entry ($3,000 / 12 * 10) to remove revenue related to the maintenance contract that has not been completed.

This entry will increase your deferred revenue balance in the liability section by $2,500 and reduce revenue by $2,500. Each month for the remaining 10 months of the maintenance contract, you will move $250 from the liability account to revenue, satisfying the matching principle and revenue recognition standards.

Deferrals and accruals are commonly confused. Both can result in adjusting journal entries due to timing discrepancies and applicable accounting standards. However, deferrals push the recognition of a transaction to a future accounting period, while accrual expedites reporting.

For example, let’s say you are planning on paying out a bonus to your employees based on their performance from the prior year. Money hasn’t left your account yet, which means the transaction would not show up in your accounting system. Since the expense relates to the prior year, it should be recorded as an expense. An accrual entry is needed to add the cost to wages with the offsetting entry being recorded as a current liability.

Now, let’s say that you decide to prepay bonuses for quarter one of the next year. The transaction hit your bank account in December, meaning it will likely be recorded on your income statement. However, the transaction doesn’t apply to the prior accounting period, meaning you need a deferred entry to remove the expense until it can be recognized in the next year. The transaction will be moved to the balance sheet as a prepaid expense in the current asset section.

When adjusting expenses, deferrals increase your assets, while accruals increase your liabilities. When adjusting revenue, deferrals increase your liabilities, while accruals increase your assets. Understanding this differentiation is important to issue accurate financial statements and comply with the matching principle and GAAP.

Deferral reporting will involve both the balance sheet and the income statement. To ensure accuracy in your adjusting entries, it’s important to work with an accountant or invest in a robust software application that helps you track costs.

Deferred revenue removes overreported revenue from the income statement to the balance sheet. This occurs when a customer prepays for a contract and your business hasn’t satisfied the performance obligations.

Deferred revenue that is expected to be recognized within 12 months will be reported on the balance sheet as a current liability. Revenue received that is not expected to be recognized within the upcoming 12 months will be reported as a long-term liability. This is common with multi-year contracts.

Deferred expenses are costs your business incurred that do not relate to the current period. Common examples include prepaid healthcare costs, software subscriptions, and maintenance agreements. Your business can only report expenses that relate to the period.

Deferred expenses can also include inventory and labor associated with contracts that have not recognized revenue. For example, let’s say you have a contract with a customer to deliver a custom piece of machinery. You incur both direct labor and supply costs in the process of customizing the machine.

At year-end, you have not satisfied any performance obligations or received progress payments from the customer. The direct labor and supply costs will need to be deferred to the future accounting period to satisfy the matching principle.

Deferred expenses can either be reported as prepaid expenses or as costs in excess of billing. Like deferred revenue, costs expected to be recognized within the next 12 months are reported as current assets, while costs exceeding 12 months will be reported as non-current assets.

Multi-factor authentication (MFA) is a security method that requires users to prove their identity using two or more distinct factors before accessing …

Imposter scams are a type of fraud where scammers pretend to be trusted individuals, companies, or government agencies to deceive victims into …

Accounts payable fraud is a deceptive practice that exploits vulnerabilities in a company’s payment processes. It occurs when individuals—whether employees, vendors or …

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.