What is RAT malware?

Remote access trojan (RAT) malware is malicious software that permits cybercriminals full, unauthorised remote access to a victim’s computer. Once installed, the …

In finance, double dipping occurs when two incomes are received from the same source.

To better understand how double dipping occurs in the financial services and investment industry, let us consider two key contexts: managed money accounts and wrap accounts.

Managed money accounts are investment accounts that are actively managed by an investment manager. Clients incur a fee for the management of their assets which tends to be 1% to 3% of the total assets under management (AUM).

Here’s how double dipping may occur:

In this context, the fund manager receives a direct fee from the client to manage their assets. They also receive an indirect fee (in the form of a commission) from the fund where the client’s money is invested.

Wrap accounts are a type of money managed account where various investment and brokerage services are bundled together and sold for a single fee.

This fee – which also covers administrative costs and received commissions – is also based on the total AUM.

Double dipping can occur as follows:

Here, the fund manager receives a wrap fee from the client that, in theory, should cover all related costs. However, the manager also earns income from commissions on trades, commissions for sending business to the fund as well as any revenue earned from the fund’s management fee.

In the financial services and investment industry, the drivers of double dipping include:

Many of these drivers interact with (or reinforce) others.

Financial advisors and investment managers often enjoy diverse compensation models that incorporate multiple revenue streams.

As touched on earlier, revenue can be earned via direct fees from clients, product sale commissions, trade commissions and revenue-sharing agreements.

The structure of this model encourages double dipping to occur.

Related to the fund manager’s compensation model is the potential for conflicts of interest.

When an individual is incentivized to recommend products that offer a higher return, they may act in their own best interests and not in the best interests of the client.

One example is the practice of churning, which is the excessive trading of assets in a client’s account to generate commissions.

Churning is illegal and unethical, but for the client, it increases their management costs and potentially weakens their investment position(s).

The fee structures in financial services can also be complex and opaque. Clients may not fully comprehend fees if they are not clearly disclosed or buried in fine print.

Embedded fees are one context where transparency can be lacking. These fees are not directly billed to clients and instead are included within the expense ratios of investment products such as mutual funds and ETFs.

Think of expense ratios as costs the client must absorb to cover the fund’s management, administrative and marketing fees.

Historically, fund managers and brokers primarily earned a living through commissions on the sale of financial products such as bonds, stocks, mutual funds and insurance policies.

However, the commission-based model frequently caused conflicts of interest without advisors acting in their own best interests. Regulations were introduced and the industry shifted to a fee-based model, but the commission-based model has persisted.

The main drivers of this include the persistence of complex fee structures, the ongoing use of revenue-sharing agreements and the frequent introduction of new financial products with opaque fees or terms.

The relationship between a client and their advisor is often based on information asymmetry. In other words, the advisor has more knowledge about a financial product than the client.

When clients do not fully comprehend the fee structure or implications of a product or service, they essentially trust the advisor to manage their assets and dispense fair and impartial advice.

Other clients may possess the requisite knowledge, but double dipping still occurs because they are disengaged, distracted or otherwise unaware of the practice.

Aside from financial services and wealth management, variations of the practice have been observed elsewhere and are commonly associated with fraud.

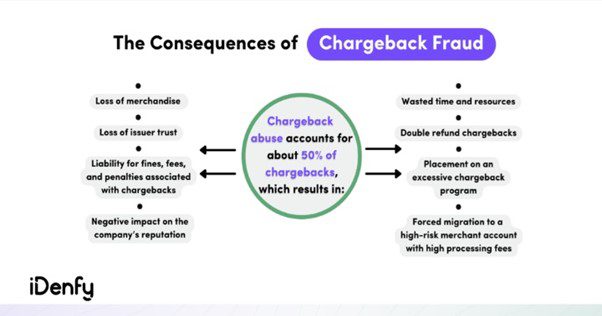

In a chargeback scam, an entity (usually a consumer) profits from the same transaction twice.

These scams represent a significant cost to merchants, with every $1 defrauded by the consumer costing the business around $3.60 in compliance infrastructure, support teams and other expenses.

Here’s how the scam works.

In some instances, a criminal may also steal the identity of a consumer and carry out a chargeback scam. However, the practice is generally considered a form of fraud no matter the initiator.

Double dipping in insurance refers to a situation where an individual or entity attempts to receive compensation from multiple sources for the same loss.

This fraud can be facilitated in various ways,

In finance, the prevention of double dipping involves:

Some onus must also be placed on the client to prevent double dipping.

While becoming as knowledgeable as a fund manager may defeat the purpose of hiring one in the first instance, clients should at least be aware of the different fee structures that relate to their financial products and services.

They can also be more proactive. This means keeping detailed records, monitoring statements for duplicate transactions and where possible, consolidating the management of their funds under a single advisor or firm.

Summary:

Remote access trojan (RAT) malware is malicious software that permits cybercriminals full, unauthorised remote access to a victim’s computer. Once installed, the …

A PayPal invoice scam is a type of phishing scam where fraudsters send fake invoices from the PayPal platform to trick recipients …

Agent Zero (A0) is an open-source AI tool that doesn’t have the same restrictions as current AI tools available to users. This …

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.