How likely am I to be scammed? A guide to cybersecurity hygiene

In a world increasingly dependent on digital platforms, you may wonder how likely it is that you’ll fall victim to a scam.

Financial leaders face an escalating risk of cyber-crime, with tactics becoming more and more sophisticated. As threats grow, it’s increasingly critical for financial leaders to assess and update their internal controls on a regular basis.

When determining whether your organisation is vulnerable to cyber-crime and payments fraud, leaders need to ask themselves a blunt question: how robust are our financial controls, really? Are they updated according to protect against rapidly evolving cyber-crime and digital fraudsters? And how do you know whether they’re sufficient, especially since many scams go undetected and unreported?

The uncomfortable truth is that fraudsters are always looking for new ways to circumvent your controls. Many of them have an in-depth understanding of financial processes and corporate structures, and they’re leveraging new technological advances like generative AI to deploy tactics that are increasingly scalable and sophisticated. But too many financial controls are designed for fraud tactics that predate this proliferation of cyber-crime.

The only way to know for sure whether your controls are adequate within this fast-evolving landscape? Pressure testing. It’s one of the best ways to assess how your controls actually perform in the face of a growing range of financial threats.

So let’s dive into what pressure testing looks like in Accounts Payable, including how to implement it and why it’s important for securing your organisation’s finances against fraud, cyber-crime and error.

Pressure testing in accounting is a process that evaluates the effectiveness of internal controls. It involves subjecting financial procedures and processes to simulated scenarios and testing their ability to withstand risks like fraud or cyber-attacks. Pressure Testing was widely introduced into the banking sector following the 2008 Global Financial Crisis as a way to determine whether a bank had sufficient capital reserves to withstand major economic shocks, such as a deep recession or a financial market crash.

Pressure testing falls under the umbrella of auditing and compliance. The goal is to identify weaknesses in controls and processes, and then address them before an actual risk event occurs. Financial leaders are responsible for overseeing financial operations and often conduct regular pressure tests as part of their responsibilities to ensure that effective control measures are in place.

This sort of routine testing helps organisations know – and demonstrate to regulators – that they have strong internal controls in place. Pressure testing can happen in a variety of ways, performed by internal or external auditors. The process can be as structured as a formal audit or as casual as a CFO sending test emails from their own email account.

In some ways, pressure testing is similar to a risk assessment. Whereas a risk assessment identifies potential risks and what sort of controls are needed, pressure testing is a little more focused on existing policies, processes and procedures.

Pressure testing is also similar to penetration testing, a cybersecurity practice in which “ethical hackers” hunt for vulnerabilities through simulated cyber-attacks.

The recent release of AS8001:2021, the standard issued by Standards Australia for fraud and corruption control, makes it clear that organisations should embrace pressure testing as a way to assess their controls’ effectiveness.

When pressure testing an Accounts Payable function, auditors carry out certain actions to evaluate whether or not your policies, processes and procedures are working as intended. The goal is to determine whether or not, in a real-world scenario, your organisation would be able to identify and prevent potentially fraudulent activity.

Pressure testing also plays an important role in assessing risk tolerance. It enables financial officers to determine their organisation’s ability to absorb losses or overcome unforeseen events without significant disruptions to operations or finances. Throughout this process, financial leaders can identify areas needing additional safeguards or updates and can prepare contingency plans accordingly.

This is one of the most effective ways to determine whether your policies, processes and procedures are strong enough to defend against popular fraud tactics – especially digital ones.

When pressure testing your Accounts Payable function, testers will carry out certain actions to ascertain whether or not your policies, processes and procedures are successfully operating as intended. The objective is to determine whether or not, in a real-world scenario, your organisation would be able to identify and prevent potentially fraudulent activity.

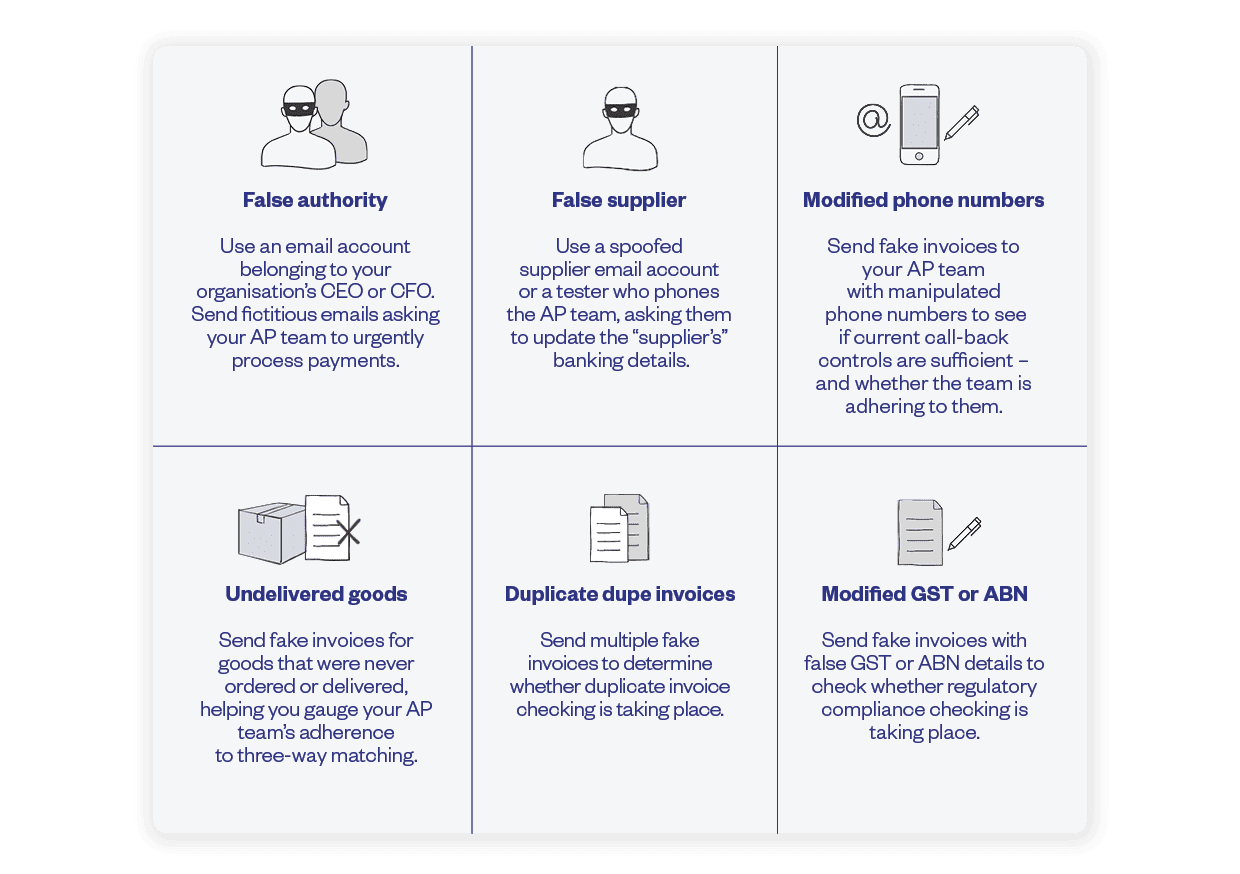

There are multiple ways your organisation could undertake Pressure Testing to determine your ability to prevent fraud.

These are just some of the pressure testing you can use when auditing your financial controls. You might need to adjust tactics based on your organisation’s processes and the specific risks that you’re more likely to face. This is where engaging with third-party auditors can be helpful. We don’t know what we don’t know, but external specialists can help you identify vulnerabilities or gaps that might otherwise get overlooked.

When undertaking regular pressure testing of your accounts payable function, you can expect a range of benefits.

What are they?

Reviewing transaction processes, assessing document retention policies and evaluating segregation of duties policies are all key steps in understanding your vulnerabilities. It’s important to thoroughly examine each area to ensure that all bases are covered and vulnerabilities are identified.

Pressure testing identifies weaknesses and vulnerabilities in your internal controls so you can implement remediation measures that strengthen your resilience to an ever-shifting threat landscape. When reviewing processes, consider the following:

When assessing document retention policies, ask yourself:

Finally, when evaluating your segregation of duties, consider:

By addressing these areas thoroughly during a pressure testing exercise, AP managers can identify potential weaknesses within their organisation’s internal controls.

Conducting regular vulnerability assessments is a critical step in protecting against the cyber threats that your IT or security teams aren’t in a good position to mitigate – that is, the threats that primarily affect AP teams and financial processes.

Hackers and cyber-criminals know that your IT team can’t prevent risks like human error. For instance, even if a security team has successfully fortified an organisation’s infrastructure, systems and data against malicious actors, they can’t protect AP employees from scammers who’ve infiltrated a supplier’s systems or data. You’ll need to know if your internal controls are adequately protecting against these types of threats.

Plus, financial pressure testing can reveal any gaps in your broader cybersecurity defences, such as any areas that aren’t currently protected by multi-factor authentication or workflows that inadvertently reveal sensitive data to unauthorised employees. Pressure testing can help leaders know how to refine or adjust staff training, which is a crucial part of good security hygiene. Regular training sessions should cover topics such as recognising suspicious emails, creating strong passwords and avoiding phishing scams.

When financial leaders conduct pressure testing, it’s a great opportunity to communicate the potential for scams and fraud.

Depending on the type of test you conduct, it can be a concrete example of the tactics that staff should be noticing. The greater their awareness, the likelier that staff can identify, thwart and report potentially fraudulent actions. In addition, routine pressure testing acts as a regular reminder to stay alert and keeps cyber-threats front-of-mind even during hectic periods.

Just remember that you’ll need measures in place to ensure your organisation doesn’t experience any actual loss of funds as a result of the testing activities.

Defining acceptable levels of financial risk is crucial when assessing risk tolerance. Financial officers must identify the level of risk that their organisation can handle without compromising its financial stability. This involves determining the amount of loss that the organisation can bear and remain operational. Setting acceptable levels of financial risk will require weighing multiple factors, including industry standards, regulatory requirements and company objectives.

Analysing the potential impact of insufficient controls is another critical aspect of assessing risk tolerance. Internal controls are put in place to minimise risks and ensure accurate financial reporting. But weaknesses in your internal controls could leave an organisation vulnerable to fraud or errors that can seriously impact the bottom line.

Many organisations struggle to ensure their internal controls are fit-for-purpose. This is particularly so when those internal controls are supposed to protect the organisation from fraudulent activities that are constantly adapting to take advantage of potential vulnerabilities. Ensuring your internal controls are sufficiently robust requires ongoing monitoring and vigilance.

By embracing automated internal controls, you can leverage technology in a way that strengthens your policies, processes and procedures, thereby providing your organisation with a far more robust anti-fraud posture.

With Eftsure integrated into your AP processes, you benefit by having a technology-enabled layer of security that ensures that all outgoing funds are remitted to the right person. Irrespective of what tactics a fraudster may adopt to try and deceive your AP team, Eftsure centralises and ensures strong anti-fraud processes – without slowing down workflows.

In a world increasingly dependent on digital platforms, you may wonder how likely it is that you’ll fall victim to a scam.

Accounting problems are issues that create a material financial statement error, hide fraud due to poor internal controls, stray from Generally Accepted …

Internal controls over vendor master file keep your data secure with clear rules, audit trails, and consistent oversight for long-term data integrity

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.