The biggest US bank failure since the 2008 financial crisis has created major uncertainty throughout the banking system – and it has heightened fraud risks for organizations across Australia and New Zealand. California regulators closed the prominent tech lender Silicon Valley Bank (SVB Banking Group) on 10 March, an unravelling with significant ramifications for the US tech sector and wider market.

Most crucially for those outside the US tech sector, fraudsters will be looking to capitalize on the chaos by duping tech companies’ customers into paying fraudulent accounts – organizations that bank with Silicon Valley Bank are already telling customers not to pay bills to that account.

As of this article’s publication, the US Treasury, Federal Reserve, and Federal Deposit Insurance Corporation have announced that “depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

The only certainty is that the story will continue to evolve, and we’ll learn more about its ramifications over time. However, there are still risks around paying into these accounts unless advised otherwise. Many accounts will still be closed or taken over by other entities, and many companies will have already opened new accounts.

So here’s how to protect your organization.

How to mitigate your fraud risks during the SVB fallout

Finance professionals should be on high alert for account detail change requests.

Remember that anything coming through email needs to be verified, and don't perform checks by email

Verification questions should never assume that the other party is trustworthy. For instance, fraudsters can intercept phone calls performed for verification purposes. Don't call and ask them to confirm that their details have changed, ask them what their details have changed to

Don't trust phone numbers listed on invoices or email chains, since these can also be manipulated by fraudsters

Eftsure has blacklisted SVB bank account details as insolvent and provides protection against fraudulent attempts to change account details.

Whether or not you’re an Eftsure customer, the collapse of Silicon Valley Bank is the sort of black swan event that proves the importance of robust callback controls and a cybercrime strategy that aligns your financial controls with your cybersecurity measures.

What caused the Silicon Valley Bank collapse and what are the consequences?

Both US and Australian media have reported widely on Silicon Valley Bank’s disintegration, offering a variety of analyses and perspectives on the factors leading up to its collapse. You can read those in outlets like the AFR or Sydney Morning Herald.

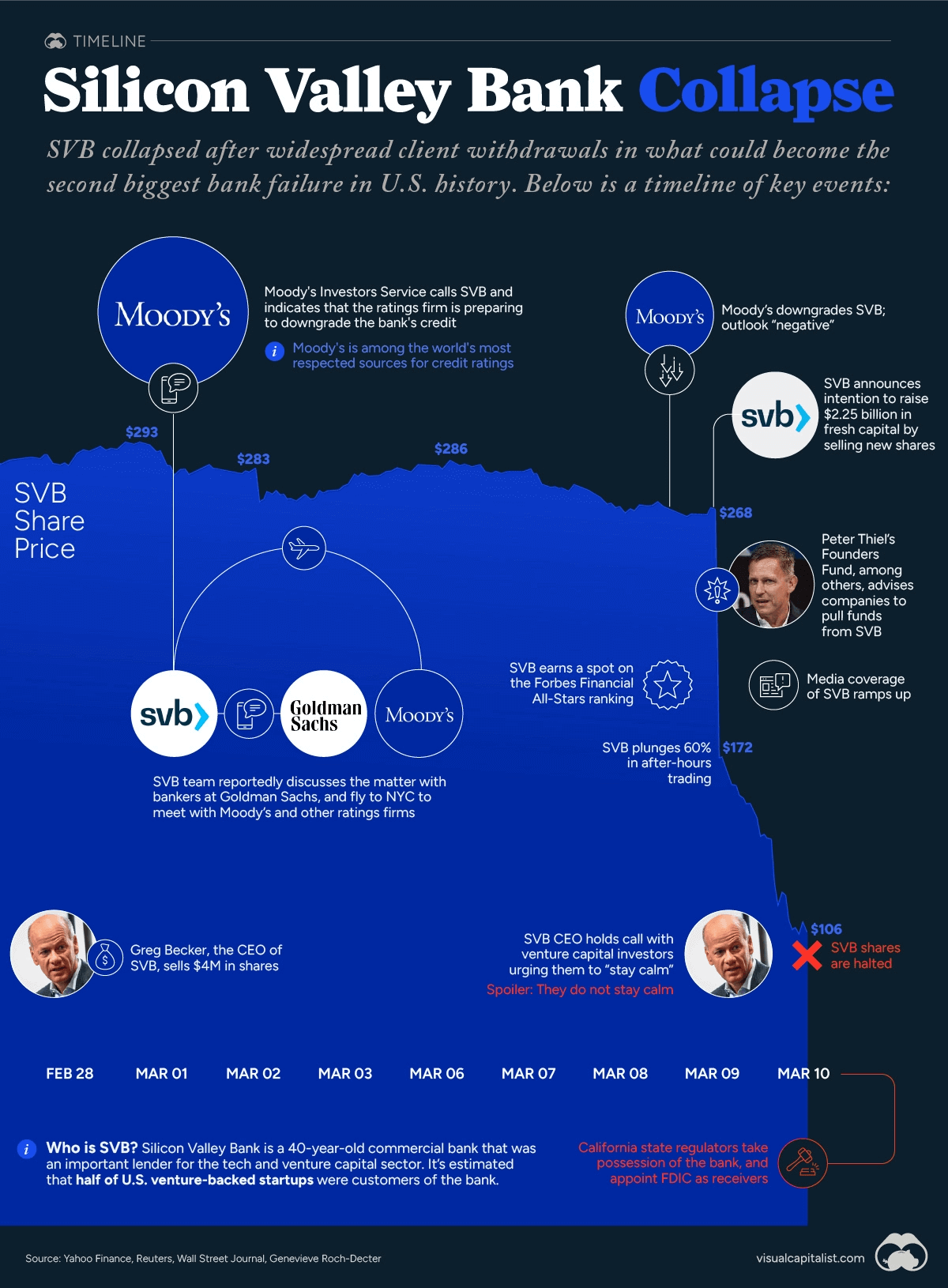

Basically, Bloomberg’s Matt Levine explains the situation as the bank making a “huge concentrated bet on interest rates.” Since so many of its startup customers had ample cash, SVB instead invested in longer-dated fixed-income securities but, in a high-interest-rate environment, had to sell those securities at a loss. After venture capital firms began expressing doubt about SVB’s stability, it wasn’t able to survive a bank run.

Visual Capitalist has provided a handy visual timeline below.

The collapse has sparked broader unease in the financial system. State regulators closed a second bank, Signature Bank of New York, whose depositors have also been promised protection from federal authorities.

It bears repeating that the situation is still unfolding, but the bottom line is this: uncertainty in the banking sector creates fertile ground for fraudsters and cybercriminals. Finance professionals will need to stay on their toes as we learn more.