What is RAT malware?

Remote access trojan (RAT) malware is malicious software that permits cybercriminals full, unauthorised remote access to a victim’s computer. Once installed, the …

Accounts payable fraud is a deceptive practice that exploits vulnerabilities in a company’s payment processes. It occurs when individuals—whether employees, vendors or external attackers—manipulate accounts payable systems to misappropriate funds.

A company’s accounts payable department is particularly vulnerable to fraud, as it can be exploited through various schemes like false billing and overbilling.

Understanding accounts payable fraud schemes and implementing preventive measures is critical to protecting an organisation’s capital and reputation.

Accounts payable (AP) fraud refers to the intentional deception or manipulation of a company’s accounts payable department to obtain unauthorized financial benefits. This type of fraud can be perpetrated by employees, vendors, or external scammers, leading to significant financial losses, reputational damage, and operational disruptions.

Accounts payable refers to the money a company owes its vendors for goods or services received.

Fraud occurs when payments intended for legitimate vendors are diverted or when fictitious transactions are processed through the accounts payable system. A billing scheme is a prevalent type of accounts payable fraud where employees create fictitious invoices for non-existent goods or services or inflate legitimate vendor invoices.

This can result in financial losses, strained vendor relationship and potential legal consequences.

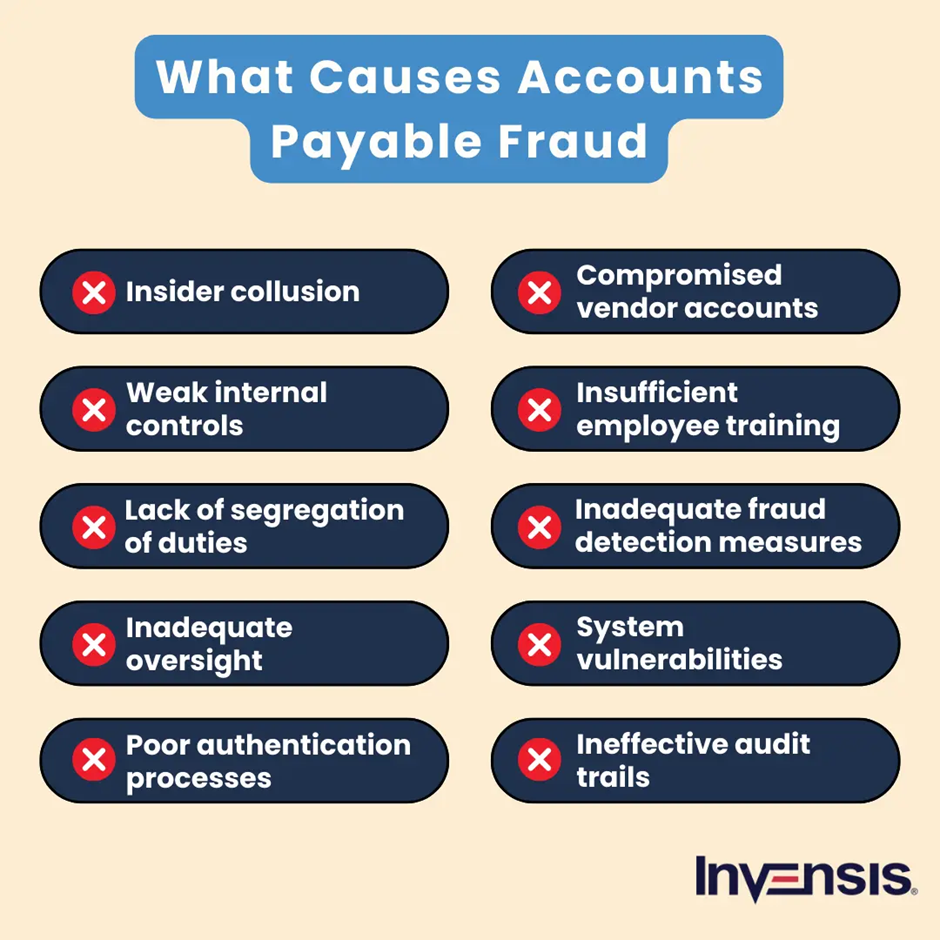

There are several reasons why accounts payable is vulnerable to fraud:

Fraud schemes targeting accounts payable systems vary widely. Awareness of these methods can help organisations identify risks and mitigate them effectively. Detecting AP fraud through effective anti-fraud controls and structural changes in business processes is crucial to prevent significant losses.

Fraudsters create and submit fake invoices to accounts payable departments. These invoices often mimic legitimate vendor details but direct payments to fraudulent accounts.

Example

An employee fabricates a vendor and submits invoices for non-existent services.

Using phishing or social engineering tactics, fraudsters impersonate legitimate vendors and request updates to payment details.

Example

A fraudster emails an accounts payable clerk claiming to represent a vendor and asks to update banking information.

This tactic is common among small businesses, with one survey finding that 39% of business owners and senior managers would agree to pay money into a new bank account without first checking if the request was genuine.

Duplicate invoices may be submitted by mistake or intentionally. Without proper checks, duplicate payments are processed.

Example

A vendor resubmits an invoice claiming non-payment, and the company pays it twice.

Employees with access to the accounts payable system create fake vendors approve fraudulent payments or manipulate invoice details. It is estimated that around two-thirds of AP fraud is committed internally.

Some employees deliberately overpay a vendor and misuse the difference when the vendor refunds the payment, while others engage in kickback schemes with suppliers that may involve:

Legitimate invoices are intercepted by attackers who alter payment details before they reach the accounts payable department.

Example

An attacker hacks email communications between a company and its vendor and then alters the bank details on an invoice.

Identifying red flags is crucial in detecting and preventing AP fraud. Some common warning signs include:

By staying vigilant and recognizing these red flags, companies can take proactive steps to prevent AP fraud and protect their financial assets.

AP fraud can occur through various schemes, each designed to exploit vulnerabilities in the accounts payable process. Some common methods include:

Understanding these schemes can help companies implement targeted measures to detect and prevent AP fraud.

Early fraud detection is essential to minimising losses. To do this, it is important to implement a combination of manual and automated processes that can help uncover suspicious activities. Automating the AP process enhances overall efficiency and prevents accounts payable fraud by improving visibility, creating audit trails, and flagging suspicious transactions.

Here are some possible warning signs of accounts payable fraud:

Modern accounts payable automation software includes fraud detection features that:

These systems often integrate with enterprise resource planning (ERP) platforms to streamline fraud prevention efforts.

Investigating AP fraud requires a thorough and systematic approach to uncover the full extent of fraudulent activities. Key steps in the investigation process include:

A thorough investigation helps ensure that all fraudulent activities are identified and addressed, minimizing the impact on the company.

Prevention is the most effective form of defence against accounts payable fraud. By strengthening internal controls and adopting technology, organisations can significantly reduce their exposure.

Here’s how this is achieved in practice.

Ensure that all vendors are vetted during onboarding and that payment details are verified through trusted contact methods.

Tip: Call vendors directly using known contact information to confirm changes in banking details.

Assign distinct roles for invoice approval, payment processing and record reconciliation. This reduces the likelihood of a single individual executing fraudulent transactions.

Three-way matching is an AP invoice process that cross-references an invoice with its corresponding purchase order (PO) and delivery receipt.

This process helps identify fake or unauthorised transactions that cost companies around 5% of their annual revenue.

Investing in a accounts payable automation and payment verification, such as eftsure, can easily:

Conduct regular audits of accounts payable records to identify anomalies. These audits can uncover patterns of suspicious activity that may go unnoticed in day-to-day operations.

Conducting a risk assessment is essential in identifying and mitigating AP fraud risks. A comprehensive risk assessment should consider the following factors:

By understanding these factors, companies can identify areas of high risk and implement targeted controls and measures to prevent and detect AP fraud effectively.

Nathan J. Mueller, an employee at a financial services firm, embezzled nearly $8.5 million over four years between 2004 and 2007.

Mueller exploited his access to the company’s accounts payable system by creating false payment requests that directed funds to his personal accounts. He also used his authority to bypass internal controls and approve fraudulent payments.

His scheme was eventually uncovered, leading to criminal charges and significant financial and reputational damage to the company. The case study also highlights the importance of AP access controls in ERP systems.

Fraud doesn’t just lead to financial losses; it also has broader implications for businesses:

If fraud is detected, swift action is necessary to mitigate damage and prevent recurrence.

Key Takeaways

Remote access trojan (RAT) malware is malicious software that permits cybercriminals full, unauthorised remote access to a victim’s computer. Once installed, the …

A PayPal invoice scam is a type of phishing scam where fraudsters send fake invoices from the PayPal platform to trick recipients …

Agent Zero (A0) is an open-source AI tool that doesn’t have the same restrictions as current AI tools available to users. This …

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.