Only 1 in 10 finance leaders are ‘very confident’ they could stop an AI-powered cyberattack

Only 13% of finance leaders feel fully prepared for AI-powered cyberattacks. Discover where the real risks lie—and how to close the defense gap fast.

Safeguarding against insider threats, such as malicious Accounts Payable (AP) staff defrauding your organisation, is a hugely challenging issue for business owners and managers. All businesses must ensure they are able to identify what an insider threat is, including all its various manifestations. Businesses must also ensure they are constantly protected by implementing a range of preventative measures.

According to Proofpoint, spending on insider threats is up 80% over the past 8 years. On average, organisations spend $184,548 annually on insider threat containment. In addition to this, organisations are also spending heavily on insider threat investigation and prevention.

In this blog, we’ll explore how you can protect your business against insider threats through strengthening internal controls and implementing tech solutions.

To defend against the rise of internal threats, such as employee fraud, organisations are conducting insider threat awareness training. Every organisation should be aware of these dangers and act before it’s too late.

Implementing insider threat training helps your employees identify malicious practices that may be occurring within your organisation. This is crucial in enabling staff to better recognise and report suspicious behaviour.

For effective insider threat training, businesses should include:

To achieve a significant uplift in your organisation’s resilience against potential insider threats, the training program must be personalised and interactive. Such training will give staff confidence to recognise potential threats, as well as the ability to make critical decisions around reporting any suspected internal fraud.

Learn what it takes to develop a fraud awareness culture in your organisation.

Although there is no such thing as a one-size-fits-all approach to creating an anti-fraud policy, you need to have a clear outline of the prevention, detection, protection, response and recovery steps. The Commonwealth Fraud Prevention Centre provides several warning signs to be mindful of when putting together a fraud prevention policy.

Businesses should start by clearly defining which stakeholders should collaborate to identify critical assets, security risk indicators, data sources, compliance requirements, privacy implications, communication protocols & training curriculums.

A comprehensive insider fraud mitigation policy must outline the following:

Implement these 3 key fraud prevention policies.

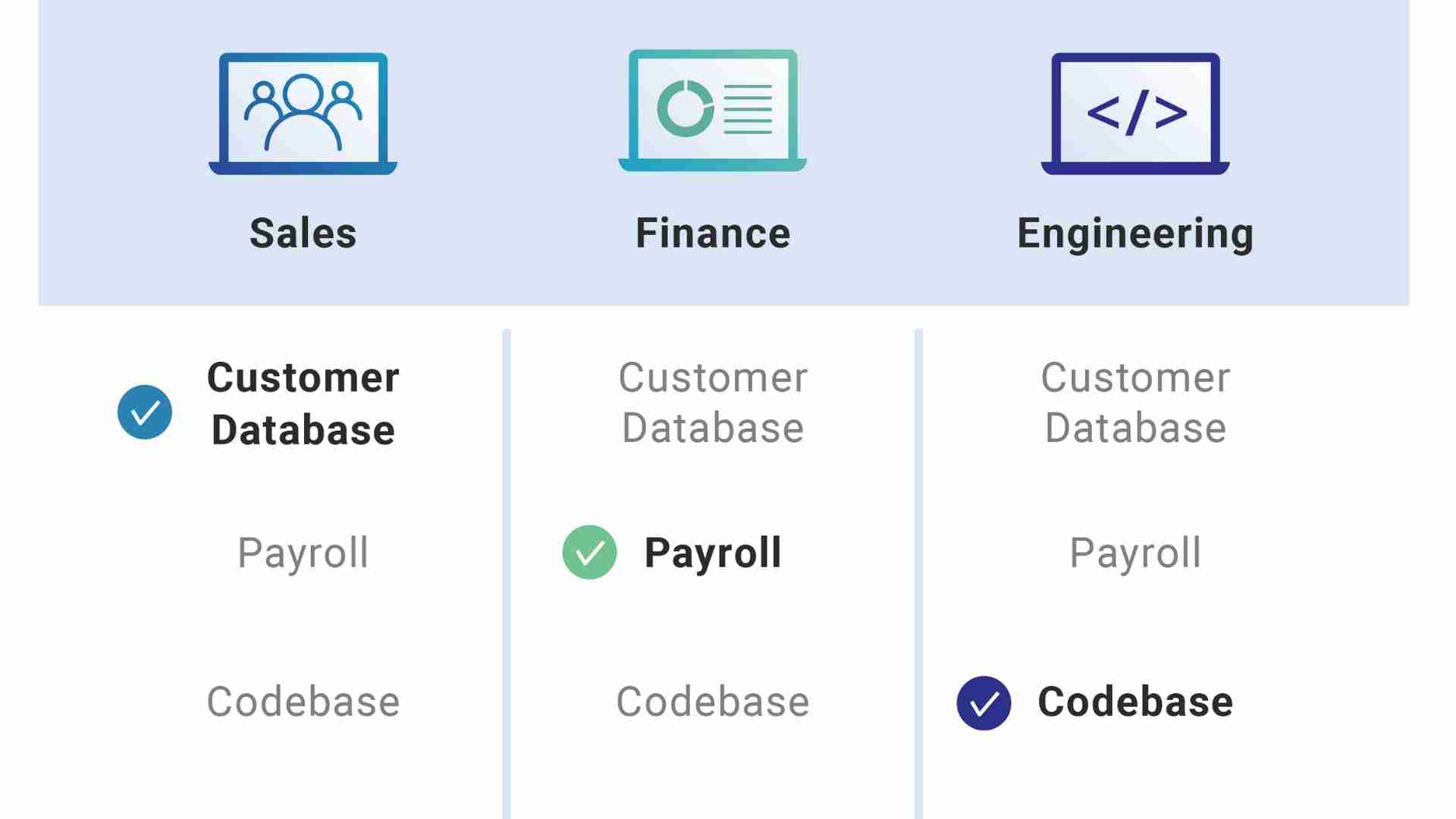

Another way to combat insider threats is through the implementation of restricted user roles and managing access to sensitive data.

In every business, you must assign user roles where each employee has restricted access to sensitive information and limited account privileges. Restricting privileges should be implemented at both the executive and frontline employee level according to a ‘need-to-know‘ basis.

For example, an AP clerk may have access to low-level supplier data and reports. Whereas, the CFO will have access to all levels of supplier management data, reporting, customer setup, and more.

By implementing management procedures with documented and segregated requests and authorisations, you minimise the risk of internal threats, particularly fraud.

Source: Cloudflare

Every organisation must ensure its network, devices, applications and critical data are protected by strong, secure passwords. If your systems are not adequately protected, an insider could corrupt company data as a pretext for committing fraud.

In some cases, an employee might take advantage of exposed passwords in the office, guessing weak passwords or accessing data after they depart the business.

The following password best practices can help ensure no data is stolen or corrupted:

Importantly, you should also ensure that any shared folders used by AP staff are password protected. This will allow your security team to identify who accessed the data in the folder should a breach occur.

Preventing insider threats, particularly internal fraud, is a huge challenge for businesses.

The threat is particularly acute when it comes to AP staff who have access to your organisation’s financial resources and know any loopholes in internal controls that may be exploited.

With Eftsure sitting on top of your accounting processes, you can identify and stop suspicious payments to illegitimate third parties. You also have a detailed audit trail, allowing you to investigate and take action against any malicious activities.

To learn more about Eftsure and how we can help your organisation stay protected from insider threats and internal fraud, contact us today.

Only 13% of finance leaders feel fully prepared for AI-powered cyberattacks. Discover where the real risks lie—and how to close the defense gap fast.

AI voice scams are targeting finance teams—using deepfake tech to mimic executives and authorise payments. Learn how they work—and how to stop them.

Discover 14 real-world AI-driven tax scams targeting US finance teams this season—what they look like, how they work, and how to stop them in action.

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.