What is source-to-pay (S2P)?

Source-to-pay (S2P) is an end-to-end process in procurement that encompasses the activities associated with sourcing products from suppliers.

An ACH debit block is a security feature offered by banks to prevent unauthorised or fraudulent electronic withdrawals from business bank accounts. In essence, ACH debit blocks are a fraud detection tool that protects the business from unauthorised transactions.

Before we delve into the finer details of ACH debit blocks, it is worth taking the time to first define two important terms.

Automated Clearing House (ACH) is a payment method often described as a digital check or eCheck. Note that these are simply digital versions of once-commonplace paper checks.

Employees receive ACH payments from employers in the form of a salary, while employees may send ACH payments when they invest their money on a stock platform, pay their bills online or use P2P apps like PayPal.

These payments occur on the Automated Clearing House network, which was established in the 1970s to process large volumes of digital credit and debit transactions.

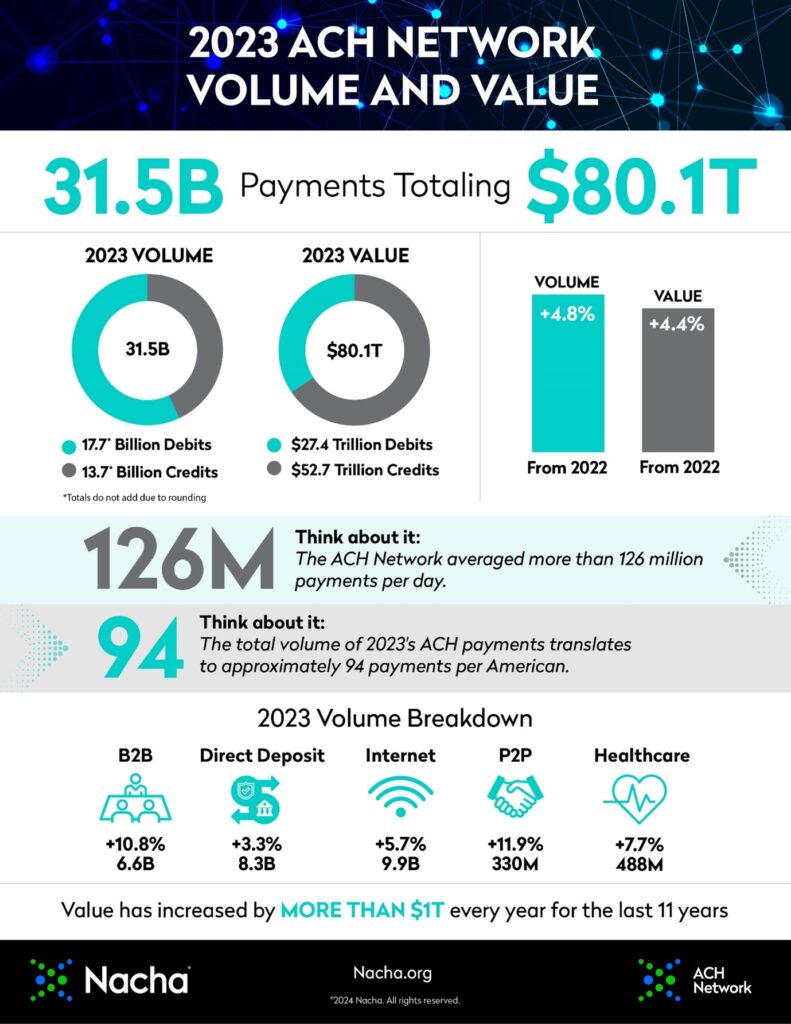

The ACH network is the preeminent network in the United States. In 2023, it processed 31.5 billion payments worth a collective $80.1 trillion.

Key data for the ACH network in 2023. Notice that debits comprised $17.7 billion or 56% of total payments (Source: Nacha)

ACH payments are relatively secure in comparison to checks, but they are not immune from fraud. As a way for businesses to protect themselves from unauthorised account access, they can enable debit blocks.

The way a debit block works is simple: when enabled, funds will not be able to be withdrawn from the account via any payment attempts on the ACH network.

It is important to clarify that debit blocks prevent ACH debit transactions. These transactions are sometimes called a “pull” because the payee actively withdraws funds from the business’s bank account.

To implement an ACH debit block, the business needs to contact their bank and make formal arrangements.

Where all debit transactions for all ACH use cases are prevented.

Where most debit transactions are prevented. In this case, the business can pre-authorize certain payees to withdraw funds from their account. Partial debit blocks are sometimes called ACH filters because payees must meet specific criteria.

Note that a full debit block is rather restrictive in that it does not allow the business to use the funds in its account. Nevertheless, the measure is an effective way to thwart suspicious or fraudulent activity, even temporarily.

If possible, the business should also have an alternative payment method in place before implementing a full debit block.

ACH debit blocks are an effective way to prevent unauthorized ACH transactions in a business bank account. They’re also relatively simple to set up and remove if the needs of the business change.

Debit blocks also represent an additional layer of security if used proactively. Businesses that use debit blocks in this way prevent electronic fraud before it has a chance to occur.

However, in the above scenario, the business will need to contact their bank each time they want to authorize an ACH debit from their account.

Source-to-pay (S2P) is an end-to-end process in procurement that encompasses the activities associated with sourcing products from suppliers.

Reading a check may appear straightforward at first glance, but the various elements that comprise a check play a crucial role in …

A hedging strategy is a risk management strategy to avoid large financial statement losses due to investment fluctuations. Hedges work like an …

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.