Cyber Brief for CFOs: July 2024

All the news, tactics and scams for finance leaders to know about in July 2024.

Each month, the team at eftsure monitors the headlines for the latest cyber & accounts payable news. We bring you essential learnings in our July 2021 Accounts Payable Security Report to help your organisation manage payments securely.

Visit ABC News to find out more.

Think fraudsters only target large enterprises with invoice scams?

Think again.

Between 1 January and 31 May this year, the ACCC received reports of 554 payment redirection scams. Almost one quarter of these were aimed at sporting clubs and community groups.

Fraudsters know that many of these groups receive Government grants to build sporting and community facilities. They also know that these groups are often run by volunteers who lack the skills or experience needed to implement rigorous payment controls – making them particularly vulnerable to scams.

Recently, the Tailem Bend Netball Club, located an hour away from Adelaide in South Australia, lost $150,000 after a sophisticated scam led to money in the club’s account being paid into a false account. Over the course of one weekend, years of hard work and fundraising by the club’s volunteers had been wiped away.

Through a combination of fundraising and a State Government grant, the club had raised enough funds to resurface their netball courts. It is believed scammers targeted the club after seeing regular progress posts on their social media profiles. This is a timely reminder that social media is being used by scammers as part of their reconnaissance efforts.

Just prior to Easter, with the court resurfacing work nearly complete, the club received an invoice, supposedly from the contractors. What they did not realise was that they had been compromised. Following the Easter long weekend, the contractors advised that they had not received payment. The club immediately contacted police, but it was too late. The funds had been dispersed to seven other bank accounts and could not be retrieved.

This case highlights the fact that scammers not only target large, wealthy enterprises. They often view smaller sporting and community groups as low-hanging fruit as they lack the systems and technologies that mitigate the risks of scams.

When sporting and community groups integrate eftsure into their accounting infrastructure, they stand a strong chance of avoiding invoice scams. eftsure cross matches the payment details against a database comprising over 2 million Australian organisations. This provides assurance that the banking details being used to pay a supplier align with those used by others when paying the same supplier. Contact eftsure for a no-obligation demonstration today.

Visit the ACCC Scams Activity 2020 PDF to read more.

Don’t think it’s only older, less computer literate, Australians falling victim to false billing scams.

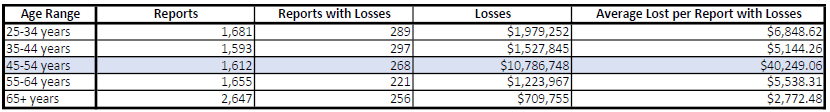

The latest Targeting Scams report by the ACCC breaks down the types of scams impacting different age ranges. Surprisingly, people aged 45 to 54 are the biggest victims of false billing scams by a large margin.

This age cohort reported 1,612 false billing scams to the ACCC during 2020. Whilst this figure is not out of line when compared to other age cohorts, what does stand out is the amount being scammed.

People aged 45 to 54 are losing approximately $40,000 in false billing scams. This is approximately 8x higher than other age groups.

False billing scams include Business Email Compromise (payment redirection) attacks and fake invoices. The most common losses were incurred when people transfer large sums of money for things such as renovations, or conveyancing fees when buying or building property.

In one case highlighted by the ACCC, a property conveyancer had had their email account compromised. Scammers had used the email account to conduct ongoing communications with a couple that was buying their dream home. The couple was instructed to transfer their deposit of $440,000 to the vendor’s solicitor. x

Within days, it became clear that the solicitor had never received the funds. The couple discovered that their email communications with the conveyancer were in fact communications with scammers.

This case highlights the fact that scammers are becoming increasingly sophisticated and invest significant time laying the groundwork to deceive their victims.

It is also a reminder that identifying scams can be extremely challenging for any of us. Even those who consider themselves to be computer literate can be deceived.

Visit the iTWire Cost of Fraud Study to read more.

For every US$1 of fraud, Australian organisations end up paying US$3.51 in total costs.

That’s the disturbing finding of the 2021 True Cost of Fraud APAC Study conducted by LexisNexis Risk Solutions. Worryingly, this figure has increased from US$3.40 barely one year ago.

A combination of factors is driving up the actual cost of fraud, chiefly the challenge of identity verification. The factors hampering identity verification include:

As the challenge of fraud becomes more complex, the study finds that various risks can occur at the same time with no single solution. This demonstrates the need for a multilayered approach to mitigating fraud, including the use of tools that can authenticate both digital and physical criteria, as well as identity and transaction risk.

Among the study’s recommendations are:

Integrating eftsure into your accounting environment will help your organisation realise all these recommendations. Our unique fraudtech platform aggregates data from over 2 million Australian organisations, uplifting everyone’s intelligence capabilities, so it is much easier to identify potential fraud in real-time as you’re processing EFT payments.

Speak to eftsure today for a no-obligation demonstration of how our platform can help your organisation avoid the increasing cost of fraud.

All the news, tactics and scams for finance leaders to know about in July 2024.

All the news, tactics and scams for finance leaders to know about in April 2024.

All the news, tactics and scams for finance leaders to know about in February 2024.

Eftsure provides continuous control monitoring to protect your eft payments. Our multi-factor verification approach protects your organisation from financial loss due to cybercrime, fraud and error.