Software to manage SoD in accounts payable

In the accounting world, accuracy and compliance with financial regulations are of utmost importance. To maintain financial integrity, financial leaders often rely …

With payment fraud and cyber-crime on the rise, it’s time for finance leaders to ask whether their processes and controls are sufficient for protecting against a new generation of fraudsters. Analogue forms of payment monitoring are necessary, but they usually aren’t sufficient by themselves.

Since cyber-criminals are leveraging technology to get ahead, finance leaders will need to do the same to protect their organisations. This is where a payment protection solution becomes indispensable – Eftsure’s solution does exactly that.

But how exactly does it prevent fraud and error and empower CFOs to outmanoeuvre scammers? Let’s get into the nitty-gritty.

Eftsure payment protection is a reliable and efficient solution designed to help teams safeguard their supplier payments from fraud and error. It creates a convenient and secure environment, protecting your business transactions by verifying the payee through ‘traffic light’ alerts.

Our payment protection solution is designed to authorise supplier payments without employees needing to conduct call-backs manually. As cyber-crime continues to ramp up each year, businesses are becoming more vulnerable to fraudulent activities. If you’ve fallen victim to any of these scams, the biggest indicators tend to be unauthorised transactions or unusual bank activity.

To stop cyber-criminals from stealing your business’s money, you’ll need to implement robust security controls around your payment system. Eftsure is a scalable, efficient way to do that. Our payment protection solution is specifically designed to address financial fraud, using real-time alerts to automatically flag potential errors, fraudulent invoices, duplicate payments or fraud.

So what does this look like in action?

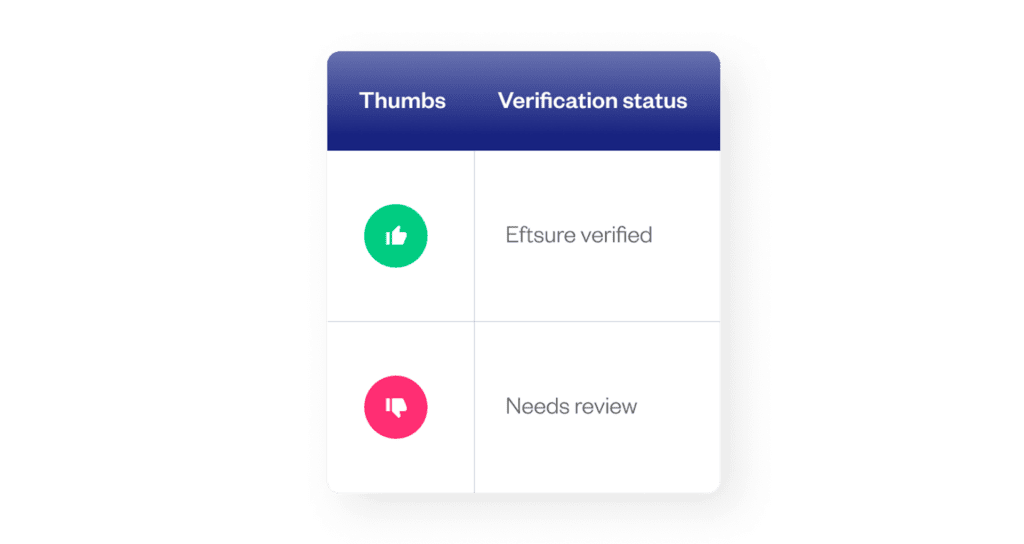

When it comes to processing your supplier payments, you can start by submitting your ABA or payment file either on your banking screen or on the Eftsure portal. As you review your payments file, you’ll see ‘traffic light’ alerts, which appear as green and red thumbs.

These user-friendly alerts are designed to work in real-time, automatically flagging a green thumb whenever payment details are verified or a red thumb if there is a mismatch in the supplier’s banking information. This may include a mismatch between the account name, BSB, account number, ABN or GST status.

In the instance where you identify one or more red thumbs, it might mean there’s a problem with the payment record and that it needs to be reviewed. Often, there’s a big possibility that the payment details were erroneously entered or manipulated by malicious actors.

Payments with red thumbs should not be processed without further verification.

To complete this verification, Eftsure may request additional identification documents from the payee, conduct background checks or contact the entity directly for confirmation. Eftsure are trained to handle these verification processes efficiently and effectively, minimising any potential disruptions to supplier experiences and your own internal workflows.

Here is a short video of what the detection process looks like in action:

By “real-time” monitoring, we mean payment checking that happens during the payment process itself – before funds are released – without the delays or lead time that come with manual checking. It’s another critical component in preventing fraudulent transactions, especially since most AP teams are busy and dealing with a large volume of payments.

Real-time monitoring is one of the ways in which Eftsure’s fraud detection solution helps you build security at scale, without sacrificing speed or productivity. After all, when time-poor employees encounter lots of friction or barriers, they tend to be more likely to skip crucial steps or cut corners. But real-time checking helps achieve both a seamless employee experience as well as a standardised, automatic layer of security.

The benefits of real-time monitoring include:

Examples of how Eftsure’s real-time payments monitoring can prevent fraud:

This helps protect you from payment fraud and cyber-attacks such as:

Finding out that you almost made a fraudulent payment to a compromised bank account can be frightening.

Liz Fourie, Manager of Corporate Services at Berri Barmera Council has a responsibility to oversee the council’s financial activities. While managing a range of suppliers and businesses, Liz ensures that all payment transactions are conducted in a secure and efficient manner.

But Liz noticed that the council constantly received fraudulent emails, often using a mix of baiting and spear phishing emails. Some of these malicious emails instructed the council to make payments to another bank account.

This was the first red flag that Liz noticed.

As cyber-crime continues to ramp up, Liz understood that integrating a robust real-time payment protection system is a must. Rather than waiting for cyber-criminals to strike, Liz knew she needed a solution that not only would combat fraud but also satisfy the stringent demands of the council’s auditors.

Months before integrating Eftsure into her accounting department’s (AP) function, Liz was alerted in real-time with a red thumb while processing her supplier payments. The system had found a mismatch in one of their payee’s banking information. Liz acted swiftly and halted the payment in order to investigate further.

It wasn’t long before that Liz noticed they were about to make a payment to a fraudulent bank account. This saved the council (and taxpayers) a potential $125,000 fraudulent loss.

As Liz puts it, “There’s one thing you want to avoid and that’s hitting the front page of the newspapers for all the wrong reasons.”

Read an in-depth version of the case study.

No. There is no charge for suppliers to be verified by Eftsure.

Eftsure’s solution covers all electronic funds transfer (EFT) payments. This is taken from your ABA file or payments file.

Eftsure is currently connected with 8 banks as of July 2023.

Eftsure provides full coverage in a number set of countries. This includes the United States, United Kingdom, Canada, Singapore, South Africa and the Philippines. We are continuously expanding internationally.

Eftsure’s payment protection solution is designed to work in real time. Powered by Eftsure’s live verified vendor database, we provide alerts that keep your organisation safe without slowing you down.

Eftsure does not stop payments from transacting. Our solutions work when you upload your ABA or payments file into the Eftsure portal or when banking. Our solution operates when the supplier details appear, upon processing payments.

Yes, you can view your business payments in the Eftsure portal.

In the accounting world, accuracy and compliance with financial regulations are of utmost importance. To maintain financial integrity, financial leaders often rely …

ERP systems are the beating heart of an Accounts Payable (AP) function. They are vast treasure troves of valuable commercial data, making …

Did you know banks in Australia ignore Payee Names when processing online payments?

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.