What Can Scammers Do with Your Phone Number?

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

Accounting is the systematic process of keeping accurate and detailed financial records.

Based on data from hundreds or even thousands of financial transactions, important conclusions can be drawn based on a detailed understanding of a business’s operations and overall financial position.

The key functions of accounting include:

Note that accounting is not a one-size-fits-all discipline. Five core types suit a variety of purposes, audiences and business needs, and each plays a specific role in the financial ecosystem.

Financial accounting is the most well-known accounting type and is focused on the creation (and presentation) of financial statements for key stakeholders.

The primary objective of financial accounting is to provide a clear and accurate picture of the financial health and performance of the business over a specific period (typically a financial year).

Managerial accounting is similar to financial accounting but with one key difference. While financial accounting caters to the needs of external stakeholders, managerial accounting is designed for internal use by an organisation’s management team.

Specifically, the team may use the reports created by managerial accounting to assist with decision-making, planning and operational strategy.

Cost accounting is a subset of management accounting that captures and analyses all costs associated with business tasks and processes.

To that end, cost accounting considers three main elements:

Manufacturing businesses rely on this type of accounting to ensure costs remain competitive. However, it is also commonly used by law firms, medical services businesses and retail companies to analyse fixed and variable costs.

Tax accounting focuses on compliance with tax laws and regulations, preparation of tax returns and planning future tax obligations. This type of accounting applies to everyone – whether that be individuals, businesses, corporations or other entities.

To assist in this process, tax accountants help clients navigate the complex world of tax law and ensure they take advantage of deductions to minimise the amount of tax they need to pay.

Auditing involves an independent examination of a company’s financial statements and records.

Unlike the other types of accounting – which primarily involve the preparation and reporting of financial data – auditing is concerned with the accuracy, completeness and reliability of the data.

Auditors provide an objective assessment of whether such data provides a true and fair overview of the company’s financial position. This process includes

An accounting standard is a formal framework or declaration that sets out the required accounting for various types of events and transactions.

Accountants in Australia follow Australian Accounting Standards (AASs) which are set down by the Australian Accounting Standards Board (AASB).

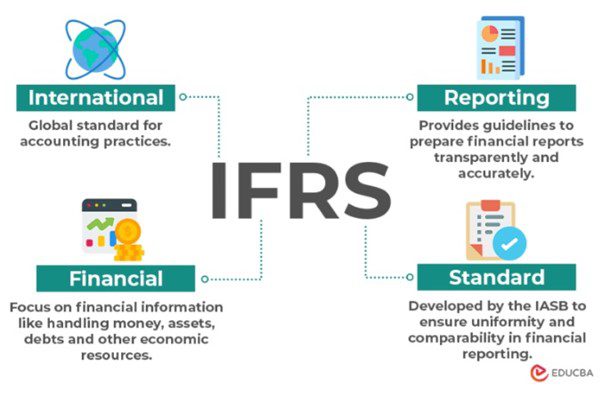

Australian standards take their inspiration from the International Financial Reporting Standards (IFRS) – a so-called “global accounting language” used by 168 jurisdictions around the world.

This global language – which was conceived by the International Accounting Standards Board (IASB) – promotes consistent and transparent financial reporting across all sectors.

They also ensure that Australian accounting standards are comparable to those used in other countries, which facilitates international business and investment.

To conclude, let’s take a look at a few specific examples of accounting standards:

Summary:

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

When Mr. Beauchamp watched a video of Elon Musk – the world’s richest man – recommend a certain investment platform to make …

Your company delivered the good or service it promised to a client and now it’s time to collect the funds owed to …

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.