What is MFA?

Multi-factor authentication (MFA) is a security method that requires users to prove their identity using two or more distinct factors before accessing …

Promo abuse (also referred to as promotion abuse) occurs when customers exploit or manipulate a company’s promotional offers.

The offers most vulnerable to abuse include:

Promo abuse tends to be most problematic in industries where promotional campaigns are a primary driver of customer acquisition. These include eCommerce, food delivery, ride-sharing and streaming platforms.

The practice is also prevalent in online gaming. Companies in that industry lose up to 15% of their gross revenue from bonus abuse with around 26% of all online accounts fraudulent in some way.

Central to most forms of promotional abuse is the creation of multiple accounts.

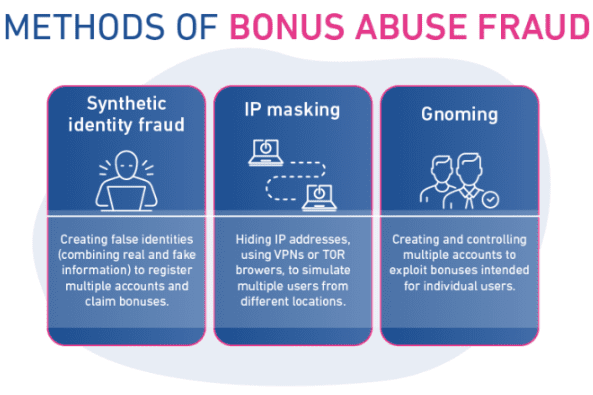

At the most simplistic level, a customer may create several email addresses (and fake personal details) to claim the same new customer discount or referral bonus multiple times. This process is sometimes called “gnoming.”

Here are some other common forms of promo abuse:

More sophisticated scams involve the use of tools to mask IP addresses such as VPNs and TOR browsers. Accounts may also be created to claim bonuses with stolen identity credentials.

One customer receiving a $15 referral bonus may seem trivial at first glance.

However, the consequences are more serious when one considers that many individuals are repeat offenders and work in organised rackets.

Below we’ve listed two impacts of promo abuse on businesses when the practice is carried out at scale.

The most obvious consequence for businesses is a reduction in revenue.

In 2014, a user discovered a loophole in Uber’s referral system and exploited it to amass $50,000 in ride credits.

At the time, the company’s referral program offered $20 to the user for every acquaintance who signed up to the platform through their code.

Over an eight-week period, the user emailed the manipulated promo code “Uber$20FreeRide” to over 700 people. He also shared the code on Reddit and others found it via Google after the search platform ranked the Reddit post for several cheap ride-related keywords.

For companies that rely on promotional campaigns to attract customers, increase brand awareness and drive sales, promo abuse is especially detrimental.

Promo abuse inflates customer acquisition metrics with inauthentic users. This skews the data on customer behaviour and makes it harder for businesses to track user engagement and craft strategies for long-term retention.

Retention of existing, legitimate customers can also be problematic. When loyal customers realise that abusers receive better deals, they may lose trust in the brand and take their business elsewhere.

Businesses can take proactive measures to prevent promo abuse without alienating their legitimate customers.

Here are some of the most effective strategies:

Implementing a robust know your customer (KYC) process helps verify the identity of users before they can claim promotional offers.

This can be as simple as the use of multi-factor authentication to verify email addresses, phone numbers or even identities for high-value promotions.

More complex solutions involve machine learning algorithms to develop risk scores for each customer.

These are based on methods such as:

Note that businesses must always be wary of the friction that additional verification checks introduce for legitimate customers.

One of the most simple ways to reduce promo abuse is to create clear and enforceable terms for promotional offers.

These terms should specify:

While clear terms and conditions do not deter every fraudster, communicating them across multiple channels does discourage promo abuse and educates customers on the potential consequences.

Taking the time to define terms and conditions also forces businesses to think about how their promotions could be exploited in the first place, and prepare accordingly.

Some platforms (such as Voucherify) offer enterprise promotion software that enables businesses to build, manage and track coupon codes at scale.

Businesses can protect themselves from coupon fraud by assigning them to individual customers. They can also set redemption limits and specify that codes are for one-time use only.

Promotions need to be attractive enough to entice new customers to become repeat customers. However, if the offer is too enticing, it inevitably attracts exploitation.

Businesses need to be careful when offering cash reward schemes in particular. These are especially vulnerable to fraud because of the attractiveness and versatility of cash.

Cart abandonment offers are also well-understood and easily manipulated. It is important to err on the side of caution with discounts: sometimes a short email is all that is required to remind the customer to complete their purchase.

Summary:

Multi-factor authentication (MFA) is a security method that requires users to prove their identity using two or more distinct factors before accessing …

Imposter scams are a type of fraud where scammers pretend to be trusted individuals, companies, or government agencies to deceive victims into …

Accounts payable fraud is a deceptive practice that exploits vulnerabilities in a company’s payment processes. It occurs when individuals—whether employees, vendors or …

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.