What is MFA?

Multi-factor authentication (MFA) is a security method that requires users to prove their identity using two or more distinct factors before accessing …

Source-to-pay (S2P) is an end-to-end process in procurement that encompasses the activities associated with sourcing products from suppliers.

To that end, it typically involves finding suppliers, negotiating with them and subsequently hiring them.

The overarching objectives of source-to-pay are to streamline the procurement process and minimise costs.

However, the process also helps businesses access the resources they need in a timely fashion, establish a competitive advantage and maintain beneficial supplier relationships.

The best way to think of S2P is as a cycle that starts with a triggering event and ends with payment of the product or service. These actions (and the others that connect them) are explained below in eight distinct stages.

Many businesses initiate the S2P process because of demand for a particular product or service.

Others will start with a spend analysis to identify cost-saving opportunities and improve their efficiency.

The analysis compels the business to answer questions such as:

In the sourcing stage, potential suppliers are located and evaluated. The objective here is to understand which vendors exist in the market and what features or benefits they offer.

Note that sourcing is a balancing act. The cost of the product should be such that it enables the company to make a profit. But decision-makers also need to consider factors such as minimum order quantity, delivery timeframes and product quality.

Some businesses will use Carter’s 10 Cs framework to evaluate suppliers. The framework, which was developed by supply chain expert Ray Carter – assesses suppliers with ten criteria: competency, capacity, commitment, control, cash, cost, consistency, culture, clean and communication.

Specialised S2P software can streamline the process of supplier bidding and evaluation. In a process known as eSourcing, the company compares bids from multiple suppliers to determine the most suitable.

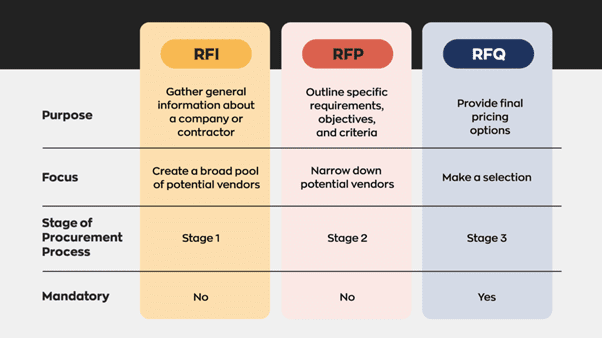

Bids are submitted with three core documents.

The RFI document is commonly sent when the business does not have a clear solution to a problem. As such, it is often the first step in the process of establishing a working relationship with a supplier.

Both the business and supplier work to define the problem, seek out external expertise to solve it and analyse potential solutions.

Unlike the RFI document, the RFP document is used when the business knows the solution to its problem. Price is also less of a concern than product quality and supplier reputation.

RFP documents enable the business to determine whether a supplier can provide a solution that is on time, on budget and within acceptable standards.

For this reason, it is an effective way to narrow down a list of potential suppliers.

The RFQ document clarifies the cost of the product, delivery schedule, product specifications and supplier terms and conditions. This document is rather granular and includes a detailed breakdown of the product or service.

RFQ documents are typically the last document a supplier receives before a deal is made.

Once suppliers are selected, they are onboarded into the procurement system.

This involves collecting and verifying necessary documentation, setting up supplier profiles and ensuring compliance with organisational and regulatory requirements.

Contract management involves the creation and negotiation of a contract that outlines key terms and conditions. For example, it may detail how the supplier should communicate price changes, promotions and product shortages.

The fourth stage also incorporates aspects of supplier relationship management (SRM) – a systematic practice that enables companies to assess their suppliers based on factors such as risk, quantity, item type, location, price and sustainability.

In the procurement stage, the business creates and manages purchase orders and ensures the process of obtaining the goods or services is efficient and cost-effective.

To maximise the company’s ROI, the procurement department may identify backup vendors in case of a product shortage or hold regular meetings to ensure supplier performance meets contractual requirements.

Approval workflows also ensure that any purchase orders align with the organisation’s budget, policies and strategic objectives.

When the product is delivered, the accounts payable (AP) team:

In the case where physical products are delivered, a quality control process will likely be instituted before the items are signed off and sent to accounts payable.

Any order discrepancies or issues with compliance are handled at this point.

In the final stage of the source-to-pay process and once invoices are verified, the AP team processes payment.

Funds are transferred according to the payment terms outlined in the contract. In other words, how the payment will be made and when it is due.

Payment processing also includes the maintenance of accurate records for financial reporting and auditing purposes

Software now automates most of the S2P process and, with procurement and AP automation software, can be incorporated into a seamless ERP system.

Here are some of the many benefits source-to-pay automation offers.

Inherent to the automation of a process is a reduction in manual, repetitive or tedious work. This reduces operational costs and enables employees to focus their efforts on higher-value work.

Software in the S2P process can:

Software also increases visibility across the procurement process. Businesses can better understand their spend and more easily identify areas where costs can be reduced.

Automation also reduces the likelihood of human error and standardises common procurement tasks.

For example, software can perform automatic three-way matching to verify invoices and flag discrepancies for review. More critically, it also houses various procurement functions under a centralised system that serves as a single source of truth for all relevant data.

This data can be monitored in real-time and since it can easily flow to other business functions, it avoids data silos and fragmented systems.

Software can also facilitate beneficial supplier relationships.

Automation continuously monitors supplier performance to address issues proactively, minimise disruptions to the business and limit or avoid inefficiencies associated with poor performance or non-compliance.

While the importance of buyer-supplier collaboration increased markedly over the pandemic, the practice remains an effective way to lower operating costs, increase profits and deliver competitive advantages for both parties.

Summary:

Multi-factor authentication (MFA) is a security method that requires users to prove their identity using two or more distinct factors before accessing …

Imposter scams are a type of fraud where scammers pretend to be trusted individuals, companies, or government agencies to deceive victims into …

Accounts payable fraud is a deceptive practice that exploits vulnerabilities in a company’s payment processes. It occurs when individuals—whether employees, vendors or …

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.