When your finance team receives a supplier invoice without a valid ABN, what happens?

If the answer is “we chase it up manually, delay the payment, and hope we catch it in time,” you’re not alone. But this routine task carries more risk than many teams realize—and often introduces inefficiencies that scale with every new supplier.

The Compliance Most Teams Miss

Under ATO rules, if a supplier doesn’t provide a valid ABN, your business may be required to withhold 47% of the payment and remit it to the tax office. It’s part of the PAYG withholding framework designed to ensure tax compliance when supplier credentials aren’t verified.

There’s also the GST angle. If your business claims GST credits on invoices from suppliers with an invalid or inactive ABN, those credits may later be denied. In some cases, the ATO may apply penalties or interest if it finds that appropriate verification steps weren’t taken.

At a minimum, this includes confirming that the ABN is valid and that the supplier is registered for GST before processing any payments.

Manual ABN Checks Are a Hidden Productivity Drain

While ABN validation seems straightforward in theory, the actual process introduces friction at nearly every step:

- Chasing suppliers for missing or incorrect ABNs

- Manually checking ABNs and cross-referencing business names

- Verifying GST registration status via separate tools

- Rejecting invoices and requesting reissues

- Maintaining audit evidence across spreadsheets and screenshots

- Training junior team members on what to look for

These aren’t strategic tasks—but they are critical, and they often fall to already stretched finance teams.

A Smarter Way to Stay Compliant

Manual checks are time-consuming and error-prone. Automation changes the equation by embedding compliance directly into your existing workflow.

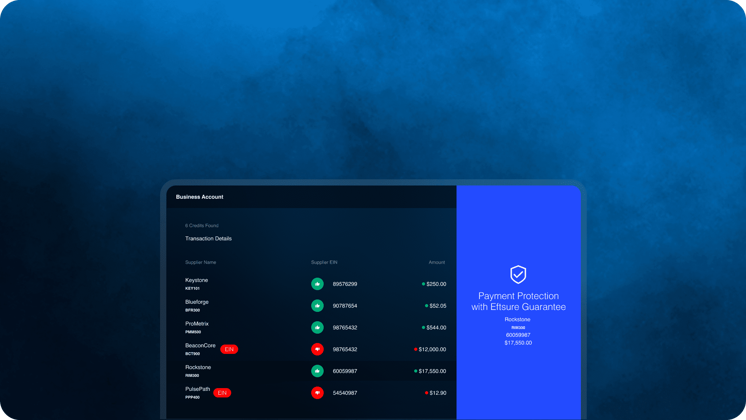

That’s where Eftsure helps.

We enable finance teams to manage ABN and GST obligations at scale by automating supplier verification—from onboarding through to payment.

✅ Real-Time ABN & GST Checks

Eftsure verifies every supplier’s ABN against the official Australian Business Register in real time. It alerts you if the ABN is inactive, doesn’t match the business name, or if the supplier isn’t registered for GST. You can also pull reports on inactive or invalid ABNs to help identify and address compliance gaps across your supplier base.

✅ Supplier Onboarding Portal

New suppliers enter their ABN, bank account, and GST status into a secure portal. Eftsure validates that information on the spot, so any discrepancies are caught early—before an invoice hits your inbox.

✅ Integration with Your Finance System

Eftsure integrates with systems like Oracle NetSuite and Microsoft Dynamics, and many more. Supplier validation happens within your payment workflow, without the need to toggle between tools or manually reconcile data.

✅ Audit-Ready Documentation

Every verification, exception, and approval is logged. Come audit time, your compliance trail is already organized—no need to compile or recreate it manually.

From Compliance Chore to Confidence at Scale

Staying compliant with ABN and GST obligations shouldn’t rely on manual checks or disconnected systems. Eftsure helps finance teams enforce verification standards without slowing down operations.

If your team is spending too much time chasing supplier details or second-guessing payment data, there’s a better way forward.