Business Email Compromise: A Growing Threat

Australian businesses are facing a tsunami of BEC, or Business Email Compromise, scams. The Australian Government’s Annual Cyber Threat Report 2022 has just been released. The statistics are nothing short of shocking:

Losses from BEC scams are up 21% over the previous year to $98 million

Average amount lost from a successful BEC scam is up 28% over the previous year to $64,000

These cybercrime statistics make one thing very clear: The global cybercrime syndicates who launch BEC scams are not stopping. If anything, they are becoming more audacious than ever before.

Scammers Are After Your Identity

Every day, scammers are usurping the identities of senior executives, such as CEOs and CFOs, in order to send fake emails to accounts payable (AP) teams. Their goal is simple: to deceive unsuspecting AP staff into processing fraudulent payments to bank accounts controlled by the scammers.

That's why identity theft is such a threat. It is the necessary precursor to many types of scams, particularly BEC. With national BEC rates skyrocketing, it's clear that too many Australian executives are still having their identities compromised. This is resulting in unprecedented BEC losses. It's a threat business leaders cannot afford to ignore.

Identity Theft a Major Concern this Scams Awareness Week

The recent spate of large-scale data breaches is causing anxiety for millions of Australians. With their personal information and identity documents compromised, many now fear they will be targeted by cunning cybercriminals. Most at risk are high-profile individuals, such as corporate leaders. Once scammers have access to an executive's identity, the damage they can inflict is unlimited. But, with heightened vigilance and the right tools, it is possible to prevent becoming the next scam victim.

That's a key lesson every business leader should focus on this Scams Awareness Week (SAW), an initiative of Scamwatch that runs from 7 - 11 November 2022. As Scamwatch warns:

"With scammers continually developing new ways to catch people out, we need to increase our vigilance in checking for those little clues that can alert us that something is a scam."

That's why Eftsure is partnering with Scamwatch this Scams Awareness Week. We are committed to doing everything possible to prevent identity theft, whilst ensuring AP teams are equipped to stop BEC scams.

Business in the Crosshairs

To any business leader who thinks scams only affect naïve individuals, it's time to think again! Scams are run as professional, organised businesses. Like any business, they have strategies in place that seek to maximise revenue. That means it's not just individuals they are targeting. They also seek substantial revenue by targeting organisations with deeper pockets. This means that business is now in the scammers' crosshairs.

That's an important lesson business leaders need to understand according to Peter Price AM, the CEO NSW and Director Australia of CrimeStoppers.

Which Businesses Are Most at Risk?

If you think scammers are only targeting large organisations, you would be wrong. In fact, the latest Annual Cyber Threat Report 2022 clearly shows that medium-sized businesses are losing an average of 42% more than larger organisations. A medium-sized business employs between 20 and 199 staff.

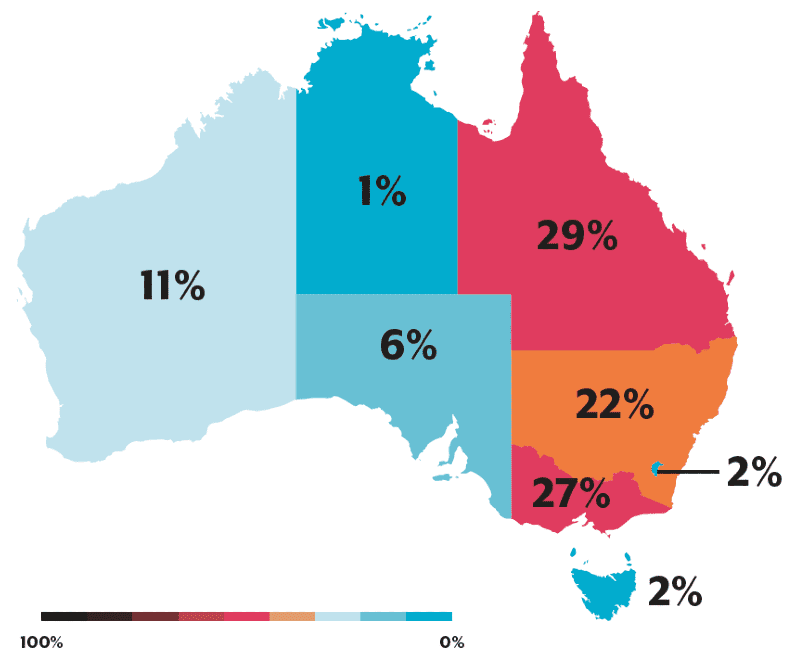

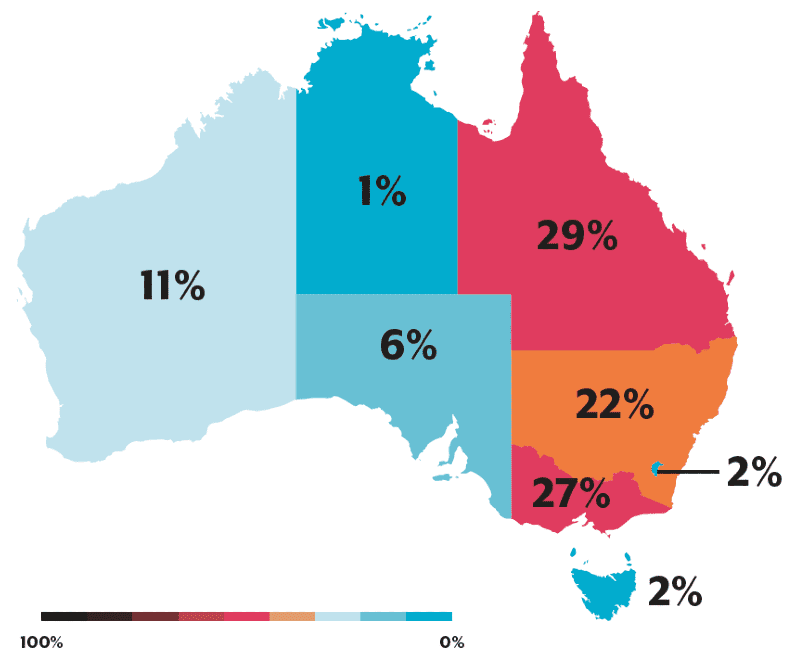

Not only that, but BEC victims in Western Australia lose substantially more than those in any other state or territory. The average amount lost due to BEC in Western Australia is $112,000. That's 62% more than losses incurred by BEC victims in NSW!

With BEC scammers successfully targeting organisations of all sizes, right across Australia, and with unprecedented losses, there's no room for complacency. Every business executive needs to be proactive in stopping the threat.

How Can Eftsure Help?

Eftsure is Australia's leading organisation committed to stopping BEC. With Eftsure sitting on top of your existing accounting processes, you gain unprecedented visibility over external payments. In real-time, you can see whether the funds being processed by your AP team are being sent to the intended recipient or supplier.

A simple 'thumbs-up' indicates that others have successfully sent funds to the same recipient using the same bank account information. A red 'thumbs-down' indicates that the recipient's bank account details do not align with the information in our proprietary database, giving you time to pause the payment and investigate it further.

To learn how Eftsure can protect you from surging BEC rates, contact us today.

BEC Incident Response Guide for Finance Teams

Learn how to respond to a Business Email Compromise attack by following the necessary steps. Download the Business Email Compromise (BEC) Incident Response Guide today to strengthen the odds of recovering your funds following a BEC attack.