What is source-to-pay (S2P)?

Source-to-pay (S2P) is an end-to-end process in procurement that encompasses the activities associated with sourcing products from suppliers.

In the United States, tax law refers to the laws and regulations that govern the assessment, collection, and enforcement of taxes. Note that this occurs at the federal, state, and local levels.

The Constitution of the United States permits Congress the power to tax.

Congress enacts federal tax law in the Internal Revenue Code of 1986 (IRC) – the primary source of federal tax legislation in the country.

However, Congress occasionally enacts laws that are not part of the IRC that nevertheless impact tax policy.

The IRC dictates the collection of various types of taxes, such as:

Federal tax regulations in the United States are formally known as treasury regulations, which constitute an official interpretation of the IRC by the U.S. Department of the Treasury.

This interpretation helps shape the implementation and enforcement of tax laws in the USA and provides advice on how taxpayers can comply with requirements set forth in the IRC.

How is this achieved?

There are five principle ways:

According to the official IRS.gov website, the mission of the Internal Revenue Service is to “provide American’s taxpayers top quality service by helping them understand and meet their tax responsibilities and to enforce the law with integrity and fairness to all.”

To carry out this mission, the IRS has the authority to perform certain tax responsibilities outlined in Section 7801 of the IRC. This authority is granted by the Treasury Secretary and essentially permits the IRS to both administer and enforce internal revenue laws.

While the IRS acknowledges that the vast majority of American taxpayers are compliant with tax law, part of its mission is to help the minority who are unwilling to pay their fair share.

The Internal Revenue Service claims it is one of the world’s most efficient tax administrators. In 2020, for example, it processed more than 240 million tax returns and collected just under $3.5 trillion in revenue.

Put another way, the IRS spent just 35 cents for each $100 it received from taxpayers.

While most domestic federal taxes are collected by the IRS, various other authorities also hold power to collect relevant taxes.

Two of the most relevant are explained below.

The TTB administers taxes related to alcohol, tobacco, firearms, and ammunition.

Like the IRS, the TTB operates as a bureau of the Department of the Treasury.

CBP is the largest federal law enforcement agency of the Department of Homeland Security.

Most know the CBP as a border control agency, but it also collects import duties and taxes via the enforcement of trade and tariff laws.

Tax policy in the USA is handled by The Office of Tax Policy within the Department of the Treasury.

Among other initiatives, the Office of Tax Policy:

Each fiscal year, Treasury issues a so-called “Greenbook” that explains various tax proposals.

The book – officially known as the General Explanations of the Administration’s Revenue Proposals – is in many respects a fiscal policy wish list. Each proposal is just that and has not been ratified by Congress.

Nevertheless, the department’s release for fiscal year 2025 lists numerous tax proposals across multiple key objectives.

Some of these objectives (and the tax proposals that underpin them) include:

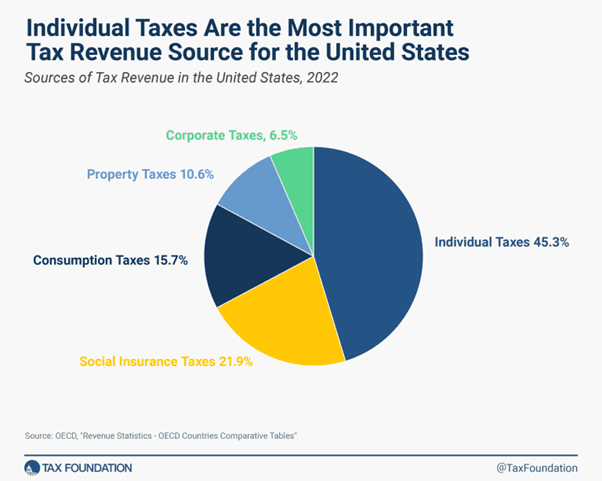

Individual income tax is the primary source of tax revenue in the United States, with the latest publicly available data showing it accounted for 45.3% of total tax revenue.

Other major sources of tax revenue include social insurance tax, consumption tax, property tax, and corporate tax.

Note that the United States differs markedly from the Organisation for Economic Co-operation and Development (OECD) average across multiple sources of tax revenue.

The amount of the revenue the U.S. Government collects from personal income tax is nearly double the OECD average of 23.6%, for example. This can be explained by tax policy which dictates that most business income be reported on individual tax returns.

Furthermore, the USA relies much less on consumption-based tax than countries such as the United Kingdom (VAT) and Australia (GST). Indeed, consumption taxes accounted for just 15.7% of tax revenue compared to the OECD average of 31.6%.

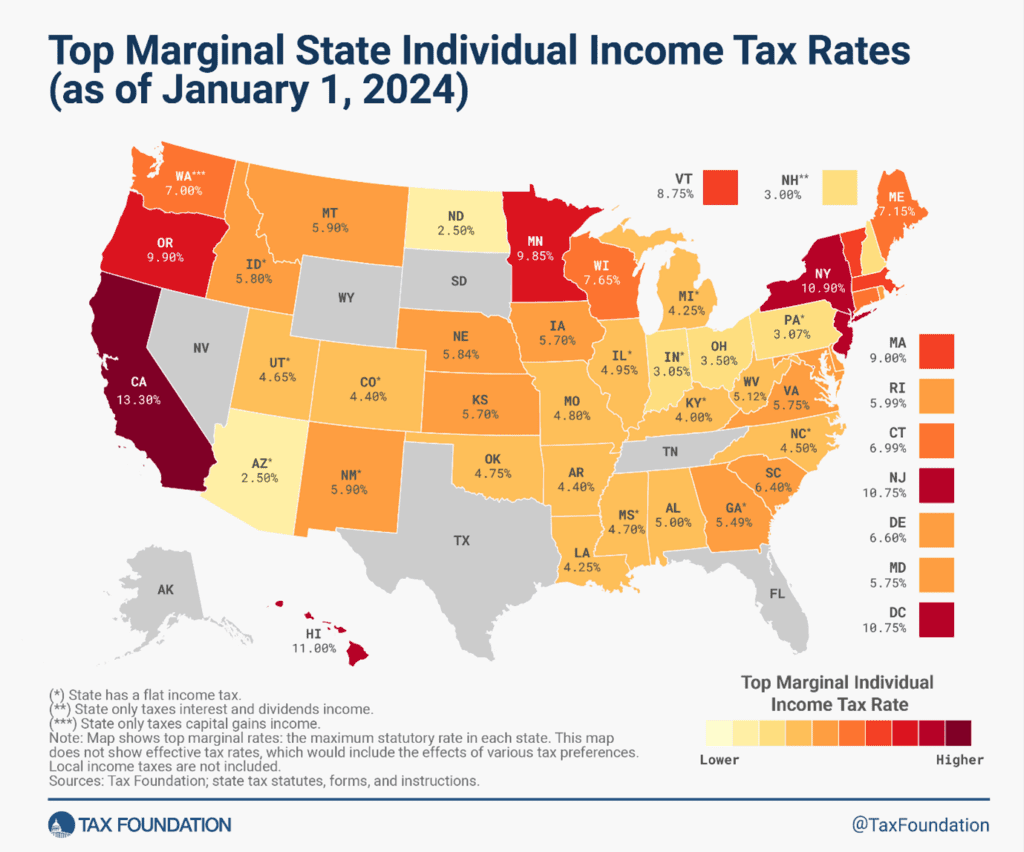

Almost 50% of total tax revenue in the United States is collected at the state and local levels, which makes the country’s tax system relatively decentralised.

Each of the 50 states has its own tax administration. In California, for example, the California Franchise Tax Board (FTB) administers and collects taxes from both individuals and corporations. But in other states, such boards are simply referred to as the Department of Taxation.

Tax authorities confer different levels of power depending on the state, and each operates under its own rules and procedures.

Seven states do not impose state income tax, for instance. But these states may impose a flat tax on property, sales, dividends and interest to compensate.

With respect to personal income, most states impose tax on a progressive scale such that the more one earns, the more one pays. Depending on the state in which the income was earned, individuals may have to pay income tax at both the federal and state level.

Some state tax departments may also collect local taxes, while others permit municipal authorities to collect them.

Unlike Australia – where local authorities only collect tax in the form of council rates – municipal authorities in the USA may also collect property tax and income tax, among other forms.

Corporate tax is predominantly imposed on the federal level, though most states and some local governments also impose it.

Following the passage of the Tax Cuts and Jobs Act (2017), the corporate tax rate in the United States has remained at a flat 21%.

Corporations, like individuals, must file annual tax returns and they must also pay quarterly tax contributions. They may be subject to tax on their foreign income, but the majority of business formations and select types of mergers, acquisitions, and liquidations are exempt.

Partnerships (where two or more people contribute money, skill, labour, or expertise) are not subject to income tax. Instead, individual partners calculate their tax obligation by assessing their proportional share of business items.

S Corporations, which are those entirely owned by U.S. citizens or residents, may also be treated as partnerships for income tax purposes.

When a taxpayer raises a dispute with the IRS for whatever reason, there are various avenues they can pursue:

The above avenues may also apply when the IRS issues a civil audit to a taxpayer. Many taxpayers are selected at random for an audit, but others may be selected if they raise suspicions by:

The civil audit process starts with a postal letter from the IRS. Taxpayers can substantiate their claims with the relevant evidence, or alternatively, appeal the findings of the IRS.

Note that some appeal processes will ultimately reach the U.S. Tax Court.

Other civil audits become criminal audits as new information becomes available. In this case, a civil examiner may involve the Criminal Investigation (CI) branch of the IRS before deciding whether to pursue a criminal investigation.

Federal tax disputes may go before a grand jury to determine whether the individual should be indicted for the allegations made. Grand juries can also subpoena additional documentation or solicit witness testimony without the presence of the defendant.

In civil cases where the matter remains unresolved, tax litigation may occur.

In the United States, this is often referred to as a “tax controversy”. In essence, the term is used to describe an area of legal practice involving disputes between taxpayers, businesses, non-profits and tax agencies.

Tax litigation matters may be heard in dedicated establishments such as the U.S. Tax Court. But they may also be heard in the U.S. District Court and U.S. Bankruptcy Court.

When matters do proceed to court, the state is defended by the Tax Division. Part of the U.S. Department of Justice, the Tax Division enforces the country’s tax laws fairly and consistently across both civil and criminal litigation.

The Tax Division also deals with cases related to unemployment taxes and benefits that are administered under the country’s Labor Code and Federal Unemployment Tax Act (FUTA).

Summary:

References

Source-to-pay (S2P) is an end-to-end process in procurement that encompasses the activities associated with sourcing products from suppliers.

Reading a check may appear straightforward at first glance, but the various elements that comprise a check play a crucial role in …

In finance, internal controls are processes that ensure and maintain the integrity of financial and accounting information. These controls foster accountability, safeguard …

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.