Fraud prevention is a strategic approach to identifying and combatting fraudulent transactions, safeguarding financial systems, and preventing fraudulent activities that could lead to financial loss or reputational damage. Just about every business transaction is now digital, therefore businesses are facing fraud at higher rates and experiencing greater fallout when fraudulent acts are successful.

Closely linked with cybersecurity, fraud prevention isn’t something that humans can do alone. In order to keep up with technology-led fraud, using technological tools to flag suspicious behavior, encrypt sensitive data, and closely monitor secure transactions is a must. Fraud is always changing, and as such, the tools available for businesses to use to prevent fraud are always changing, too.

Staying on top of your organization’s fraud prevention program is about more than stopping fraud before it happens; it’s about illustrating to customers, business leaders, and stakeholders that trust and security are key pillars in your company.

Common Fraudulent Schemes

Not only are businesses at risk of being exposed to fraud but individuals can also get caught in the crosshairs of these schemes. Some of the most common types of fraud today are:

When someone uses a stolen credit card or stolen credit card information to make a purchase, they are committing fraud. Because payments can be made in-person, online, and over the phone, it can be hard for businesses to catch credit card fraud. Verifying the buyer’s identification, as well as tracking location details of the user and of the credit card itself can help stamp out credit card fraud.

Accounting Fraud

If a person inside of an organization is inflating revenue numbers, mis-categorizing expenses, or trying to hide historical transactions altogether, accounting fraud is happening. Accounting fraud is incredibly serious; it has taken down large companies and had massive negative impacts on the global economy when it happens at scale.

Identity Theft

Identity theft can happen in many different settings, but anytime someone uses another individual’s information -- such as their name, address, Social Security number, or credit card details – without their permission, it’s considered identity theft. Identity theft can be used to lie to the federal tax authority, open new lines of credit, or make large purchases.

Insurance Fraud

Everyone knows the story of a struggling business owner who tries to burn down the shop and get money from the insurance claim, right? If not, it’s a classic attempt at insurance fraud. Insurance fraud can be executed on an individual level, such as trying to get health insurance coverage after a major injury takes place, or on an enterprise level as described above.

Malware Attacks

Looking at digital fraud, malware attacks are used by hackers to infect computer systems and business networks with viruses such as ransomware or spyware. These viruses can corrupt the systems entirely, expose sensitive information, and lead to businesses going belly-up if they can’t recover from the attack.

Phishing

Another cybersecurity attack that everyone needs to watch out for is phishing. Phishing emails can trick even the smartest employees into changing payment information for certain transactions, sending large sums of money to hackers, and entering their login credentials into a fake website. Employee training and building a culture of open communication are two of the best ways to prevent damage from phishing attacks.

Fraud Detection vs. Fraud Prevention: How Do They Differ?

The best fraud protection solutions are two-pronged, consisting of both fraud prevention and fraud detection activities. Although the terms sound similar, they are slightly different, and the difference is worth highlighting.

Fraud prevention solutions are best practices, systems, and additional safeguards that are meant to stop fraud attacks before they occur. By reducing the risk of future fraud, businesses can focus more on business growth and other priorities, instead of cleaning up fraud-related disasters down the line.

Fraud detection, on the other hand, happens during a fraud attempt. For instance, if a hacker is using a bot to test out thousands of different platform login credentials to break into a business system, some fraud detection tools can flag that behavior and send an alert to the leadership team, giving them time to respond before the attempt is successful. Detection is more about mitigating fraud when it’s happening, while prevention focuses on stopping fraud from happening in the first place.

Fraud Prevention: Best Practices

A robust fraud prevention solution stops fraud risk before it starts. Because of the impact that fraudulent activity can have – no matter where it originates from – the best approach to mitigating those risks is through fraud prevention. Big or small, businesses of all sizes are major targets for hackers and fraudsters. Some hackers may want to gather and sell customer information while others want to stop manufacturing plants from working and hold a company for ransom. So, if such a wide range of fraud risks exist, can you actually do anything to prevent them? The answer is a resounding “Yes!”

Implement Strong Internal Controls

Strong internal controls aren’t just for accounting teams and financial processes; implementing internal controls throughout the organization can lead to heightened accountability and transparency surrounding key transactions or priorities. With strict access controls to sensitive data sets and a clear segregation of duties, it’s harder for employees to commit fraud and easier for them to avoid it altogether. Not only is it important to implement strong internal controls, finance professionals should be pressure testing these controls periodically to ensure due process is being followed and organizations are always protected against fraud attempts.

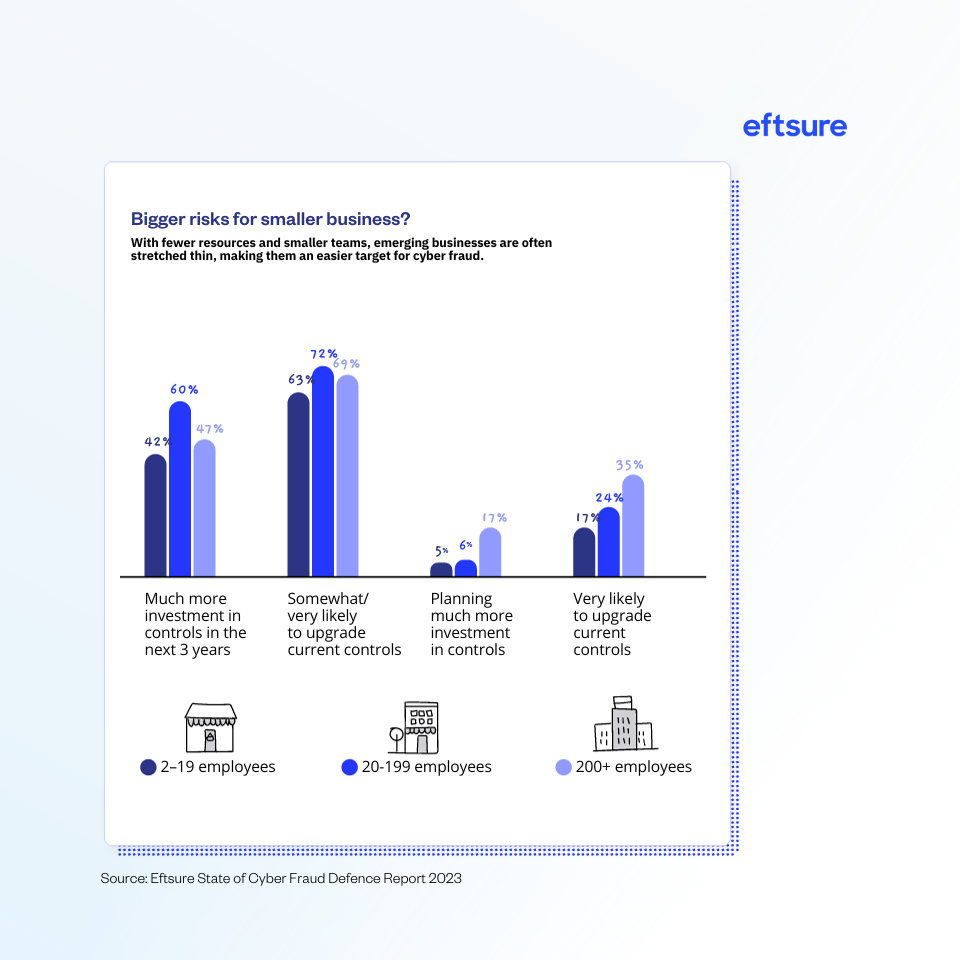

In our recent State of Cyber Fraud Defence Report, we looked at the risks for small businesses versus large organizations and assessed their likelihood to invest in new fraud prevention controls:

Partner with IT Experts

Some companies have knowledgeable IT teams within the organization, but for many businesses, that’s not the case. Because of the constantly changing threats in the technology space, being able to access an expert resource for system architecture needs, security measures, and next-generation fraud prevention tools is non-negotiable. Because internal IT teams are costly and can take a while to construct, consider working with a managed service provider that has experience in serving businesses in your industry.

Invest in Fraud Prevention Software

Specialized fraud prevention software is one of the best ways for businesses to insulate their operations from hackers and bad actors. Because computer-based solutions can work faster than humans, these software tools can process thousands of records in an instant, acting as a final line of defense before an act of fraud takes place.

Use Secure Payment Platforms

Accounts payable teams are a key target for fraudsters. Our technology specializes in B2B payment protection to mitigate the risks of payment errors, fraud, and cybercrime. Safeguarding $216B in payments annually, Eftsure is trusted to verify vendor identities, validate bank account information, monitor compliance requirements, and protect payments from end-to-end.

Create Whistleblower Hotlines and Accessible Reporting Mechanisms

All businesses should give their employees access to a safe reporting hotline where they can alert leadership about fraud threats directly. Simply having whistleblower hotlines in place will remind fraudsters that they won’t easily get away with their schemes. Even further, reporting mechanisms within an organization will help a culture of trust and transparency flourish. When employees know they can highlight risks without fear of retaliation, they’re much more likely to take action when it comes to it.

Prioritize Employee Training

Whenever a business adopts a new tool or implements a new fraud prevention solution, employee training is paramount. If internal teams don’t know how to support effective fraud prevention, then they won’t. Because things change often, fraud-related trainings should take place at least once a year, if not more.

Carefully Vet Vendors

Conduct thorough due diligence on vendors, suppliers, and business partners to verify their legitimacy, financial stability, and reputation. Establishing clear contractual terms, conducting periodic reviews, and monitoring vendor activities can help prevent fraudulent schemes such as billing fraud, kickbacks, or procurement fraud.

Fraud Detection: Tactics that Work

Uncovering fraud isn’t always easy, but with the right strategies in place, organizations can cut down on the time it takes to identify malicious behavior, saving time and downstream costs associated with recovery after an attack. Some of the best ways to detect fraud while it’s happening are:

Advanced Monitoring Systems

There is a plethora of advanced software solutions that are built specifically for fraud detection. These tools rely on fraud detection algorithms, anomaly detection, and machine learning models to identify behavior that is out of the ordinary.

Regular Audits

Audits are not the most glamorous method of detecting fraud, but there are plenty of instances where routine accounting audits pick up fraud attempts. By auditing financial transactions, business systems, and payment information closely, organizations can detect fraud in real time. In order for audits to be effective at fraud detection, the auditors need to be different from the people who own the tasks or systems that are being audited. If that’s not the case, a dangerous conflict of interest is at play.

Employee Training and Awareness

Detecting fraud risks is everyone’s responsibility. With proper training and a clear understanding of what fraud can look like within their day-to-day roles, employees at all levels can serve as impressive fraud detectors.

Every Person’s Role in the Fraud Prevention Program

Fraud prevention solutions will simply never work if only one person within a company is prioritizing them; fraud prevention is a team effort. Every person plays a part, including:

Executive Leadership Team: Because they are responsible for assigning resources, authoring fraud-related policies, and supporting fraud prevention efforts, the executive leadership team must be committed to cultivating a culture of fraud prevention.

Board of Directors: As the body responsible for approving or adjusting leadership policies, the Board will act as a crucial internal control to keep company leadership in check. If execs aren’t prioritizing effective fraud prevention, these are the people who can push for change.

Internal Audit: A lot of responsibility around fraud detection rests on the shoulders of internal auditors. They must make sure accounting policies are being followed and dig into any accounting records that are out of the ordinary. Internal audit usually has a sub-team that audits business systems in partnership with IT, and as more businesses go digital, these task forces are becoming even more important.

Risk Management Team: Since most internal teams have a long list of priorities related to their “day jobs,” assembling a risk management team is a great way to assign responsibility to specific individuals and actually see a fraud prevention program come to fruition.

Human Resources: Most of the time it’s unintentional, but the people within any organization are wild cards when it comes to fraud risks. By screening applicants, conducting thorough background checks, and managing personnel issues, HR is on the frontlines of fraud protection.

Individual Employees: As we’ve mentioned, one person’s impact on fraud prevention can be game-changing. Every individual within an organization should see their responsibility to detect and prevent fraud as a key function of their role – no matter what their role is.

External Business Partners: When a business partners with vendors or other external businesses, they are exposed to the fraud risks of those businesses too.

Benefits of Prioritizing Effective Fraud Protection

Hopefully, your organization never experiences the negative impacts of fraud, but if you’re looking for some encouragement as to why businesses should prioritize a robust fraud prevention solution, here are some of the benefits of doing just that:

Preventing and detecting fraud early on can help cut down on fraud-related costs. Recovery efforts, legal fees, and ransom payments can all take a toll on your bottom line.

Customers expect the businesses they work with to protect their information and implement fraud prevention plans. With one in place, a company can help reassure customers of the safety of their information, leading to high rates of customer retention and brand loyalty.

Cyberattacks and other fraudulent activities can lead to businesses shutting down all operations. The shutdown of operations has massive financial implications, but with the right prevention solutions, shutdowns can be avoided.

Effective fraud prevention safeguards the reputation and trust of the business among customers, investors, and stakeholders, maintaining credibility and goodwill in the market.

Summary

Fraud prevention consists of cohesive strategic measures that are meant to stop fraud from happening in business settings. There are many types of fraud risks, and as such, fraud prevention programs must be robust enough to address all risks.

Various fraudulent schemes pose risks to both businesses and individuals, including credit card fraud, accounting fraud, identity theft, insurance fraud, malware attacks, and phishing scams.

Effective fraud prevention requires the collaboration and commitment of key stakeholders, including the executive leadership team, board of directors, internal audit, risk management team, human resources, individual employees, and external business partners.

Prioritizing fraud protection offers numerous benefits, including reducing fraud-related costs, maintaining customer trust and loyalty, avoiding business shutdowns, and safeguarding the reputation and credibility of the business in the market.