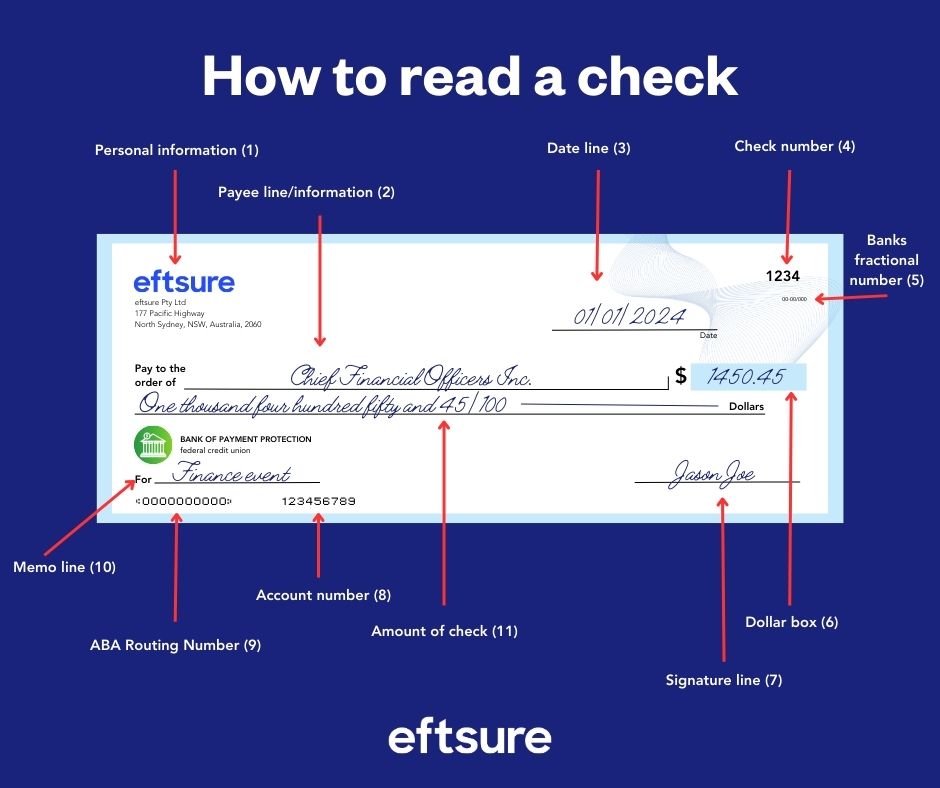

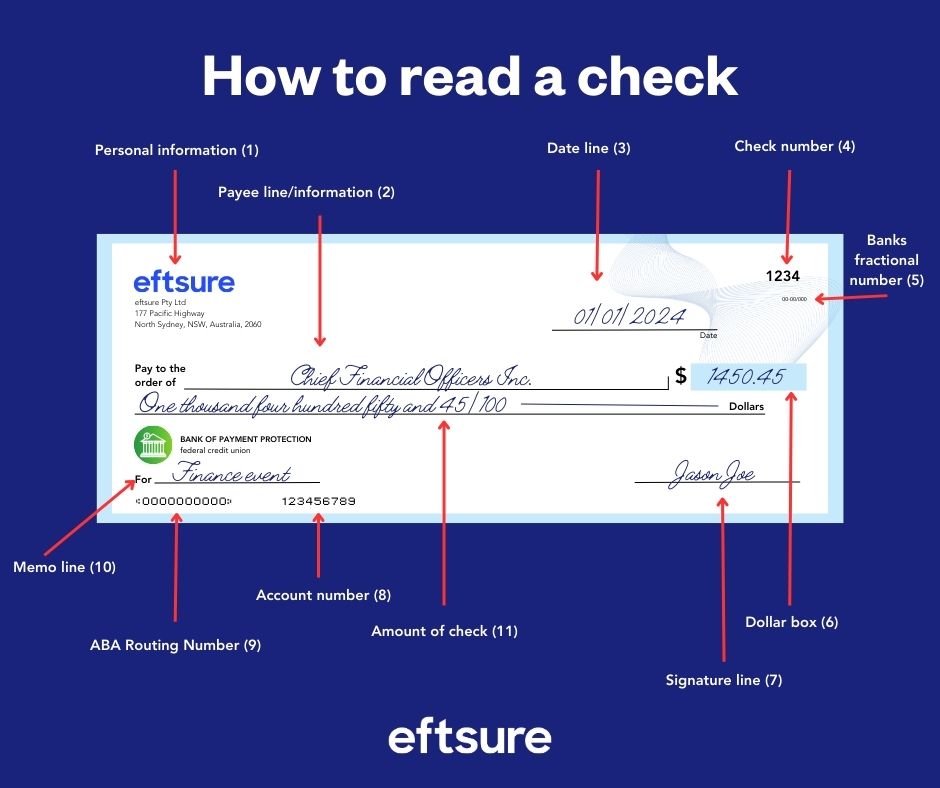

Reading a check may appear straightforward at first glance, but the various elements that comprise a check play a crucial role in preventing fraud and catching errors.

While digital payment methods are on the rise, 33% of business transactions in America still use checks and around 81% of companies still use checks to pay at least some of their bills.

In this short explainer, we’ll detail the 13 key elements of checks and some tips on how to avoid problems when it comes time to write or cash them.

The upper left-hand corner of the check features information on the person (or entity) writing the check. This tends to include the name, address, and in some cases, the phone number of the check writer.

The Payee Line (2)

The payee line denotes the person or business that will be paid and is typically annotated with the text “Pay to the Order of” or “Pay to”. This text prevents check fraud as it stipulates that only the payee is authorized to receive payment.

However, in some cases, the word “cash” may be written on the payee line. This means the check can be cashed by whomever is in possession of it.

The Date Line (3)

The date line indicates the date the payer wrote the check. Some checks are post-dated if the payer needs to wait until there are sufficient funds in an account to cover the check amount.

The date line is an important part of reading a check since financial institutions may not honor checks with a date more than six months in the past (so-called “stale-dated” checks).

Some states may also enact their own laws around check expiration, while other checks may indicate on the front that they expire after 90 days.

The Check Number (4)

In the upper right-hand corner of the check is the check number. The check number serves as a unique identifier for each check and helps the payer keep track of the checks they have written.

The check number can also appear at the bottom of the check where it contributes to the Magnetic Ink Character Recognition (MICR) line – but more on this below.

The Fractional Number (5)

The fractional number tends to occupy a space at the top center-right of the check.

It contains information such as the bank’s routing number, but since this is usually included elsewhere on the check, the fractional number isn’t as widely used as it once was.

The Dollar Box (6) and Check Amount (11)

The dollar box clarifies how much the check is worth in dollar terms.

Underneath the dollar box and the payee line is the check amount line. Here, the dollar amount is written out in words, but cents must be expressed as a numbered fraction.

For example, if the check amount was $350.75, the check amount line would read “Three Hundred Fifty Dollars And 75/100”.

If there is a discrepancy between the dollar box value and the check amount, a bank will typically honor the latter.

The Signature Line (7)

The signature line is located at the bottom of the check. Payers sign their names here to grant permission for the funds to be withdrawn from the designated account.

The Account Number (8)

The account number – which can comprise anywhere from nine to twelve digits – tells the bank which account to debit funds from when paying the check.

This number is located on the bottom left of the check.

The Routing Number (9)

Adjacent to the account number is a nine-digit routing number.

Each financial institution has a unique routing number used for various purposes such as direct deposits, funds transfers, bill payments, and digital checks.

The routing number may also be referred to as the ABA number or routing transfer number.

The Memo Line (10)

The memo line will not feature on all checks and even when it does, there is no legal requirement to fill it out.

Nevertheless, it enables the payer to describe the purpose of the check or provide context for the transaction.

The MICR Line (8 & 9)

The MICR line runs along the bottom of the check and is comprised of the check number, account number, and routing number. This line is read by specialized equipment to process checks securely, accurately, and efficiently.

The Endorsement Line

On the back of the check is the endorsement line which is in fact a box with three or more lines.

Here, the recipient of the funds signs the check to confirm they are the payee and also to authorize the bank to process the check on their behalf. The name the recipient signs with should always match the name that appears on the payee line.

If the payee name is misspelled, the endorsement line should have the incorrect name, correct name, and official (accurate) signature detailed within the box.