Payment Security 101

Learn about payment fraud and how to prevent it

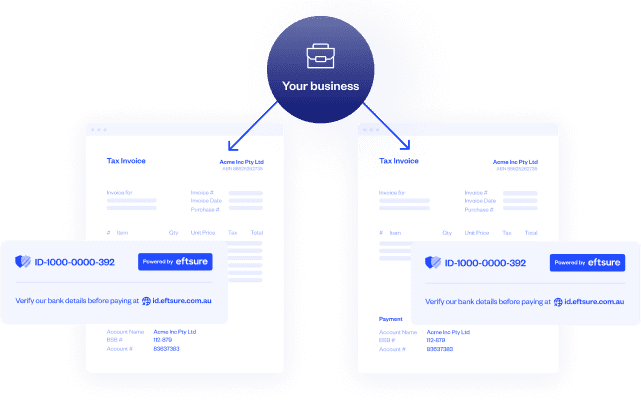

Cyber-criminals are constantly probing for vulnerabilities in your supply chain, trying to exploit any weaknesses. While companies have focused on securing accounts payable systems, many have neglected safeguarding their accounts receivables. Stop them in their tracks from impersonating you.

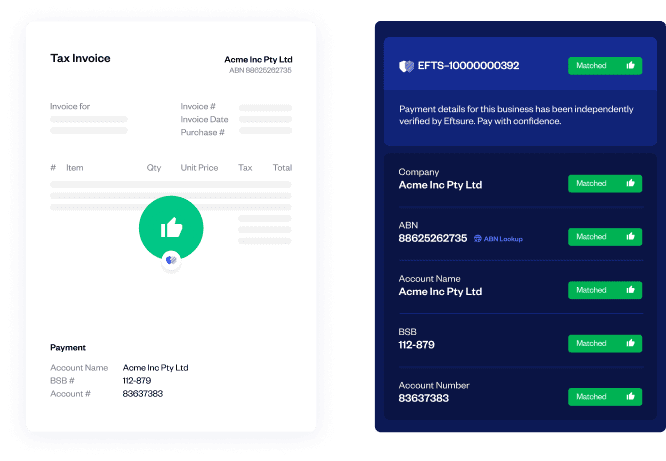

Preventing payment fraud works better as a community. EftsureID allows larger organisations to mitigate the risk for the small businesses they trade with. Fraudsters have more opportunities and tools to commit fraud in an increasingly digital world, but digital third-party invoice authentication helps protect your customers from paying the wrong bank details.

Although businesses aren’t liable for misplaced payment in accounts receivable, a defrauded customer can damage your business reputation and relationships. EftsureID allows you to go the extra mile in providing a safe and secure service to customers by verifying the authenticity of the payment info you send them.

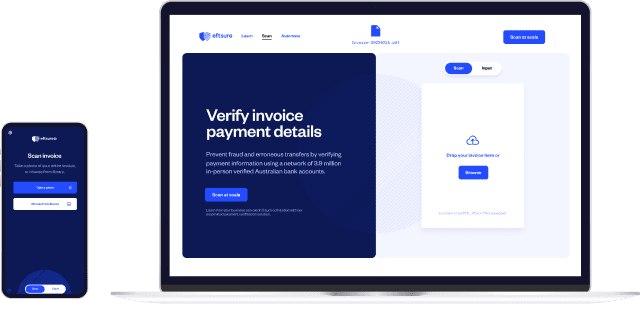

See how your customers will experience EftsureID by uploading an invoice in the authentication tool.

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.