An in-depth look at Eftsure’s payment protection solution

With payment fraud and cyber-crime on the rise, it’s time for finance leaders to ask whether their processes and controls are sufficient …

In the accounting world, accuracy and compliance with financial regulations are of utmost importance. To maintain financial integrity, financial leaders often rely on controls like segregation of duties (SoD).

Before implementing SoD in your workplace, it’s important to understand its significance for accounts payable (AP) teams and how it minimises fraud and errors.

Once you’re familiar with the benefits that SoD offers for your organisation, the next essential step is implementing it within your AP function. This involves assigning distinct responsibilities, establishing strong access controls, setting approvals and tracking account logins.

In this article, we explore how you can implement SoD to stay compliant and mitigate the risk of fraud and error.

In today’s fiercely competitive cyber threat landscape, fraud and cyber-crime can come from any vertical.

Whether it’s a sophisticated cybercriminal launching an external attack on your computer networks or a disgruntled insider exploiting system access during non-working hours, the importance of SoD as a formidable financial control cannot be overstated.

Recent trends emphasise the rise in malicious threats instigated by internal stakeholders, such as disgruntled employees or suppliers. According to Proofpoint, insider threats have increased in both frequency and cost over the past two years. For example, 56% of incidents experienced by organisations represented in this research were due to negligence, and the average annual cost to remediate the incident was $6.6 million.

Moreover, senior executives aren’t just grappling with malicious insiders but also contending with other insider threat categories, including negligent insiders and compromised insiders, as outlined by IBM.

The question then arises: What are organisations doing to thwart the menace of internal fraud?

Enter the solution – segregation of duties, a tailored financial control that empowers organisations to assert authority over their unique structure while meticulously dictating who gains access to sensitive data.

Segregation of duties is designed to prevent any single individual from having too much control or access within a critical process or system. By separating key duties and responsibilities, it becomes more challenging for a single person to engage in fraudulent activities without detection.

The challenge that comes with SoD in the real world is that it requires senior executives to continuously monitor roles and responsibilities. And complex processes that make it difficult to establish clear boundaries between said roles.

Not to mention for smaller businesses, the challenges with the separation of duties are greater. A business that only has one or two network administrators may simply not be able to divide the responsibility or role.

To navigate these challenges while upholding effective SoD, consider laying the groundwork with these key practices:

For a more comprehensive overview of evaluating internal controls, such as SoD, consider undertaking pressure testing. Keep in mind that SoD is a continual endeavour, and when finely tuned to suit your unique business needs, it stands as a formidable defence against the threats posed by internal fraud and cyber-crime.

For businesses using Eftsure, the main objective is to ensure mitigation of fraud and error, without compromising productivity or employee autonomy. An effective approach to mitigate these risks is to implement SoD tailored to your organisation. As a basis, we recommend implementing the following:

The first step to SoD implementation is to assess the current state of your organisation. This means identifying your existing key processes and roles within your accounting operations. This will allow you to determine which tasks need to be segregated and who is responsible for those tasks. For example, you may identify these critical roles that need to be segregated.

The number of separate key processes and roles an organisation should have for SoD depends on its size, complexity and industry. The objective is to ensure that no single individual has control over every aspect of a critical role or process. In addition, the more intricate the organisation’s financial processes, the more complex SoD becomes.

Once you identify each process and role involved, it’s time to determine which individuals are currently responsible for these tasks.

Once key processes and roles have been identified, you need to clearly define clear roles for each employee and assign specific responsibilities to each role. This will prevent conflicts of interest, help detect and deter fraud, identify errors and establish accountability. By assigning specific responsibilities to different individuals, you significantly reduce the likelihood of error or fraudulent activity.

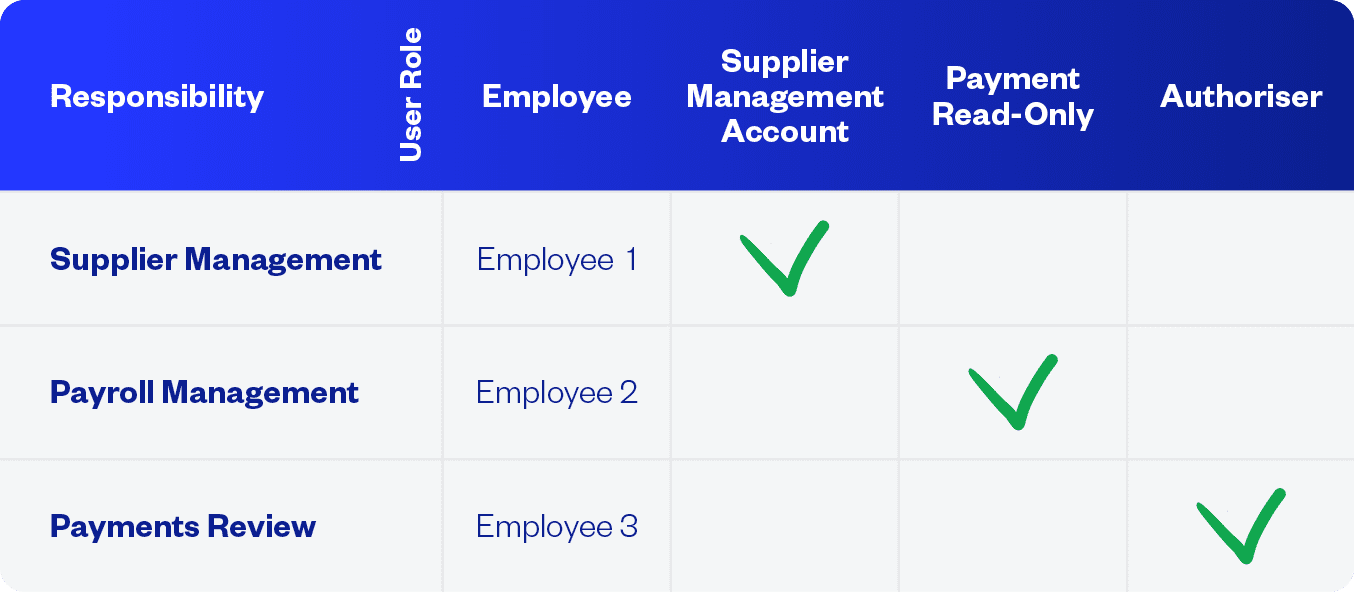

If your organisation has a large accounting department, it might be worth considering creating a segregation of duties matrix to effectively manage a diverse range of roles and responsibilities. You can start by drafting an Excel spreadsheet, where roles are listed in the top row and corresponding responsibilities are detailed in the left-hand column.

After the columns are created, you can allocate employees to a specific role and responsibility. You can then appoint a tick or green box in the SoD matrix to indicate tasks that don’t conflict with the principles of segregation of duties. One example might be Employee A, who is authorised to verify and input invoices to the payment or accounting system. Whereas Employee B will have a different responsibility and will have a red box to indicate tasks where a SoD conflict exists.

The objective of the matrix is to eliminate any ambiguity regarding each user’s designated role and responsibility, while also demonstrating a clear overview of each AP clerk’s role and where they may be restricted. This ensures that each task is allocated to the appropriate personnel and that equitable distribution of critical tasks throughout the entire organisation.

Here’s one example below:

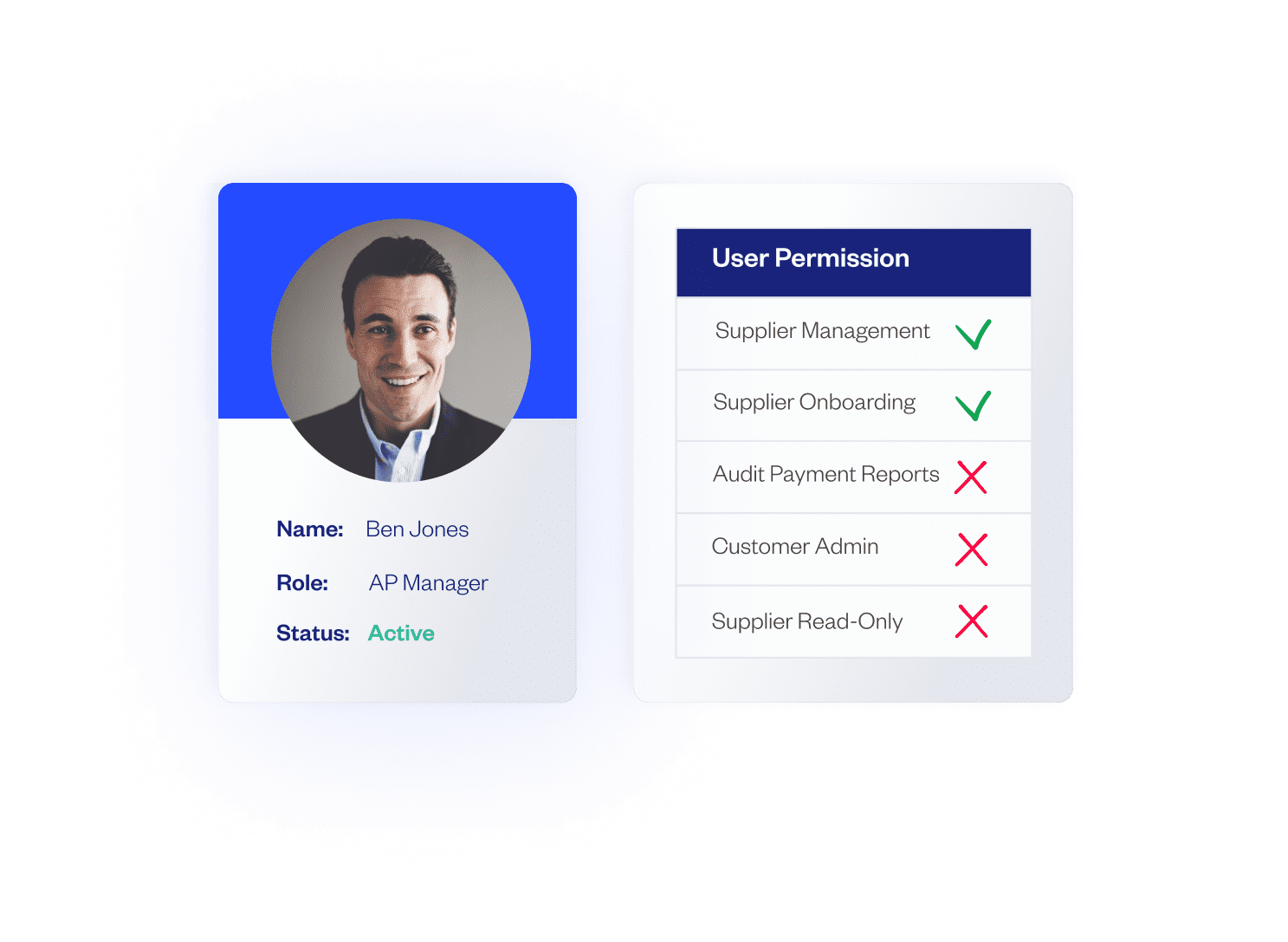

After you allocate the appropriate personnel to each segregated task, you can move on to implementing stringent access controls to regulate and manage user access. This means that finance professionals can assign role-based permissions, where each AP clerk is granted access only to the specific tools, applications and data relevant to their responsibility.

For instance, an employee responsible for processing invoices might have access to view invoices, financial reports and supplier information, but they may not have access to approve invoices or modify sensitive data. To add an extra layer of security, organisations can add multi-factor authentication (MFA) as a requirement for certain actions.

The main objective in step three is to restrict unauthorised access to sensitive data. By incorporating strong access controls, you enforce strict segregation of duties. As a result, you control which employees have access to certain functionality – that is, the only functionality they need to carry out their tasks.

With a solution like Eftsure, you can grant users access to specific resources and functions required for their job roles, while restricting the resources and functions they don’t need. For example, an employee responsible for entering invoices can be restricted from seeing if an invoice has been approved or paid.

By limiting access, the organisation can minimise:

By combining user profiles with stringent controls, you add another layer of security.

User profiles can be created on the application or network system that holds sensitive data. This allows admins to add a set of permissions granted on a single application or system. Profiles are related to roles, which means that the roles you’ve assigned in your SoD matrix will reflect the perspective changes on applications and systems.

Creating user profiles removes the headache of managing the SoD matrix manually. A profile ensures that specific individuals only have access to certain amounts of information more efficiently. It’s also easier to identify users who have operation capabilities outside of the operations required by their role, reducing potential security vulnerabilities.

The difficult aspect of creating user profiles is that all employee information must be updated at all times. This means where employees have been promoted or have left the company, their user profiles must be updated accordingly.

Maximising your security measures through the implementation of segregation of duties is imperative. It’s important to recognise that proactively combating cybercrime will help minimise the risk of unauthorised access to critical functions and sensitive data. During the 2021-22 financial year, more than two in ten businesses experienced a cybersecurity attack.

Unfortunately, most businesses don’t prioritise their cybersecurity posture until it’s too late.

By incorporating Eftsure into your accounting function, you not only introduce a powerful way to streamline user access but also boost your ability to defend against various types of cyber-crime.

Eftsure’s solution eliminates the headache of manual segregation of duties management. Instead, we automate some of the processes. Through secure controls such as user permission management, defining user roles and simplifying financial investigation processes, you can thwart potential fraud attempts without sacrificing productivity or efficiency. This creates robust segregation of duties and safeguards sensitive information.

With payment fraud and cyber-crime on the rise, it’s time for finance leaders to ask whether their processes and controls are sufficient …

ERP systems are the beating heart of an Accounts Payable (AP) function. They are vast treasure troves of valuable commercial data, making …

Did you know banks in Australia ignore Payee Names when processing online payments?

End-to-end B2B payment protection software to mitigate the risk of payment error, fraud and cyber-crime.