Over the years, fraudsters mainly targeted individuals with identity theft. However, they are enhancing their methods and widening their range by now stealing business identities.

Business identity theft, also referred to as commercial or corporate identity theft, has grown increasingly popular with criminals as they look to explore vulnerabilities associated with business practices.

If you have fallen victim to this cybercrime, then you might be liable.

As we explore the question "are you liable for identity theft?", we uncover how to know if your identity has been stolen, what the determining factors are, and if you are liable.

How Do You Know If Your Identity Has Been Stolen?

Over subsequent days, if your business’s identity has been compromised, then your accounts payable department will likely be the first to notice suspicious activity. However, as a CFO, you can look out for these common warning signs:

Unusual Bank Activities or Transactions

According to the National CyberSecurity Society report, “criminals are changing business records to their advantage”. Typically, small to medium-sized businesses fall victim to identity fraud. Once criminals gain access to your bank account details or credit card information, they attempt to commit financial fraud such as the following:

Transferring funds from the business account to a fraudulent account

Committing fraudulent Uniform Commercial Code (UCC) filings, impacting a business entity's credit rating

Updating or altering financial information to make online applications

Making new lines of credit, loans, or credit cards in the business's name, which can negatively affect your credit history

Unrecognized withdrawals or purchases that the business or AP staff have not made

Ultimately, you may receive a call from creditors, debt collectors, and solicitors or receive a security alert from your bank about suspicious transactions.

Locked Accounts or Manipulated Permissions

Once cybercriminals obtain access to work, financial, or ERP accounts, the first thing they’ll do is change credential logins such as passwords or remove any form of authentication in order to lock you out.

If you have email notifications switched on for when a password is updated, and you are unaware of any changes, then your accounts and ERP systems may have been compromised.

By accessing sensitive information, they may change information about your business such as registered owners, addresses, emails, and revenue. Keep note that sophisticated criminals can access other accounts or networks quicker if the same password was used more than once for various accounts.

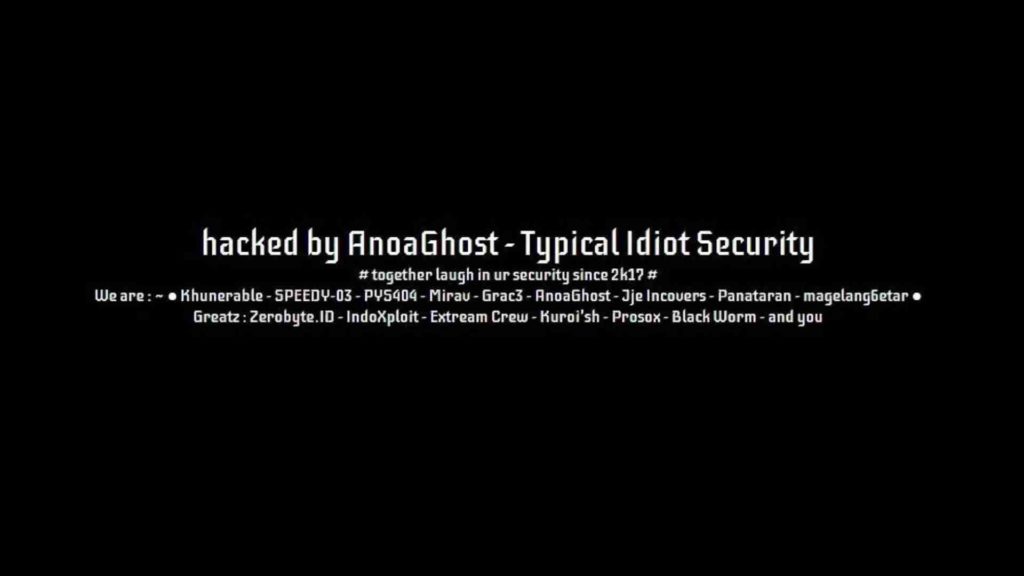

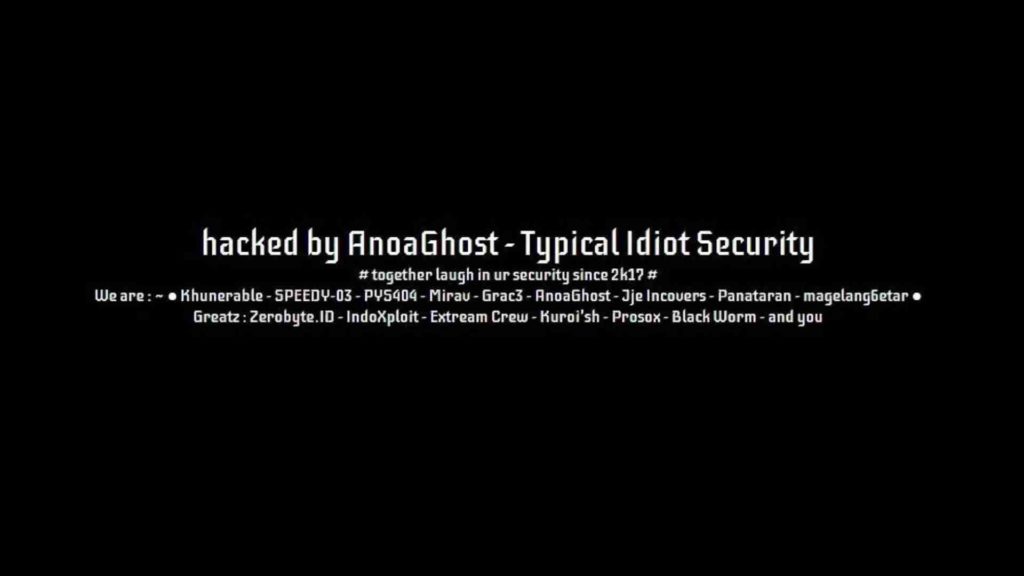

Website Defacement

Website defacement can be defined as an attack in which malicious perpetrators penetrate your business website and replace content on the site with their messages. They may also replace or delete contact information, content, web pages, logos, and more.

If you identify unexpected changes on your website or missing files, this might signal that your website security has been compromised, resulting in a defacement attack. An example of a website defacement attack is the message displayed below during a defacement of a UK National Health Services website in 2018.

Source: BBC

Identity theft doesn't stop at financial fraud. Motivations of the attacks can vary and result in severe organizational consequences.

Unusual Tax Activities

According to Norton, tax-related identity theft occurs when cybercriminals use your business or personal information, including your tax file number, to file a tax return in your business name.

Many organizations publish their corporate documents on the web. Identity thieves can use this information to file fraudulent tax returns to claim a refund or may register a new business name or logo as an official trademark under your business’s identity.

In instances where you identify any of the warning signs or if a hacker has deceived your accounts department into exposing sensitive files, then you should respond immediately.

Are You Liable for Identity Theft?

Typically, cybercriminals who attempt a data breach targeting an enterprise are unlikely to be the same perpetrators who commit identity fraud.

Most of the time, stolen data is sold exclusively on the dark web.

By accessing a business entity’s information, they may also infiltrate your business’s network, accessing employee or customer information such as tax file numbers, bank details, super fund details, personal addresses, and more.

In this case, cybercriminals may use stolen IDs to carry out other fraudulent activities. For example, they may use the ID to acquire a new SIM card with the same phone number belonging to the person whose identity documents were stolen.

This results in criminals using that SIM card to contact accounts payable departments to approve payment transactions. This exposes the vulnerability of call-back controls. Cybercriminals can then impersonate suppliers or legitimate individuals to attempt identity fraud.

Essentially, making the business liable for identity theft.

Even with strong internal controls and call-back procedures, you can still fall victim to identity theft and become liable for the damages that occur in the aftermath.

How Eftsure Can Help

Business identity theft is a severe consequence for all organizations. In Australia, a court may determine that your organization had inadequate measures in place to mitigate the risk of identity cybercrime, making you liable.

To reduce the likelihood that a court will find your organization negligent, you need to be able to demonstrate that you have taken reasonable steps to avoid a business identity theft attack.

You can minimize your exposure to lawsuits by strengthening security controls, implementing prevention methods, and creating a fraud awareness culture.

In addition, by adding a solution like Eftsure, we can help you limit the risks of identity theft by cross-referencing payments, providing you real-time alerts of any suspicious activity, and allowing your accounts payable team to investigate before processing payments.

Contact Eftsure today for a full demonstration of how we can protect your business from identity theft.