Eftsure and Westpac work to raise anti-fraud awareness

Employee awareness is a critical part of any anti-fraud strategy. Westpac and Eftsure have been working to hard to help organisations raise theirs.

Australia’s mining, construction and utilities industry is worth hundreds of billions of dollars, representing two-thirds of all export revenue for the nation.1 But according to ACFE 5% of all those dollars may be transferred into the account of a fraudster.2

That’s why we’re pleased to announce that Felix customers can now integrate with Eftsure, adding yet another layer of protection when making payments.

In capital- and asset-intensive operating environments (like construction and mining), procurement processes can be disconnected and complicated. Felix is the leading vendor management and procurement software for helping organisations streamline those procurement processes and deliver sustainable, safe and profitable outcomes.

Across industries like critical infrastructure, mining, utilities and property, organisations use Felix to gain a deeper understanding of their supply chain. This includes areas like compliance, historic performance and ESG insights. By connecting supplier data with Felix’s intelligent tendering capabilities, Felix makes procurement smarter and more efficient.

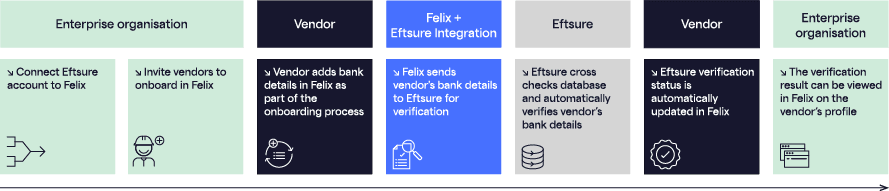

Eftsure and Felix customers can integrate the two solutions to save additional time and effort in validating vendor bank details as part of the onboarding process.

When vendors use Felix to input payment details based in Australia or New Zealand, this information is automatically routed to Eftsure to match the BSB and account number with the vendor’s business name and ABN. The added benefit of the integration is that Felix’s customers don’t need to change their procurement process, while benefitting from Eftsure’s database of 6 million verified bank accounts.

Dan Wilson, Felix’s Chief Revenue Officer, says that the integration helps reduce the risks that are common – and severe – for many of their customers.

“Incorrect payment details entered during vendor onboarding can be due to either human error, potentially leading to misdirected payments, or, in more concerning cases, a deliberate attempt at cybercrime or fraud.

“We’re excited to partner with Eftsure to bring to life the Felix-Eftsure integration, which will solve this problem,” says Wilson. “Vendors get instant feedback on their payment details when submitting this into Felix, validated by Eftsure, instead of organisations having to do manual checks themselves.”

Justine McFarlane, Head of Partnerships at Eftsure, echoes this sentiment and points out that the risks facing many organisations are greater than they might realise.

“In 2023, we’ve observed a significant increase in fraud attempts targeting the entire Australian business community. By our own estimates, we believe that about 15% of all Australian businesses are targeted on an annual basis. We’ve found that the heavy industry sectors such as construction and mining are targeted most frequently.

“Unfortunately, cyber-criminals are aware that these industries handle many large payments, which are often processed quickly. These sectors also tend to relying on manual processes that are prone to error and risk making them an even more attractive target.”

McFarlane explains that the integration helps mitigate these risks, creating a safer supply chain and proving that stronger security doesn’t need to come at the cost of efficiency or speed.

1 Australian Bureau of Statistics (2023). Media Release: Mining turnover continues to fall. Available at: www.abs.gov.au

2 The Association of Certified Fraud Examiners (2022). 2022 Report to the Nations. Available at: www.acfe.com

Employee awareness is a critical part of any anti-fraud strategy. Westpac and Eftsure have been working to hard to help organisations raise theirs.

Find out how NAB and Eftsure are teaming up to keep B2B payments safe from scammers.

Eftsure is officially the 41st fastest-growing Australian company according to the AFR’s Fast 100 List for 2023.

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.