Eftsure's Rapid Growth Amid Rising Cybercrime

Cybercrime and scams are on the rise, but Eftsure is growing rapidly, showing that businesses are finding ways to fight back. This growth has made us the 41st fastest-growing company in Australia, according to the prestigious Australian Financial Review's Fast 100 List for 2023.

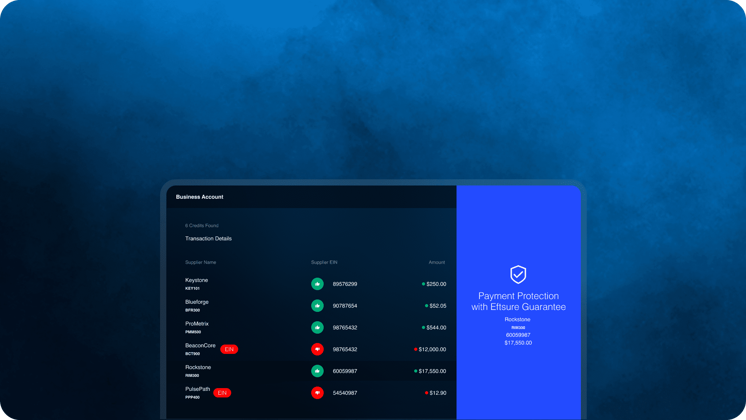

The growth couldn’t be timelier. The Australian Signals Directorate’s (ASD) recent threat report estimates that Australians face cyberattacks every six minutes, representing a 23% increase in cybercrime reports compared to last year. Eftsure safeguards more than $216 billion in payments annually, helping organisations across Australia and New Zealand protect themselves against some of those cyberattacks, many of which come in the form of payment fraud.

“What's even more exciting than making the list is the story behind this achievement,” says Mark Chazan, Eftsure’s Chief Executive Officer. “Since our inception in 2014, we have been on a mission to provide secure and efficient payment protection solutions to our customers. Our growth signifies that we are succeeding in this mission, helping more and more customers feel confident and secure in their transactions.”

The Fast 100 List recognises the growth of Australian standalone companies that started trading before July 1, 2018. To be eligible, companies must have recorded at least $5 million of revenue in 2022-23. They also need to provide three full years of revenue data and are ranked according to the compound annual growth rate achieved over that period.

The list is ranked by the CAGR of revenue over the previous three financial years, the majority of which must have been generated organically and must be from more than one customer. Entrants must provide third-party verification of revenue from an external accountant or auditor.

Chazan says Eftsure’s growth is a promising sign that businesses are protecting themselves against cyberattacks and payment fraud, but that organisations will need to be more vigilant than ever.

“Particularly now that generative AI is providing cybercriminals with more sophisticated tools, it’s a critical time for leaders to reassess their fraud prevention strategies,” says Chazan, stressing that businesses should be examining their processes, people, and technology.

“It’s encouraging that so many businesses are investing in safer payment processes, but plenty of organisations are still exposed and these losses often happen when you least expect them. And a single incident can be very damaging, both financially and reputationally.”

"Fortunately, the right strategies, solutions, and culture will lower your risk of those incidents."