How to Stop Spam Texts on Android

If you’ve received text messages about fake prizes, suspicious links, or sketchy offers from unknown numbers, you’re not alone. Spam texts have …

One of a company’s three financial statements, the income statement showcases all income and expenses within a given period. The final output on the income statement is “net income,” a metric that business leaders, investors, and stakeholders use to understand more about the financial health of a company.

Income statements are also called “Profit and Loss Statements” because they compare and contrast profits and losses within a period.

It’s important to note that the income statement template doesn’t just show revenue and expenses; it also highlights gains and losses that contribute to the overall net income result. With a clear picture of net income, businesses can then understand their Earnings Per Share, or EPS.

The income statement doesn’t exist in a silo; to get a full snapshot of a company’s financial standing, be sure to look at all three key financial statements: the income statement, balance sheet, and statement of cash flows.

There is a reason that income statement analysis is so important; this financial statement provides a lot of information about how a business is performing. Income statements can tell business leaders or external stakeholders many different things, such as:

With the income statement, leaders can analyze revenue trends over different periods to assess the growth or decline of the company’s core operations. Understanding revenue trends can help highlight opportunities for expansion or areas that may require attention.

The detailed expense breakdown on income statements allows leaders to evaluate the effectiveness of expense management methods. If certain line items are taking too many financial resources to support, the income statement is often the first clue that something needs to be addressed.

At an individual product or service level, income statement analysis can bring together the revenue associated with specific products and compare it to the expense required to sell those products. If expenses are outpacing revenue, it might be time to adjust the price mix or work with new suppliers to source raw materials.

If a company is experiencing long-standing profitability and positive net income results, chances are, the financial health of the company is in good standing. However, if net losses are a regular occurrence, the income statement provides a glaring alert for leaders and investors, helping them to address the root cause of any issues before irreparable damage is done.

Financial statements are one of the best ways to compare companies against one another. If companies operate in the same industry and with similar specifications, looking at the income statements of the two companies can help leaders get a quick understanding of the strengths and weaknesses of each organization. This is a great tool for internal leaders and external investors alike.

Income statements can range in complexity depending on each business’s structure, but there are a few items that most businesses use in the financial statement. These items play a critical role in providing the full picture of financial health:

Net income is the most important metric that comes from the income statement. In some instances, determining net income is as simple as using this formula:

In other cases, where multi-step income statements are used, the net income formula is a bit more complex.

For larger businesses with more complexities, multi-step income statements are the norm, but for smaller organizations, it really can be as simple as revenue minus expenses.

All businesses need to create and maintain income statements on a regular basis. Usually, all financial statements are made and distributed on a monthly basis, but publicly traded companies in the US are required to share their statements with the Securities and Exchange Commission and the general public. All public companies’ income statements and other financial statements can be found online, usually on the “investor” page of their websites.

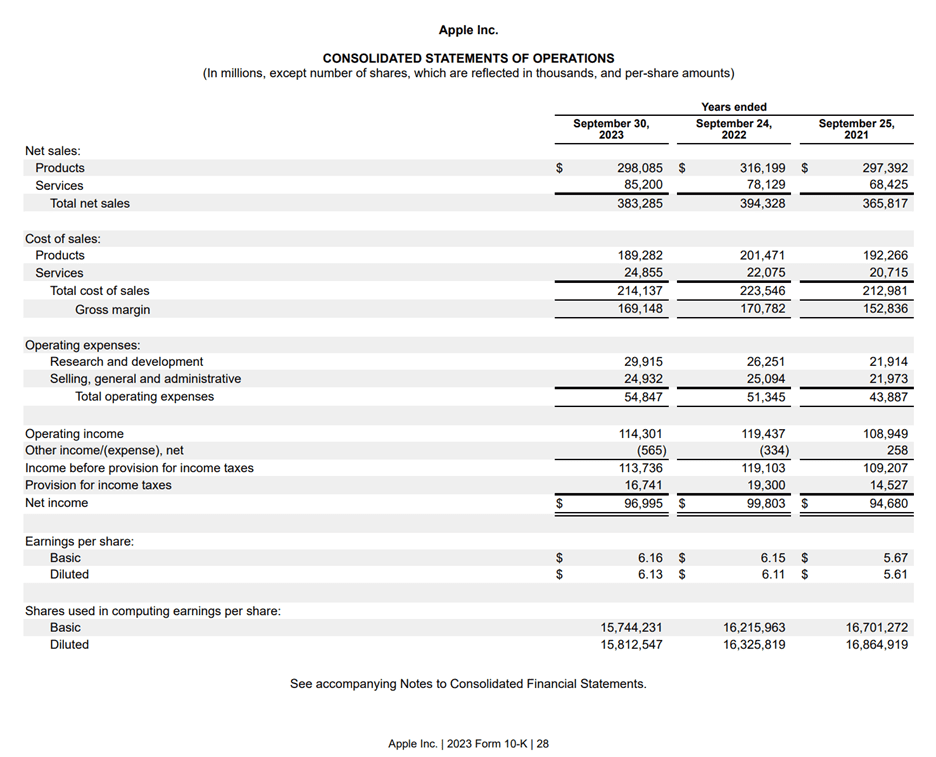

Here is the Consolidated Statement of Operations – AKA a sample income statement – from Apple’s 2023 10-K:

When looking at the income statement above, it’s easy to see many of the financial metrics and components that we’ve discussed in this article. Apple uses “net sales” instead of “revenue” in its income statement, but the two terms are interchangeable and can both be used to represent the total revenue generated by sales.

By looking at real-world income statements, it starts to become clear how important they are to investors, analysts, and other business stakeholders. For instance, with a quick glance, business leaders can see that Apple’s net income in 2023 was actually lower than its net income in 2022. That’s usually not a good sign, but it gives a starting point to those looking to dive deeper. Why is it lower? What’s driving the difference? Can we recover? All the important answers are found by pulling the threads found here.

Every income statement starts by breaking down a company’s revenue outcomes for the period in question. Apple uses the term “net sales,” but revenue will often be seen here, too. Some companies break revenue into more specific categories, such as “revenue from products” and “revenue from services” as you can see above.

This breakdown helps isolate different business components, pointing to well-performing aspects of the business and exposing aspects that may be dragging down summarized results. This added granularity gives decision-makers extra leverage when solving problems and charting new go-forward strategies.

Following the revenue details, businesses break down the costs associated with their total sales. Often called the “cost of goods sold,” or COGS, this portion of the income statement includes all costs required to produce the goods or services a company sells. COGS wraps up costs like raw materials, labor, manufacturing overhead, shipping costs, and inventory adjustments into one metric.

When COGS is subtracted from revenue or net sales, the product of the equation exposes the gross margin. The gross margin is a key financial metric used for many reasons; it showcases how much profit is being generated after taking into consideration all the money that went into developing the product in the first place. Companies can have really high revenue numbers, but if they have low margins, they might struggle to see the necessary financial gains to continue operations.

On an income statement, operating expenses include R&D expenses, selling and general administrative expenses, and similar line items. Business expenses that don’t directly correlate to production are usually listed here. You’ll may also see supplementary expense line items depending on the business being discussed.

If a business is unable to manage expenses well, it could be a sign of poor financial stewardship. Investors don’t favor companies with expense-related challenges because expenses are one of the key levers that leaders can pull when a business is struggling. Sometimes, having a handle on expense management is even more important than smashing revenue goals.

There used to be a time when income statements were created by hand, then most businesses moved to using Microsoft Excel and similar tools that provide an easy-to-use income statement template. Now, software solutions and advanced ERPs can do most of the heavy lifting to create income statements on their own. Here’s what’s happening behind the scenes.

Chances are, if you’re a business leader, you’ve been asked to provide your income statement a number of times. There are so many people in the business space who need income statements to do their jobs, such as:

Business owners rely on income statements to assess the profitability and financial health of their ventures. They use this information to make strategic decisions, such as expanding operations, adjusting pricing strategies, or identifying areas for cost reduction.

Investors utilize income statements to evaluate the financial performance of companies before making investment decisions.

Creditors and bankers use income statements to evaluate the creditworthiness of a company when assessing loan applications. They analyze the company’s profitability and ability to generate sufficient cash flow to meet debt obligations.

Financial analysts rely on income statements to conduct in-depth financial analysis and provide insights to clients or investors. They examine trends, ratios, and other key performance indicators to assess the company’s financial strength and prospects.

Government agencies and regulators use income statements to monitor the financial performance and compliance of companies with accounting standards and regulations.

If you’ve received text messages about fake prizes, suspicious links, or sketchy offers from unknown numbers, you’re not alone. Spam texts have …

The “Voice Activation Department scam” is a type of phone-based fraud in which scammers impersonate customer service agents or technical support staff …

A phishing kit (sometimes referred to as a “phishkit”) is a bundled set of tools used to create convincing fake websites that …

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.