What Can Scammers Do with Your Phone Number?

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

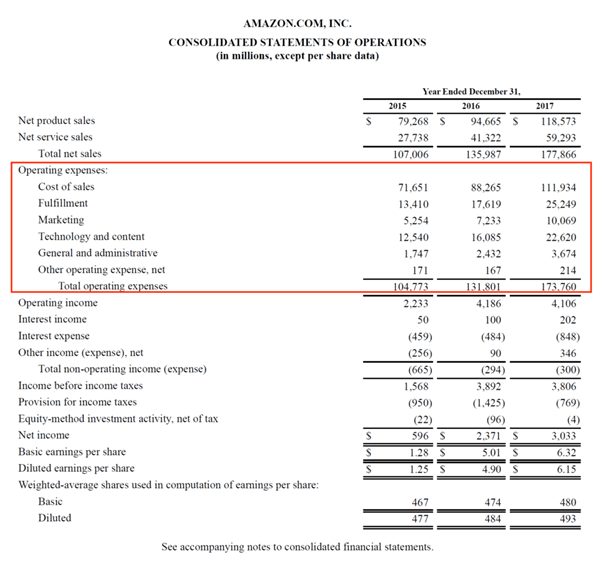

Operating expenses, often abbreviated to OpEx in the finance world, refers to any costs incurred by a business related to it’s day-to-day operations (also known as operating activities). Essentially, any activities related to running the business that may incur a cost.

Operating expenses will vary business-to-business, depending on what the company does. Examples of operating expenses could include:

It’s important to know operating expenses could vary depending on the business type, but to help narrow down examples, it doesn’t include expenses related to loans, borrowing or investing.

Looking to the Corporate Finance Institute, they showcase Amazon’s income statement. In this image, you can see how they claim operating expenses, as highlighted in red:

Operating expenses can either fixed costs or variable costs.

Fixed costs: costs that do not change based on variables related to business, production or output. An example of a fixed cost would be rent, as the space you’re in will cost the same per month (unless otherwise noted in a contract).

Variable costs: costs that fluctuate based on volume. An example of a variable cost would be production supplies, because the more you are producing, the more supplies you will need. Like with most businesses, production can fluctuate week-by-week, therefore these costs will increase or decrease in accordance with these changes.

Non-operating expenses account for anything not related to the actual business operations. Stakeholders can put non-operating expenses in a separate bucket to operating expenses, so they can easily assess company performance without them. Examples of non-operating expenses include:

It’s important for business owners to be aware of operating expenses, so they can asses the profitability of their business model. Based on opex being a certain amount, the company knows they will need to make a specified % more to consider themselves profitable. Opex can also lend a hand in pricing strategies to ensure margins on production are high enough to sustain the business.

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

When Mr. Beauchamp watched a video of Elon Musk – the world’s richest man – recommend a certain investment platform to make …

Your company delivered the good or service it promised to a client and now it’s time to collect the funds owed to …

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.