Payment Security 101

Learn about payment fraud and how to prevent it

If cyber criminals attempt to use a compromised bank account of a money mule repeatedly, Eftsure’s fraud detection will identify and blacklist the account. This benefits all our customers, since once a fraudulent account has been flagged, it will be added to the shared blacklist.

As you gain access to our network, you’ll discover that +/- 90%* of your suppliers have already been verified by us. You can begin using these verified details to make payments immediately.

*Actual results from previously onboarded customers

By joining the Eftsure community you gain the support of Eftsure’s fraud specialists who are helping to safeguard the integrity of the payment details you use to pay. It’s a highly-trained team that uses algorithms and human checks to validate the information in our network is trustworthy.

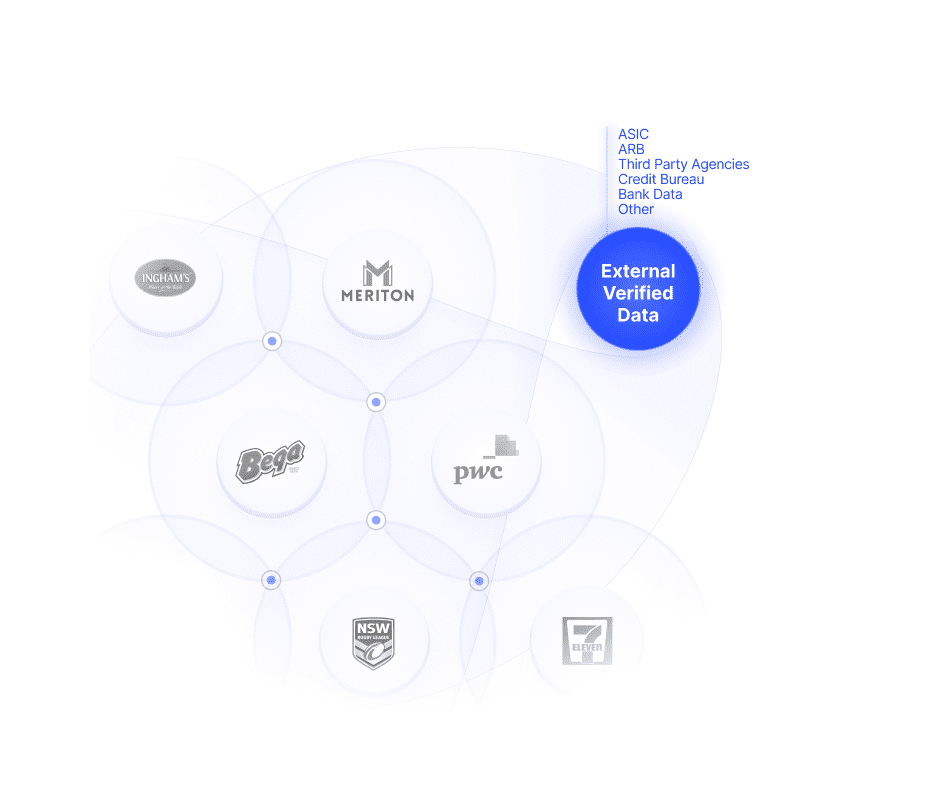

Eftsure’s cross-match algorithms validate payment details regularly. This ensures that when you click “pay now,” you are paying the right bank account. Additionally, Eftsure’s database is linked to third-party databases, granting you easy access to ABN numbers and GST statuses. This information is used to validate payee identity but also saves a lot of time searching these databases.

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.