What Can Scammers Do with Your Phone Number?

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

False declines are legitimate transactions that are incorrectly rejected by the fraud detection system of a bank or payment processor.

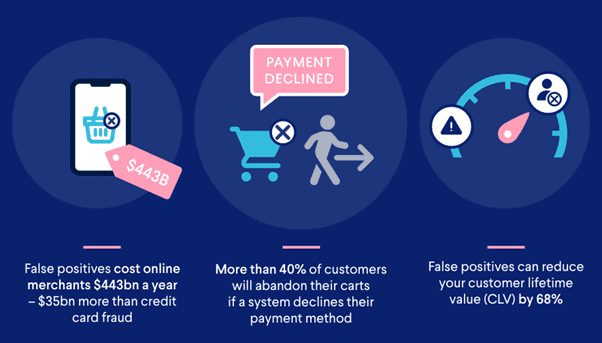

Also referred to as false positives, false declines often result when a transaction is labelled as potentially fraudulent despite it being authorised by the cardholder. Online transactions are the most susceptible since the card and cardholder are not physically present.

False declines negatively impact a company’s brand reputation and cause customer churn. They’re also expensive.

According to research firm Aite-Novarica, false declines cost businesses $443 billion each year – a number that far eclipses the losses incurred from actual credit card fraud.

False declines are caused by overzealous fraud detection systems that rigidly follow the rules and reject perfectly valid transactions.

Some of the varied reasons for this behaviour are explained below.

Fraud detection systems use algorithms to analyse a customer’s typical spending habits and look for anomalies. If a purchase deviates significantly from this pattern, it may be flagged as suspicious and declined.

Examples include:

If a consumer enters a billing address, card security code or expiry date that does not match the information the bank has on file, the transaction may also be declined.

Many payment systems use address verification systems that verify the billing address of a transaction with the address the card issuer has on file.

A consumer with multiple addresses (such as for their home, work or holiday home) may inadvertently use an address that doesn’t match the one stored with their bank.

False declines are also caused by consumers who attempt make purchases with an expired card.

On occasion, banks and payment systems experience service outages that prevent legitimate transactions from being processed.

The recent global outage caused by a faulty update to CrowdStrike’s cybersecurity platform is a prime example.

Some merchants operate in high-risk industries because of factors such as elevated chargeback rates, market volatility and regulatory complexity.

These industries include:

Transactions with such merchants are more likely to be declined as a precautionary measure.

If a bank or payment processor uses outdated authorisation techniques, the algorithms that underpin them may not be able to tell the difference between fraudulent and legitimate transactions.

This is especially true of authorisation techniques that rely on fixed criteria to make assessments and fail to consider behavioural or contextual nuances.

Most banks impose a daily limit on how much a customer can spend with their card. The default daily payment limit for Westpac online banking customers, for example, is $750 per day.

If the limit is exceeded and the consumer has not obtained pre-authorisation for the transaction, it will be declined.

While fraud detection algorithms have a beneficial impact on businesses, false declines can sometimes create more problems than they solve.

When legitimate transactions are declined, businesses lose out on potential sales. This is particularly detrimental for expensive purchases or when a customer wants to make multiple purchases in a short period.

Compounding the problem is that once a customer experiences a false decline, they may take their business elsewhere. Indeed, a 2020 poll of 1,000 consumers found that 25% would buy from a competitor in this scenario.

Other surveys report higher numbers. A 2021 poll found that 38% of consumers had switched merchants after a false decline and noted that it was the leading cause of customer churn in eCommerce.

Another study from 2022 reported that 42% abandoned their carts if a fraud detection system declined their payment method.

By extension, false declines cause consumers to perceive the business as unreliable or difficult to deal with.

Dissatisfied individuals share their negative experiences with friends and family and may post online reviews about their experiences. Ultimately, this can damage the business’s brand and cause it reputational harm.

Effective fraud detection systems rely more on comprehensive data analysis and machine learning than they do on strict rules and manual reviews.

Outdated systems rely on rules that have the power to decline transactions across a broad swathe of use cases. However, this limits the amount of data the system can learn from and thus weakens its future fraud detection capabilities.

False declines will never be eradicated, but sophisticated algorithms now utilise filters to discern between fraudulent and authentic transactions. Some types of fraud are so prevalent that the filters used to identify them have their own names.

Examples include:

It would be counterproductive for banks to provide a list of the filters they use. Nevertheless, false decline algorithms comprised of rule-based, statistical and machine learning (ML) analysis may employ as many as 500 filters.

In essence, filters work to understand the context of false declines over time and reduce their prevalence as much as possible.

Take payment processor Stripe’s approach, for example. Its payment system processes billions of transactions each year and is better able to identify fraudulent transactions and false declines as a result.

Importantly, ML models learn in real time by analysing outcomes and adapting accordingly. This enables them to stay one step ahead of the latest fraudulent schemes tactics and the patterns these schemes create.

Context is also related to the particular industry. To better understand why, consider these examples:

Consumers can also play a role in reducing the rate of false declines.

Measures include:

Summary:

When cell phones first became popular, no one thought they’d become what they are today. For the first few years, it was …

When Mr. Beauchamp watched a video of Elon Musk – the world’s richest man – recommend a certain investment platform to make …

Your company delivered the good or service it promised to a client and now it’s time to collect the funds owed to …

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.