What Can Scammers Do with Your Phone Number?

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

Royalty payments are payments made by one party (the licensee) to another (the licensor) for the ongoing use of an asset.

Typical assets associated with royalty payments include:

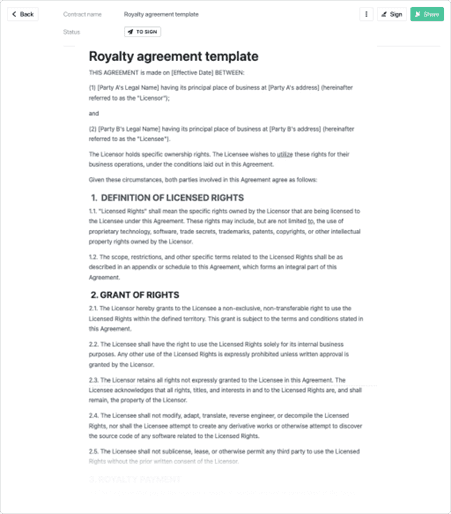

The terms of a royalty payment are detailed in a licensing agreement between the entity that wants to use an asset and the owner of that asset.

Note that the owner of an asset may be:

In general, a license agreement should include these elements.

Defining the scope of the agreement is a crucial first step because it outlines the boundaries and limitations of the usage of the asset.

One primary consideration is geographic scope. In other words, does the license apply to worldwide use or is it limited to a specific state, territory, country, region or continent?

It is also important to define:

The payment terms section outlines how (and when) royalty payments will be made from the licensee to the licensor.

This is often based on a percentage of the revenue or profits an asset generates over time. However, there do exist several other ways to determine the rate:

The frequency of payments outlined in a royalty agreement depends on several factors. This includes:

Reporting and auditing promotes transparency, accuracy and accountability between the licensor and licensee.

To determine exact royalty payments, licensing agreements should clarify when (and how often) sales, usage or production figures are disclosed.

Reports also help verify the performance of the asset and build trust between the parties. Clauses in the agreement may permit the licensor to audit the licensee’s records as well as dictate how often they can do so and under what circumstances.

What’s more, clauses may outline how discrepancies in the data are handled.

These provisions encourage both parties to adhere to applicable laws and regulations while also protecting their respective rights and interests.

Licensing agreements should state that the licensor retains ownership of the intellectual property (IP) being licensed. That is, the licensee is only granted the right to use the IP and does not take ownership of it.

The licensor may also include provisions about actions they may take to protect their IP from authorised use (either by the licensee or a third party).

In the context of a royalty payment, compliance relates to IP laws, commercial laws and any other industry-specific legislation.

Licensing agreements may also identify the legal jurisdiction which determines which country or state laws apply in the event of a legal dispute.

Here are some other key parts of the legal and compliance section:

Let’s finish with a more detailed look at five types of royalty payments and some examples for each.

Music royalties are payments made to songwriters, composers, artists and record labels whenever their music is used, performed or sold.

Within this royalty type are several sub-types:

Patent royalties are paid to inventors (or patent owners) for the rights to their invention(s). Similarly, trademark royalties are collected by the licensor when the licensee wants to use their trademark.

The latter is commonly used by Disney as part of its merchandising strategy, where it allows other companies to produce items featuring Disney characters.

Patent and trademark royalties typically comprise a one-time licensing fee or percentage of revenue generated by the patented product or trademarked brand.

Mineral royalties are paid by companies that extract minerals from a property to the property owner. In Australia, the property owner tends to be the Crown and not a private landholder.

The actual royalty rate depends on the mineral type. In South Australia, for example, the rate ranges from 3.5% of the mineral’s value for refined minerals up to 5% for mineral ores and concentrates.

In other states such as Queensland, the royalty rate may be a flat rate per tonne or reflect the current metal price. Rates can also differ according to whether a mined commodity is consumed within the state.

Publishing royalties are payments made to authors, writers or creators for the use or sale of their written works.

The most common example of this type of royalty payment is a percentage of total book sales. Authors may also receive a lump sum payment before publication of the book which is, in effect, an advance of future royalties.

What’s more, royalties can encompass subsidiary rights. This includes books that are adapted into movies, translated into different languages or released as audio versions.

Royalty financing is a somewhat left-field type of royalty payment where an investor provides capital to a business in exchange for a percentage of the company’s future revenue.

Royalty financing is used to fund projects that require substantial upfront capital in the production, music and digital media industries. It’s also used in:

Summary:

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

When Mr. Beauchamp watched a video of Elon Musk – the world’s richest man – recommend a certain investment platform to make …

Your company delivered the good or service it promised to a client and now it’s time to collect the funds owed to …

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.