Felix and Eftsure integrate to fight fraud in high-stakes industries

In industries like manufacturing or construction, procurement processes tend to get complicated fast. A new partnership between Felix and Eftsure can help.

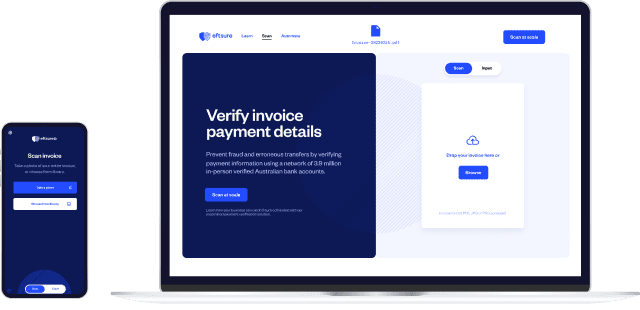

Payment fraud is increasingly common and costly. The Australian Competition & Consumer Commission (ACCC) estimates a total of $224m lost in the past year, along with a 73% increase in reported losses from payment redirection scams. To combat the issue, Eftsure – the market-leader in B2B payment fraud prevention – is releasing its new accounts receivable fraud prevention tool, EftsureID, as featured in Accountants Daily.

Fast-evolving technology like artificial intelligence (AI) is aiding criminals in their hunt to exploit weaknesses in financial control procedures. While companies have mostly focused on securing outgoing payments and their accounts payable (AP) systems, many have neglected safeguarding their incoming payments and accounts receivable (AR) systems. This leaves organisations exposed to incoming payment fraud – and the risks can be considerable.

“Currently we prevent an average of two or three high-value fraud attacks per week in accounts payable for our customers,” said Mark Chazan, Eftsure CEO. “But when it comes to collecting payments, our customers rely on the controls of the individuals who pay them.

“Unfortunately, these controls don’t always meet their own internal standards. And most of us aren’t privy to other businesses’ processes or whether they’re following best practice.”

EftsureID allows businesses to fulfill their duty of care by providing them with tools to verify the authenticity of the payment data presented on the invoices they issue. The tool uses the power of its comprehensive database, which includes 4 million verified Australian businesses amassed over the past seven years.

“Solving payment fraud in accounts receivables isn’t an easy task. It’s why we are the first on the market. We had to come up with something that’s user-friendly but can’t be easily sidestepped by fraudsters,” said Chazan.

Individuals can use EftsureID by uploading their invoices that bear the authentication badge to a verification website, https://id.eftsure.com.au. The tool matches the information found on the invoice with Eftsure database and provides the end user with advice to pay or warns them about potential fraud.

“Although businesses are not necessarily liable for missing accounts receivables, losses can cause lengthy legal proceedings or operational interruptions to the business,” Chazan explained. “We’ve developed EftsureID to make it harder for fraudster to come in between the transactions.”

In industries like manufacturing or construction, procurement processes tend to get complicated fast. A new partnership between Felix and Eftsure can help.

Employee awareness is a critical part of any anti-fraud strategy. Westpac and Eftsure have been working to hard to help organisations raise theirs.

Find out how NAB and Eftsure are teaming up to keep B2B payments safe from scammers.

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.