What is RAT malware?

Remote access trojan (RAT) malware is malicious software that permits cybercriminals full, unauthorised remote access to a victim’s computer. Once installed, the …

A PayPal invoice scam is a type of phishing scam where fraudsters send fake invoices from the PayPal platform to trick recipients into making unauthorised payments.

These scams exploit the trust of the PayPal brand and often use the company’s infrastructure to send seemingly authentic invoices.

Victims may be pressured into paying quickly or calling fake customer service numbers included in the invoice note.

These scams are effective because, as noted above, they take advantage of the payment facilitator’s infrastructure. The invoices are sent via official PayPal channels—email, the PayPal app, or the PayPal website—which makes the payment request look more authentic.

Scammers typically target individuals and businesses with invoices for high-value purchases they never made. Common themes include antivirus subscriptions, tech support or crypto services, and invoiced amounts are often set in the hundreds of dollars to appear believable.

Here’s what makes the PayPal invoice scam a potential threat:

Once the scammer creates a PayPal Business account, they can generate and send invoices just like a legitimate vendor. From there, the process is as straightforward as it is deceptive.

A typical scam unfolds like this:

This approach circumvents many of the red flags associated with phishing scams. There are no fake links or spoofed email domains; just a convincing message sent using a platform the recipient already trusts.

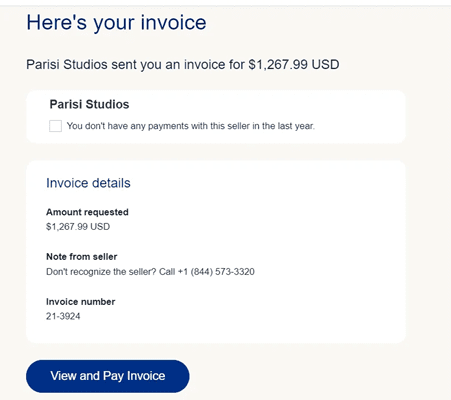

Over 2023 and 2024, numerous Reddit users reported receiving PayPal invoices from a company called Parisi Studios. Amounts ranged from $699.99 to almost $1300 in some instances.

In what appears to be a relatively sophisticated phishing scam, invoices were sent to suspicious email addresses such as noreplyyy5@donotreplymaster.com, gmail4@donotreplymaster.com and derivations thereof. But they still landed in the legitimate inboxes of those targeted in the scam.

A contact number discrepancy was one of the main clues that the invoice was fraudulent. In the “Note from seller” section, fraudsters included a number with which to contact PayPal if the victim believed the invoice to be fraudulent.

However, this differed from the official fraud hotline number listed by PayPal at the bottom of the invoice.

Part of the fraudulent invoice from a company purporting to be Parisi Studios (Source: Reddit)

The presence of a helpful number on the invoice lures the recipient into a false sense of security. What scammers bank on is that many will call it thinking they’ve stopped a scam in its tracks, only to expose themselves to further deception over the phone.

In this particular context, the scam revolves around Bitcoin transactions and cryptocurrency wallets. Victims have been asked to hand over sensitive information or install software that gives fraudsters remote control of their computer.

These scams are designed to appear legitimate, but as we saw in the above example, a little caution and due diligence go a long way.

To stay protected:

In summary:

Remote access trojan (RAT) malware is malicious software that permits cybercriminals full, unauthorised remote access to a victim’s computer. Once installed, the …

Agent Zero (A0) is an open-source AI tool that doesn’t have the same restrictions as current AI tools available to users. This …

First-party fraud occurs when an individual deliberately defrauds a business or financial institution by misrepresenting information or falsely disputing transactions for financial …

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.