Cybersecurity incidents are becoming all too common. Companies, both large and small, are facing increased cyber threats that can lead to devastating consequences.

The costs associated with those cyber incidents can range from financial losses to irreversible damage to a brand's reputation.

As a chief financial officer (CFO), it's crucial to take proactive steps to mitigate cybersecurity incidents. In this article, we'll explore the best strategies you can implement to safeguard your business from cybercriminals.

The significance of cyber incidents

As a CFO, understanding the importance of cybersecurity incidents is critical to safeguarding your business. On average, one cybercrime report is made every seven minutes according to the ACSC’s Annual Cyber Threat report.

This means that stolen information is exposed every year, like the information stolen during the Optus data breach – and that’s the exact sort of information that can be used against your organization. Ultimately, cyberattacks can lead to significant financial losses, including theft of sensitive financial information, ransomware demands, and loss of revenue due to downtime.

Once a cyberattack occurs, it can be challenging to recover stolen information or funds. For senior executives, time is of the essence. It’s critical to have an organized and carefully planned cybersecurity incident report.

Cybercriminals can use stolen information for a variety of purposes, including financial gain, identity theft, and corporate espionage.

They may sell the stolen data on the dark web, use it to commit fraudulent activities such as opening credit card accounts, or even use it to gain access to a company's internal systems.

Most crucially for CFOs and accounts payable (AP) teams, the information can be used to impersonate trusted contacts, conduct business email compromise (BEC) attacks, and otherwise manipulate staff into revealing further information or making fraudulent payments.

In other words, even if a business has not experienced a data breach itself, the potential for future attacks is high and the consequences can still be severe. Let’s look at one example of how cybercriminals used the stolen information to cause further data breaches.

The Energy Australia data breach

On 30 September 2022, Energy Australia fell victim to a cyberattack that affected hundreds of people. According to reports, cybercriminals had breached the electric company through unauthorized online platform access.

This exposed hundreds of customers' accounts including their names, addresses, email addresses, electricity and gas bills, phone numbers, and other sensitive information. The Chief Customer Officer, Mark Brownfield said, “We apologize for the concern that this issue may have caused our customers”.

The breach occurred mere days after those experienced by Optus and Medibank, in which “cybercriminals claim to have stolen 200 gigabytes of customer data from Medibank.”

What CFOs should take away is that cybercrime is constantly evolving, and cybersecurity has to be at the forefront of their priorities in 2023. After a data breach occurs, cybercrime does not stop. The loss of information from customers can be used against other businesses or, perhaps worse, sold on the dark web.

So what can you do about it?

How can businesses reduce their risk of cybersecurity incidents?

As businesses become increasingly reliant on technology to facilitate operations and transactions, the need for robust cybersecurity measures becomes even more critical.

Cyberattacks can result in reputational damage, financial losses, and legal liabilities, making it essential for business leaders to take proactive steps to minimize the risk of cybersecurity incidents. Here are some practical strategies that businesses can adopt to reduce their vulnerability to cyber threats:

1. Develop a robust cybercrime strategy

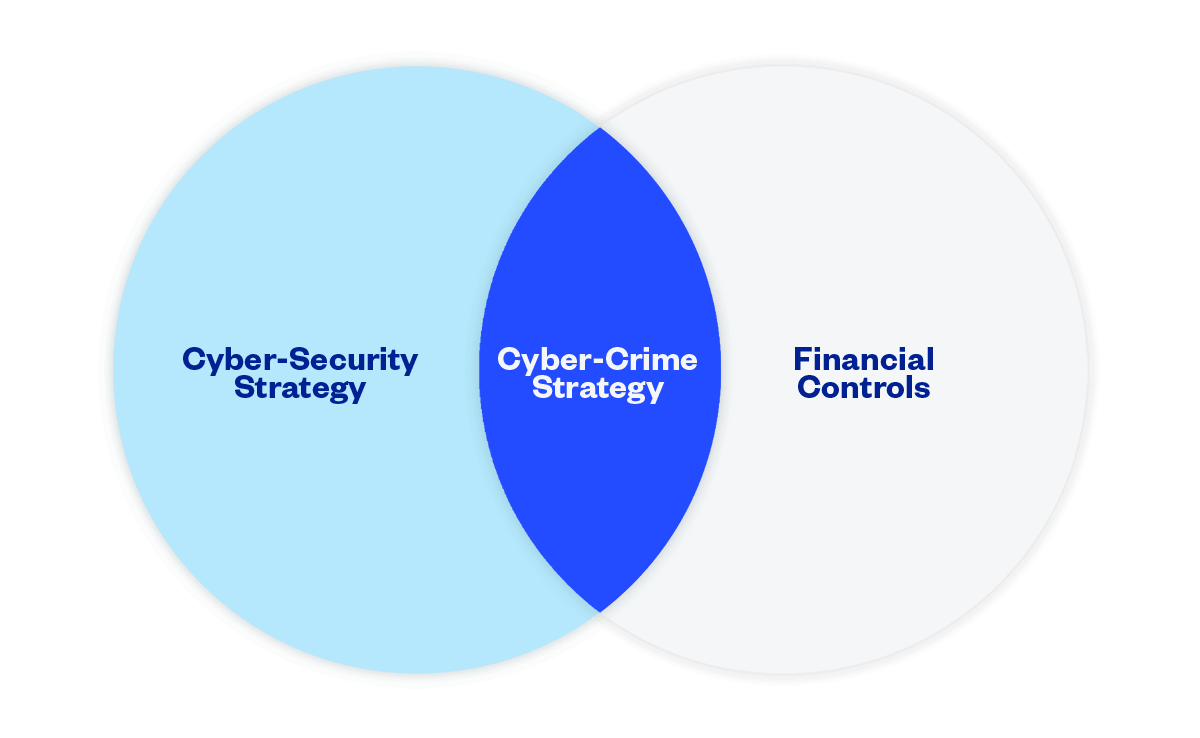

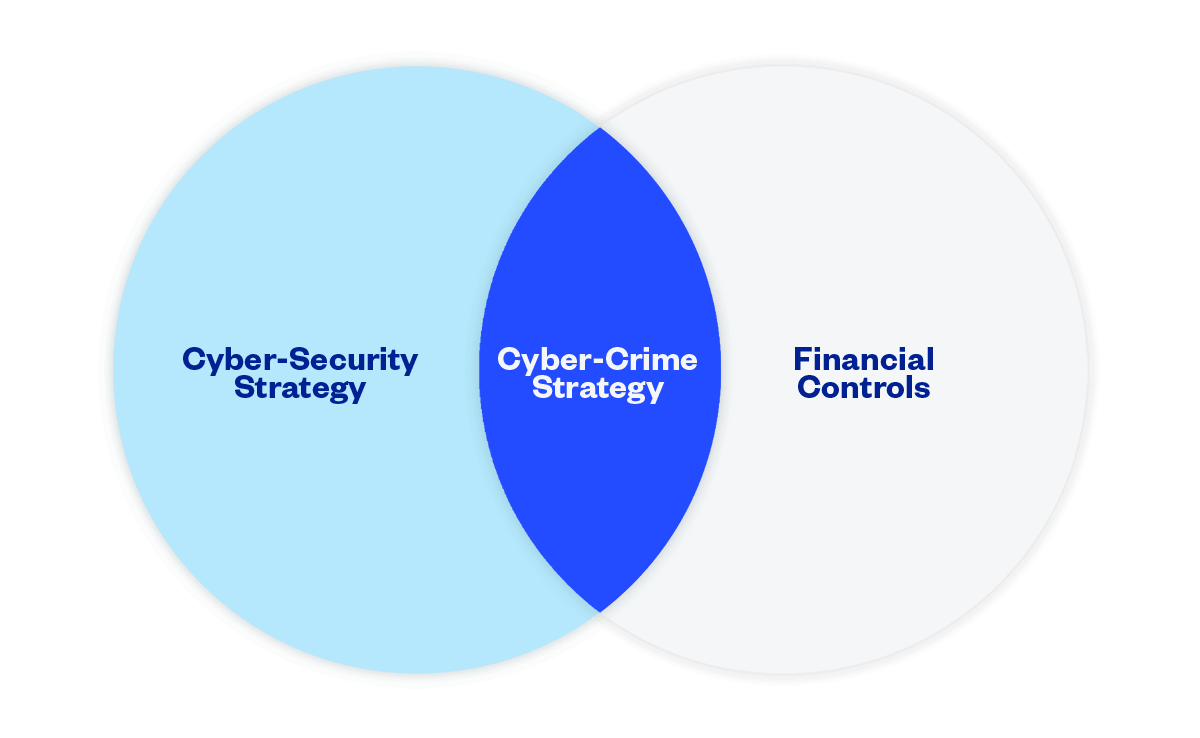

A robust cybercrime strategy includes a clear and concise security policy, outlining the alignment of financial controls and cybersecurity procedures that aim to protect the organization’s finances and financial data.

Find out more about how to implement a cybercrime strategy.

2. Implement multi-factor authentication (MFA)

Multi-factor authentication is a security process that requires users to provide two or more forms of identification to access a system or network. This approach makes it more difficult for cybercriminals to access sensitive information, even if they have obtained a username and password. In this free guide, find out more about MFA and why it’s necessary to include it as your first line of defense.

3. Encrypt sensitive data

Encryption is the process of converting sensitive information into code that is unreadable without a decryption key. By encrypting sensitive data, businesses can protect data from unauthorized access even if there is a breach. This is particularly important for data that’s transmitted over the internet or stored in the cloud.

For senior executives, this is a useful tool to send sensitive emails through encrypted email messages. By integrating S/MIME (secure/multipurpose internet mail extensions) your email messages are protected through encryption or digital signatures. We explore further in our email security best practices guide.

4. Regularly update software and systems

Vulnerabilities in software and procedures can be exploited by cybercriminals to gain unauthorized access. It’s basic security hygiene to update software and systems, helping businesses protect themselves from known vulnerabilities. Software providers are constantly improving their software, this is due to a variety of reasons such as system bugs, vulnerabilities, system loopholes, and more.

By updating your software and systems, you can stay up to date with the software provider’s defenses.

The bottom line

Cybersecurity and anti-cybercrime measures are critical for businesses to protect their data and designs from cybercriminals. To reduce the risk of a cybersecurity incident, businesses must develop a comprehensive cybersecurity plan that includes security procedures, training, and software.

As a CFO, it's essential to prioritize cybersecurity and take proactive measures to safeguard your company and customer data. By combining your financial controls and cybersecurity strategy you create a cybercrime strategy. This will mitigate the risk of cyberattacks, protect organizations’ reputations, and avoid financial losses or legal fallout.

Want to learn more? Join our upcoming webinar on Thursday at 12PM - 1PM AEST April 20th where we explore what happens after a data breach and how it's a problem for financial leaders.

Webinar: How data breaches end up at Finance's door